June 7, 2024 in Challenges and solutions

Union Bank & Trust implements omnichannel onboarding with Blend

Key Takeaways

-

Pain points: Disjointed online and in-branch experiences, difficulty authenticating existing customers during the account opening process

-

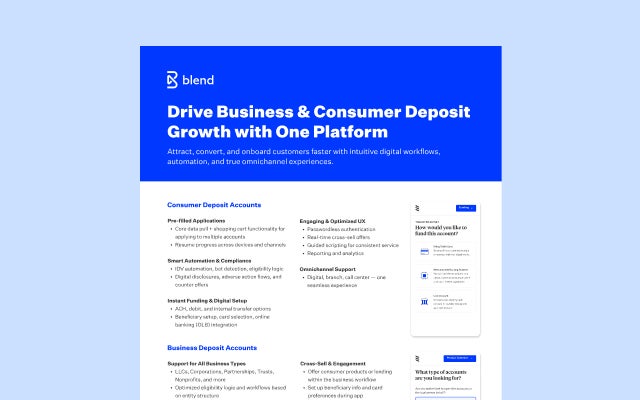

Solution: Blend’s omnichannel solution powers a smooth, consistent experience across origination channels, while accelerating onboarding, optimizing account conversion, and giving bankers time back to focus on deepening customer relationships

-

Impact: After implementing Blend, UBT was able to streamline its account opening experience to be under 5 minutes

Union Bank & Trust (UBT) is a privately owned bank based in Nebraska that offers complete banking, lending, investment, and trust services. The bank has 34 full-service and loan production offices in Nebraska and Kansas. UBT has grown steadily from a small bank into a mid-sized bank experiencing considerable growth just within recent years.

As UBT experienced this growth and developed plans for future growth, the UBT team identified a need to synchronize its digital and branch customer onboarding and account opening processes all within one platform. This realization led UBT to partner with Blend to elevate its digital onboarding customer experience and process that started within its mortgage area, expanded to its retail deposit digital account opening process, and is now synchronized and being rolled out in the branch environment.

Jason McCown, Business Relationship Manager, Retail at UBT, recounts the journey that began in 2019 when Blend was first implemented on the mortgage side. “We partnered with Blend just before the chaos of 2020. And I’m certain that we would not have had the record year that we did on the mortgage side without them,” said McCown. “We were only able to process the number of applications that we did because of Blend’s mortgage solution.”

The success of Blend in streamlining mortgage applications paved the way for its expansion into other areas of banking, including deposits. McCown, who oversees business relationships and retail solutions at UBT, was instrumental in championing Blend’s adoption across various banking functions.

Challenge: Create a fast, seamless, consistent account opening experience across all channels

Before implementing Blend, one of the primary obstacles UBT faced was the process of account opening for existing customers.

“It was fairly clumsy to authenticate existing customers. Our customer support group used to get several calls from customers who had started the application online, but had questions and weren’t able to finish. The customer would go in-branch seeking assistance to finish the application, and more times than not, the customer would have to start the application over completely.”

The other focus area was speed.

“From the very beginning, our executives wanted us to target a five-minute account opening process that became our North Star,” said McCown. “We wanted to be able to offer a simple, efficient onboarding experience, and that was what drove our evaluation as we considered providers.”

“From the very beginning, our executives wanted us to target a five-minute account opening process that became our North Star. We wanted to be able to offer a simple, efficient onboarding experience, and that was what drove our evaluation as we considered providers.”

Jason McCown

Business Relationship Manager, Retail, UBT

Solution: Adopt an omnichannel solution to streamline onboarding

Blend emerged as the ideal partner due to its proven track record on the mortgage side and commitment to enhancing the customer experience. The UBT team was particularly impressed by Blend’s omnichannel capabilities.

“A lot of our customers are college students who are trying to open a new account. They usually start the application online, and then realize they have questions and get stuck. Then they’ll come visit us in-branch to finish out the application. It was really important to us to be able to offer the omni-channel experience so that we could assist them,” said McCown.

Blend’s deposit solution enables UBT to provide for a fast and consistent onboarding experience across every channel because the unified platform synchronizes the process and collection of customer information. A customer can now complete the process seamlessly or pick up where they left off should they desire the assistance of UBT personnel in-branch.

Outcome: UBT increased digital account openings

According to McCown, since implementing Blend, UBT has been able to consistently hit a three-and-a-half-minute account opening time and has seen a substantial increase in digital account openings.

“After launching our new account opening experience, we felt more confident in increasing our marketing efforts to drive more potential and current customers to our digital account onboarding experience,” said McCown. “The result is that we have had significant increases in processing more applications and successfully opening more accounts online.”

Looking ahead, UBT envisions a holistic user experience across all banking products, both online and in-branch, with plans to adopt other Blend solutions, including instant HELOCs and consumer loans.

“The incredible thing about Blend is that you only need one product. And then our bankers only need to learn how to use that one product to do deposits, consumer loans, HELOCs and more.”

Jason McCown

Business Relationship Manager, Retail, UBT

“The incredible thing about Blend is that you only need one product. And then our bankers only need to learn how to use that one product to do deposits, consumer loans, HELOCs and more,” said McCown. “It saves us an enormous amount of training time since we’re not working on multiple systems. And there is a lot of excitement and satisfaction being expressed by our in-house customer service teams now that they are able to offer the same, consistent, amazing experience for our retail products.”

The recent extension of the partnership to a three-year agreement reflects UBT’s confidence in Blend’s ability to support its long-term strategic goals. By embracing digital innovation, UBT has transformed its ease of service throughout the bank and will always continue to set the bar high in delivering a superior customer experience.

Accelerate your own new account opening process

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.