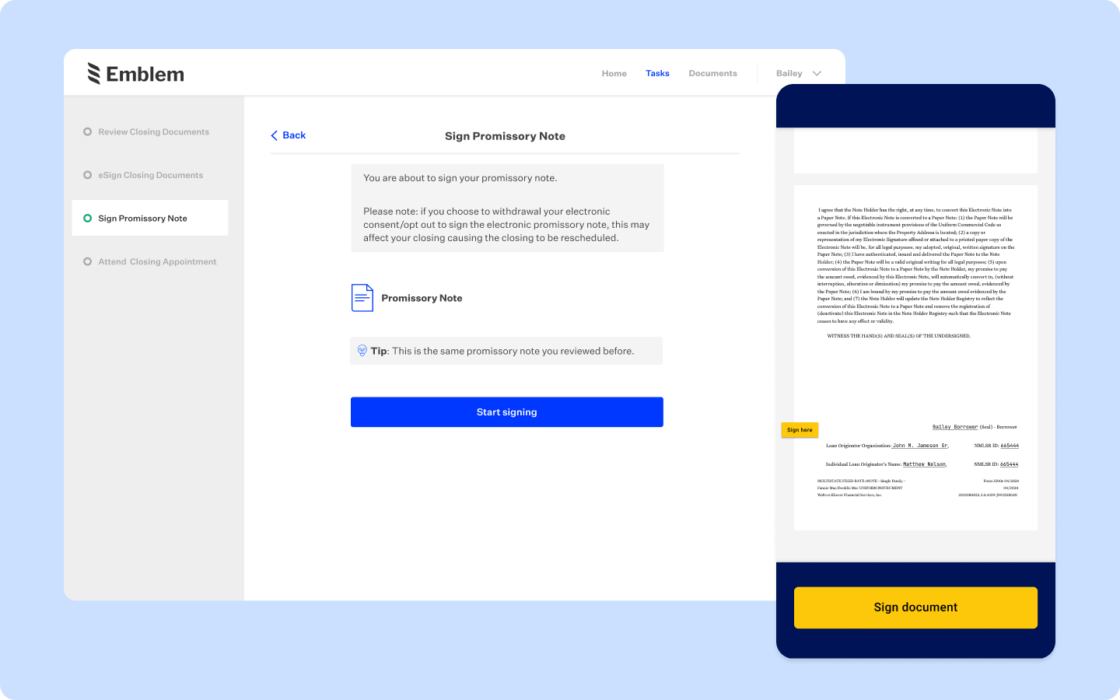

What’s the true ROI for digital closings?

Discover the ways a comprehensive digital account opening approach can improve customer experiences and increase efficiencies in consumer banking.

Read the article about What’s the true ROI for digital closings?