January 14, 2022 in Thought leadership

Insights on modern personalization from BOK Financial and Blend

A strategic mix of technology with a human touch can help meet demands for personalized, digital experiences.

Recommended for you

Subscribe for industry trends, product updates, and much more.

This year at the Digital Banking conference, I had the pleasure of sitting down with Nicholas Iervolino, Product Owner and Channel Manager for Digital Accounts at BOK Financial. We discussed Blend and BOK Financial’s relationship and how Blend’s cloud banking platform is helping BOK Financial expand its team’s ability to build deeper, more meaningful relationships with customers through consistent and personalized experiences.

Spending time with our partners helps us learn about their wins, understand new opportunities, and what they envision for the future. Let’s dive into some of the key topics from our conversation.

Creating a consistent Amazon-like experience across all channels

Consumers are often looking for what I like to call the Amazon experience — a marketplace that uses my data to recommend the right solution for my specific needs and individual circumstances.

Today’s consumers desire timely, relevant, and personalized experiences across different aspects of their lives, and this includes their financial wellbeing. Because their expectations are high, it’s up to us to deliver a digital experience that is consistent, secure, efficient, tech-enabled, and informative through every step.

Let’s take a step back and look at Amazon’s historical journey in building today’s consumer expectations. For the first couple of years of the company’s history, Amazon was simply selling books online. But over the years, Amazon realized they had the infrastructure to provide nearly any retail product, with enough consumer data to proactively identify the right products for their customers. Creating an efficient and personalized experience with technology can help organizations better serve their customers.

At Blend, our mission is to provide financial institutions with the platform and best practices that help them deliver on those consumer expectations of efficiency and personalization across a lifetime of needs.

Blend’s solutions empower financial services firms such as BOK Financial to better meet the demands of their consumers. Our enterprise solution not only supports a financial services firm’s suite of products, but also creates efficiencies for sales and support teams across the firm. Positive experiences aren’t just limited to the end consumer — technological improvements can also improve efficiency and ease of work for banking teams.

The value of proactive finance

As a company, we often discuss an important philosophy we call proactive finance. This is the ability to anticipate a consumer’s future needs and desires — sometimes before they even realize it. Because consumers often already share enough data and personal information with their lender, we can understand what products may be beneficial for them and when.

The driving principles for proactive finance includes understanding who your consumer is and what they may need to better their financial situation. In the session, Nicholas correlated today’s need for personalization with ‘80s classic sitcom Cheers. He referenced the lyrics to the theme song, “Where Everybody Knows Your Name,” and likened it to the type of experience that consumers desire from the brands and services they use, including financial. In other words: continue to build strong relationships with your customers so they come back when they are ready to refinance or need other products.

Personalization isn’t new, but there is still a lot to discover within the financial services industry as we improve technology and data. A big challenge is how to utilize technology to build a better, more cohesive digital experience for consumers and bankers alike. The future of banking is evolving in the right direction, with more financial services firms improving the way they do business with their customers through digital transformation.

A personal touch drives real results

As we’ve seen throughout the pandemic, digital transformation is table stakes and no longer optional. Consumers and bankers want a consistent, streamlined experience. Today’s consumer wants a user-friendly and easy way to consume the products and services they use every day.

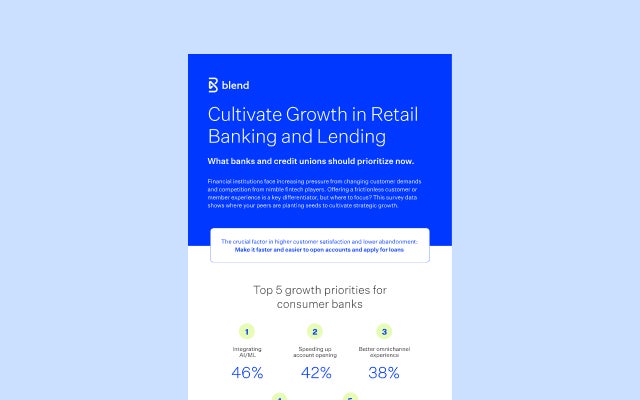

We’re proud of our partnership with BOK Financial and their response to consumer demand. With Blend, they are able to provide an intuitive and personalized banking experience. When BOK Financial began running consumer loans and mortgage applications through our platform, they saw completion rates more than triple, and over the last three years, the majority of volume now comes through digital channels when it had previously been at less than 15 percent.

What we’ve seen across our customers, including BOK Financial, is a commitment to answering the call for personalized options and capabilities for consumers. Putting your customers first means providing them with the best solutions digitally, while giving them the option to speak with a human. Giving them the option to choose means you’re one who can empower and guide them through their biggest financial decisions.

Interested in learning more about how to build customer relationships that last a lifetime?

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.