Compass Mortgage

embraces digital transformation with Blend

embraces digital transformation with Blend

Read the full story about Compass Mortgage

Streamline your process, reduce costs to originate, and close days faster—while delivering the digital-first experience borrowers expect.

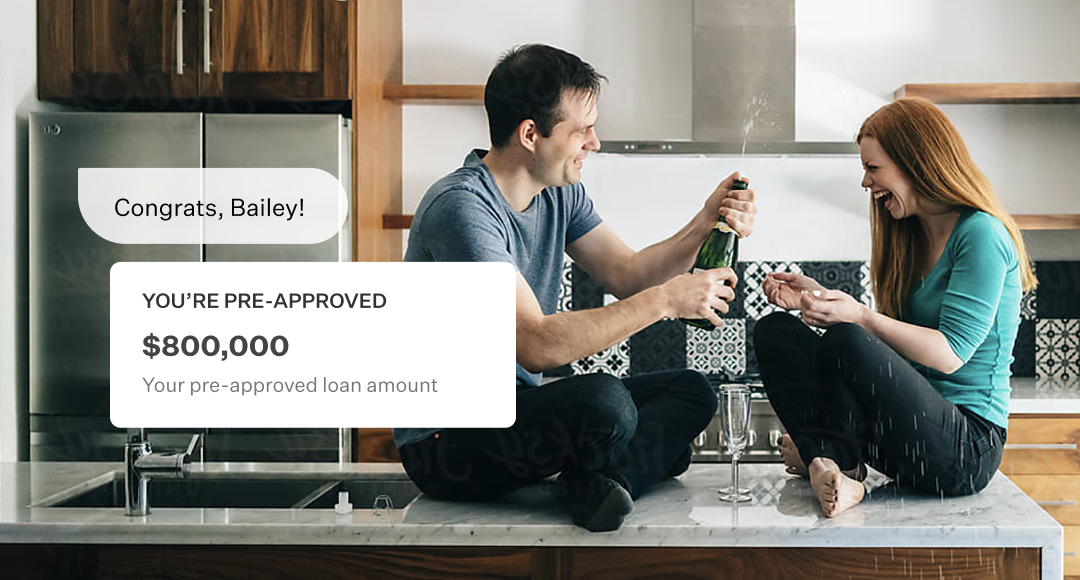

Home lending feels like homework to borrowers

Deliver a seamless experience with a clear, intuitive borrower journey from application to close.

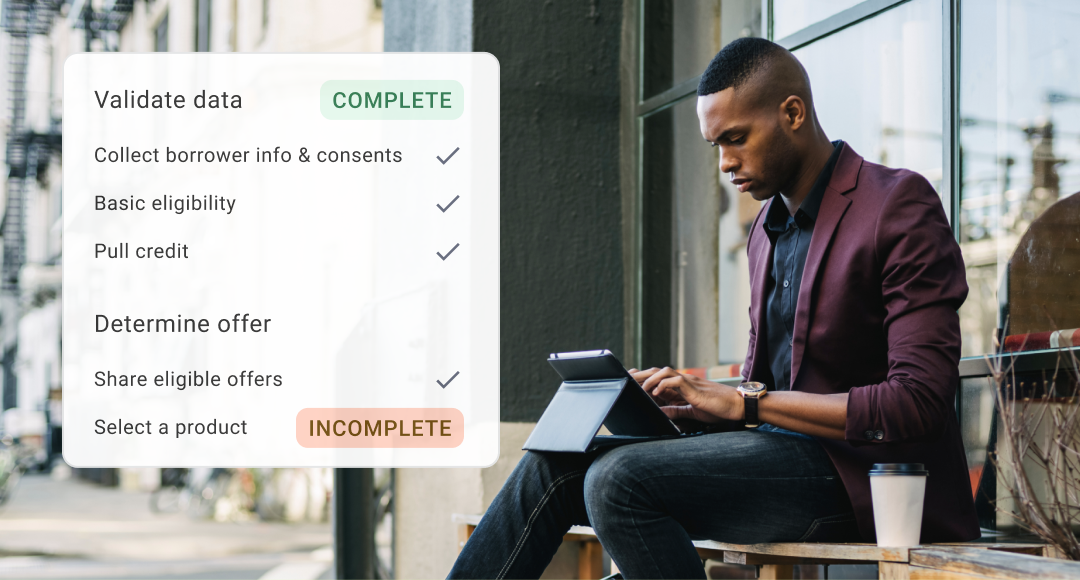

Improve your Home Equity pull-through and utilization rates with automated workflows and limited manual touches.

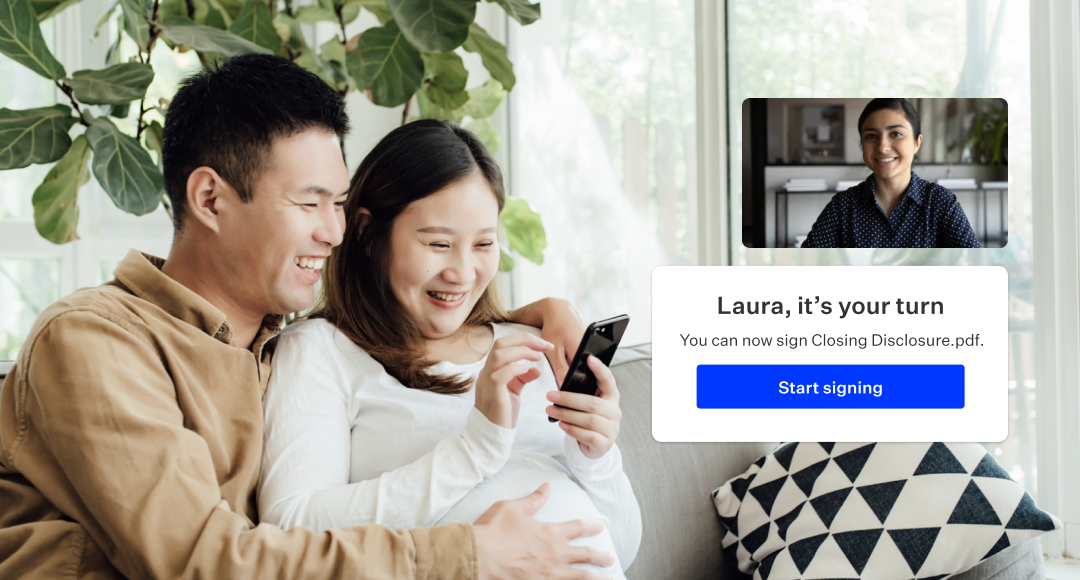

Power an end-to-end digital experience, cut your wet sign package in half, and save on hedging and warehouse costs.

Convert more borrowers, boost engagement and retention, reduce risk of competitive fallout, and scale effortlessly for the next refi boom.

Borrower app with educational, dynamic questioning and self-serve capabilities.

Instant, automated verifications — sourced directly from leading data providers — to speed up the loan lifecycle.

Dedicated mobile app enables your LOs to stay productive from anywhere, 24/7.

Hybrid, hybrid with eNote, and Remote Online Notary options that that flex for your needs.

We take care of the heavy lifting so you can focus on helping borrowers achieve homeownership faster.

Subscribe to get Blend news, customer stories, events, and industry insights.