October 20, 2022 in Thought leadership

Origin Stories: The meaning of mortgage

Take a deep dive into mortgage’s origin story as we explore its etymology, historical context, and Blend’s vision for the future of banking.

Blend

Humans are drawn to meaning-making. We’re hunters of myths, and we’re wired to relate to people and things around us. In short, we’re storied beings. And we find one genre in particular pretty fascinating: origin stories. At first glance, etymology might not be as exciting as a good superhero backstory, but it is vital to understanding how language and its evolution touches every aspect of our lives.

So, while you may not know the origin or root of the word mortgage, for many, obtaining a mortgage and owning a home symbolizes a sense of belonging and arrival — it is aspiration fulfilled.

Death pledge … not nearly as scary as it sounds

For first-time buyers, the mortgage process can seem daunting. And it’s often made worse by a general lack of information or common misconceptions that well-intentioned friends and family pass on. But have you ever stopped and really thought about the origin of the word? Or how the mortgage process has evolved over time?

Mortgage dates back to the late 14th century, with the roots “mort” meaning death in French and “gage” meaning pledge. While that literally makes a mortgage a death pledge, it’s not as eerie as it sounds. It is believed that the concept of a mortgage began in early civilizations: an exchange of property with a pledge to repay over time. The pledge would be considered “dead,” or null, once the loan was repaid or if the borrower could not fulfill the terms of the deal.

“Mortgage dates back to the late 14th century, with the roots “mort” meaning death in French, and “gage” meaning pledge.”

It’s no surprise that mortgages often get a bad rap. You might assume that the “death” of death pledge relates to either the painful process consumers must endure on the road to homeownership, or maybe you associate signing mortgage papers with signing your life away.

Language is ever-changing, and we are confident that in the near future, the word “mortgage” will have a more positive connotation: life-affirming experiences to celebrate, not dread. But before we can get there, we need to look to the past – the history of mortgages as a process, where modern, often negative associations stem from – and then continue making progress toward something better for everyone.

From depression to recession: A brief history of American mortgages

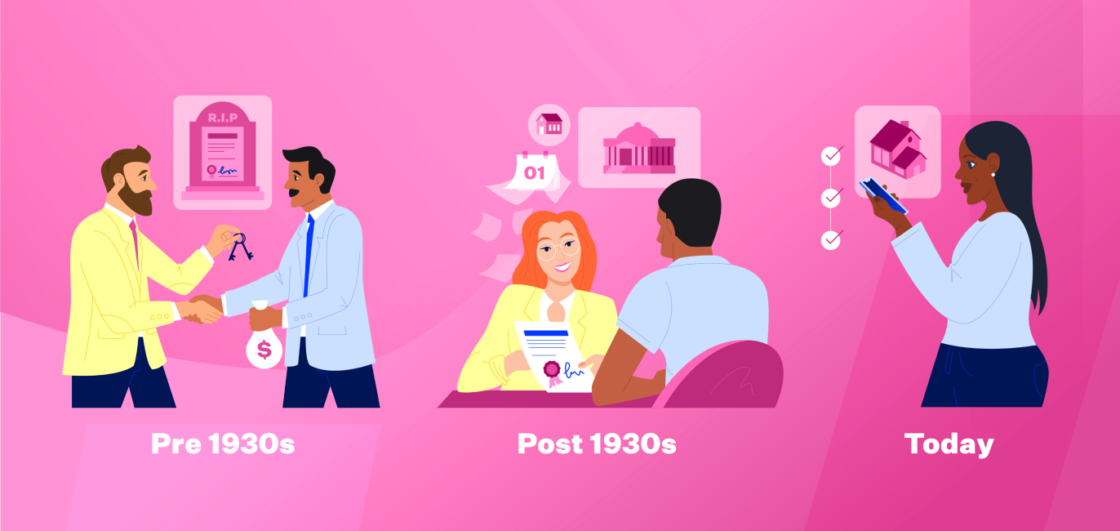

While the basic mechanism of a mortgage has existed for centuries, mortgages as we know them didn’t exist in the United States until the 1930s. Prior to that, the industry had little regulation and there were many types of mortgage lenders who operated under different guidelines. Before the US government intervened during the crash of 1929, homeowners would renegotiate their mortgages yearly, and as the economic crisis wore on, 40-50% of homes were in default by 1930.

The creation of government-backed entities, like the Federal National Mortgage Association (Fannie Mae) and the Federal Housing Authority (FHA) provided banks the assurance they needed to make loans more accessible to homeowners and home builders, leading to the post-World War II housing boom.

From that point on, the mortgage market was largely successful. And despite a few periods of difficulty, the overall mortgage and homeownership trend was one of growth that lasted for several decades — until the 2007 financial crisis hit and ushered in the Great Recession.

With accelerated digitalization spurred on by the COVID-19 pandemic, digital financial services almost seem new — especially when it comes to mortgages and loan closings.

The truth is, online banking as we know it began to emerge in the early aughts — but leading up to and in the decade after the Great Recession, financial services were still largely paper-based. In fact, the same complex mortgage loan process had been used for over seventy years with very little operational change relative to available technological advances.

Adversity is often a catalyst for progress and innovation, and in the wake of the 2007 financial crisis, Blend saw an opportunity to transform an industry. Taking it from documents to data and putting the lender-borrower relationship at the center of the conversation has been a fundamental step in the financial services industry’s recent transformation.

But it’s only the beginning. The future of finance is purposeful, perceptive, and proactive.

The next chapter

We believe that the next decade of banking will be defined by value-driven ecosystems where product developments will benefit our communities through increased access to financial resources. We also believe in data-driven insights that will enable consumers to have more control over their financial and digital lives.

Lastly, we believe that financial services institutions can achieve long-term stability and value by investing in innovative technology that positions them to understand a customer’s financial journey on a deeper level, and be there for them every step of the way.

All financial milestones matter, but mortgages in particular tend to elicit a variety of emotional responses. From its natural meaning to the assigned symbol of an important – yet historically arduous – life event, both the meaning of mortgage and the process itself have changed significantly. But what do mortgages mean to Blend?

At Blend, mortgages mean starting a new chapter in life’s story – buying a house and making it a home. They are critical to building a solid financial foundation. And mortgages are integral to our own origin story. Contributing to the modernization of the mortgage process has given us our own solid foundation that has allowed us to strengthen and expand our infrastructure to power our vision for the future of banking.,

Origin stories help explain why things are as they are, but they also give insight into what they can become. Words change meaning all the time, and over time. Through our modern lens, thinking of a mortgage as a death pledge seems extreme, and isn’t exactly aspirational. And although the mortgage process is often met with a groan, it actually used to be a fairly simple concept: an exchange of money between lenders and borrowers that makes homeownership — and all that it supports — possible. From the start, that’s been our mission at Blend: revisiting the simplicity of mortgages as we take them from transactional to experiential. Transforming both the mortgage process and mindset was just the first step of our own journey toward a brighter financial future for all.

Curious about more origin stories?

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.

How Modern VOI Extends Income and Employment Verification to Hard‑to‑Reach Employers

Learn how lenders extend income and employment verification to hard‑to‑reach employers by orchestrating instant, credential, and managed manual VOI workflows.

Read the article about How Modern VOI Extends Income and Employment Verification to Hard‑to‑Reach Employers

Protected: From Upload to Underwriting in 15 Seconds: Introducing Blend Autopilot

There is no excerpt because this is a protected post.

Read the article about Protected: From Upload to Underwriting in 15 Seconds: Introducing Blend Autopilot

Blend Showcases Rapid Home Equity for HousingWire

Blend demonstrates how Rapid Home Equity can accelerate funding cycles by 35% with automated workflows and instant, personalized offers.

Watch video about Blend Showcases Rapid Home Equity for HousingWire