April 4, 2022 in Mortgage Suite

Personalization strategies to outperform the mortgage competition

Explore three areas to narrow your focus as you develop and refine your ability to exceed consumer expectations for personalized service.

How satisfied are your customers with the level of personalization you offer? A recent study conducted by Forrester Consulting on behalf of Blend found that half of the consumers surveyed wished their financial provider would proactively offer them more tailored financial information and services. Consumer expectations for value and relevance have quickly evolved over the years. They now expect their financial provider to put them first and enable them to make better financial decisions through personalization, which leverages data, analytics, and technology to enhance the consumer experience. Personalization arms consumers with custom insights so they can feel confident and supported throughout the loan process.

Insights, targeted for your needs.

Subscribe for industry trends, product updates, and much more.

Despite changing consumer demands in a highly competitive industry, many financial institutions have failed to change their approach — according to the research, 41% of financial leaders rated themselves as being relatively weak in the kinds of personalized experiences they offer.

If your lending institution isn’t prioritizing these tailored interactions, you may find you’re being outperformed by the competition, including neobanks and challenger banks. These disruptors have captured market share with their emphasis on digitally native, bespoke experiences.

Luckily, the research also suggests that you don’t need to perfect personalization across the board in order to have a positive impact. Here are three focus areas to help narrow your approach as you develop personalization capabilities for your customers.

Focus on the human touch

Personalization depends on first having an understanding of your customers’ actual needs. So a natural area of focus as you dive into developing personalization is getting “personal” with them.

For consumers, the road to homeownership can be emotionally charged and stressful. Let’s not forget societal pressures to transition from life as a renter to a homeowner. Ever-changing market conditions may add further strain — rising mortgage rates coupled with high demand and low inventory make the current landscape extremely competitive for potential homebuyers.

When you take these factors into account, prospective homebuyers may find themselves rushing through decisions — and in the worst cases, buying a home they either can’t afford or don’t really want.

Lenders have a prime opportunity to provide relevant information and educate prospective homebuyers before moving forward with one of the biggest purchases in their lifetimes. It’s a chance for loan officers to establish a more intentional way of working with consumers that extends beyond the application and closing process.

Consider examining your in-person customer experience inside your branches. See how your loan teams are supporting and providing guidance to customers and potential new customers. Then determine the best ways to improve those interactions. Nurturing this baseline, human-focused layer of personalization is a great first step in developing a more systematic and widespread approach.

How Blend can help: Blend provides a streamlined approach to empower loan officers to automate repetitive work, increase productivity, and be more precise and personalized with their communication. By freeing them from more mundane tasks, Blend can enable loan teams to engage more directly with customers, learning about their specific needs. They can then deliver relevant and personalized support to the customer.

See how Blend equips loan officers to be trusted advisors and operate more efficiently.

Focus on the touchpoints that drive impact

Based on the Forrester research, financial institutions recognize that consumers expect options when it comes to how, where, and when they consider financial products. 49% of financial institutions believe personalization applied to customer engagement will fuel the greatest growth. More than half agree it’s crucial to empower customers to use the channel of their choosing in each step of their journey.

Examine your current customer journey through touchpoints and across channels and evaluate what is performing well and what needs improvement. Analyze how your channels are being used to better serve customers. For example, maybe there is a need to step up your teams’ efforts in providing borrowers with relevant, timely information in customers’ preferred digital channels.

See where data is getting siloed and look for ways to unlock, sharing information so that it can be applied intelligently, regardless of touchpoint.

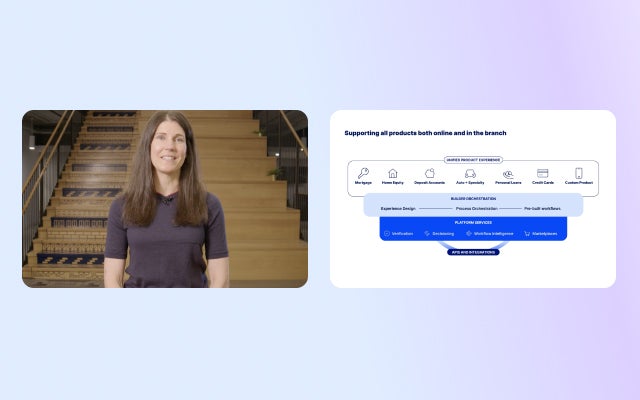

How Blend can help: Blend’s cloud banking platform helps you develop consistency across your omnichannel experience while providing the flexibility for them to choose how they complete the application process.

Blend’s tools help your loan teams efficiently take next steps, armed with the fullest context for each borrower. This borrower information is also intelligently applied directly to the application itself with pre-filled fields and even pre-approval — helping you provide personalized touches, even when your staff isn’t directly engaging.

Focus on your teams’ workflows

In addition to gaining a better understanding of customer insights and staying consistent with delivering the best in-person customer experience, you can also assess your teams’ workflows. Find out where most of their time is being spent so you can better understand what is getting in the way of providing an optimal experience for customers.

Also, take a look at how your staff is implementing personalization in their day-to-day — find out where your teams are succeeding and where they need more support. Discover where the gaps lie from the in-person experience to digital — which areas need improvement to fully deliver on the promise of better personalization?

How Blend can help: With Blend, you can establish efficient workflows for your teams and elevate your personalization experience. Blend’s intuitive software allows you to create customizable workflows so you can provide higher value to consumers, loan officers, and your back office staff.

A competitive way forward

In order to fully address your organization’s weak points and solve them, consider a technology partnership. The right partner can help you prioritize customer engagement and ultimately allow your organization to outpace the competition.

Partnerships can further drive innovation quickly by providing out-of-the-box engagement tools, for example. This enables borrowers to quickly access their loans, receive and upload the proper documentation, and effortlessly communicate with lenders to get their questions answered. In turn, this frees up valuable time for loan officers to prioritize relationship-building and be a trusted resource for borrowers.

With Blend, go beyond the generic transactional vendor connection and create a lasting, meaningful partnership. We’re an engineering-first company committed to delivering the best digital experience for lenders. We listen, share ideas, and present customized solutions as it relates to your core business.

It’s important to remember that at the end of the day, we’re only human. Transforming your organization’s personalization strategy won’t happen overnight. However, by focusing on these key areas, you can start to make incremental changes that collectively provide greater impact on delivering the best personalization.

A personalized mortgage experience delivers value, builds trust, and helps your business thrive.

Always first

Be the first to hear about industry trends and news