September 21, 2022 in Challenges and solutions

3 ways a SaaS lending platform can help differentiate your financial institution

Find out how cloud-based software can help you reduce back and forth, close loans faster, and transform customer relationships.

We live in a convenience-based society with groceries delivered to our doors in as little as 30 minutes, movies available on our TV screens as soon as they hit theaters, and real-time news coverage as it unfolds.

Key insights, delivered on time.

Subscribe for industry trends, product updates, and much more.

The key to remaining competitive in a society that demands lightning-fast delivery of goods and services lies in scalable solutions that not only meet but exceed customer expectations.

Software-as-a-service (SaaS) allows any financial institution to offer faster loan delivery cycle times, reduce redundant documentation requests, and focus on taking customer relationships to the next level.

Here’s what you need to know about SaaS platforms — and how adopting SaaS lending platforms like Blend can set your financial institution apart.

What is a SaaS lending platform?

SaaS enables financial institutions to tap into a cloud-based digital banking system, foregoing costly software integrations and the headaches of maintaining on-site servers.

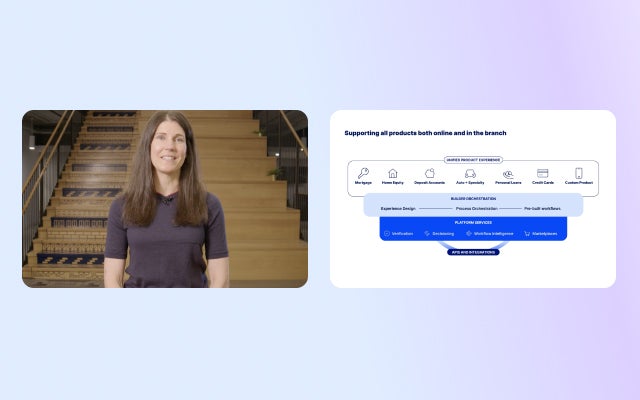

Blend’s SaaS lending platform uses existing hardware — computers, tablets, and other devices — to offer a one-stop solution for borrowers while granting access to everyone in your organization, from your operations managers to your mortgage lenders. Simply put, Blend is a cloud-based, scalable solution that lets you manage every aspect of the loan cycle, from application to delivery.

Differentiate your services with Blend

Customers are looking for more consistent, personalized experiences across all touchpoints of the lending process. Here are three ways Blend can help your financial institution evolve to serve your customers’ needs:

Reduce back and forth

The process of securing a home, auto, or personal loan can prove cumbersome for both borrower and lender. Using Blend’s SaaS lending platform allows you to automate verification processes, pre-fill form fields, quickly aggregate data from other sources like tax returns and payroll forms, and automatically flag any issues. This allows your customer to bypass time-consuming paperwork and cuts down on loan cycle times.

Offer more personalized lending products

Integrating Blend into your processes better equips your financial institution with the data you need to take a proactive approach to finance. A recent study conducted by Forrester and commissioned by Blend found that delivering timely, personalized recommendations at key moments creates opportunities for delivering more value to your customers.

For instance, that customer who just closed on a home loan through your institution may soon be shopping for a personal loan to help with renovations.

A SaaS lending platform can help you translate your customers’ financial history, credit scores, assets, and income into contextually relevant, proactive offers that tap into their current and future needs.

Transform customer transactions into meaningful relationships

While personalization can help you point customers toward other financial products and services, SaaS lending platforms also give your institution the opportunity to go beyond selling, creating enriched customer experiences.

But how do you create loyalty? Personalizing the customer journey means making customers feel valued and appreciated while giving them the confidence to make financial decisions. For instance, a customer who recently took out a loan may need guidance on the best way to repay it given their unique financial situation.

Leveraging your SaaS platform to provide tailored resources, learning tools for financial literacy, and expert support and advice can help empower your customer, increasing loyalty to your institution. Plus, using a cloud-based SaaS solution like Blend enables you to take the pain points out of loan provision while demonstrating to customers that you cater to their holistic needs and comfort.

As a leader in cloud-based banking, Blend can help your organization transform its lending processes and drive customer satisfaction.

Ready to learn more about the biggest benefits of cloud lending solutions?

Always first

Be the first to hear about industry trends and news