Affinity

celebrates a fantastic direct-to-member experience

celebrates a fantastic direct-to-member experience

Read the full story about Affinity

Wisconsin

Mortgage Suite

Blend Close

Encompass

UW Credit Union is realizing the benefits of Blend through increased productivity and members who are enthusiastic about new technology features that become available to them.

Ready to get started?

Get a demo

Wisconsin

Mortgage Suite

Blend Close

Encompass

increase in loan volume above market growth rate

decrease in loan cycles

ROI from Blend per loan

The mortgage team at University of Wisconsin Credit Union has long seen the value of digital experiences — not only for their members but also for their bottom line.

With a member base composed of frequent technology users, UWCU is expected to deliver a smooth digital application process that incorporates the latest technology capabilities. Partnering with Blend was a natural step. “Blend really listens to what we wanted and what we are looking to improve in our user experience,” said Julio Rios, vice president of mortgage lending.

UWCU is realizing the benefits of Blend through increased productivity and members who are enthusiastic about each new technology feature that becomes available to them.

By implementing and iterating on cutting-edge technologies as they arise, the UWCU team has been able to establish a reputation among their members as a company at the forefront of innovation.

Members are using the technology provided to them at high rates and finding the features easy to navigate. 83% of applications that are started online are submitted.

Since the initial implementation of Blend’s platform, UWCU has grown with the platform, adding features as they’re developed. Members have been quick to adopt these features. For example, nearly 100% of members give consent for digital disclosures, which are delivered via Blend.

The most recent addition was Blend’s consumer single sign-on and asset pre-fill, which UWCU implemented to give borrowers the “show me you know me” experience they were looking for. “Many of us have always heard, you’re my primary financial institution, why do I have to provide you data when you should already have it. Well, this has solved that,” remarked Rios.

The UWCU member base quickly showed their enthusiasm for the new feature, with twice as many applicants utilizing data connectivity for assets as a result. With an improved borrower experience and six minutes shaved off the application process on average, Rios praised the feature as “a huge success story.”

In addition to delivering a continuously improving, technology-enabled experience, UWCU has seen a substantial increase in efficiency since partnering with Blend. The simplified application process reduces the burden on loan officers: “A lot of it is done online, so the call or face-to-face meeting is reduced to about 15 minutes,” said Rios.

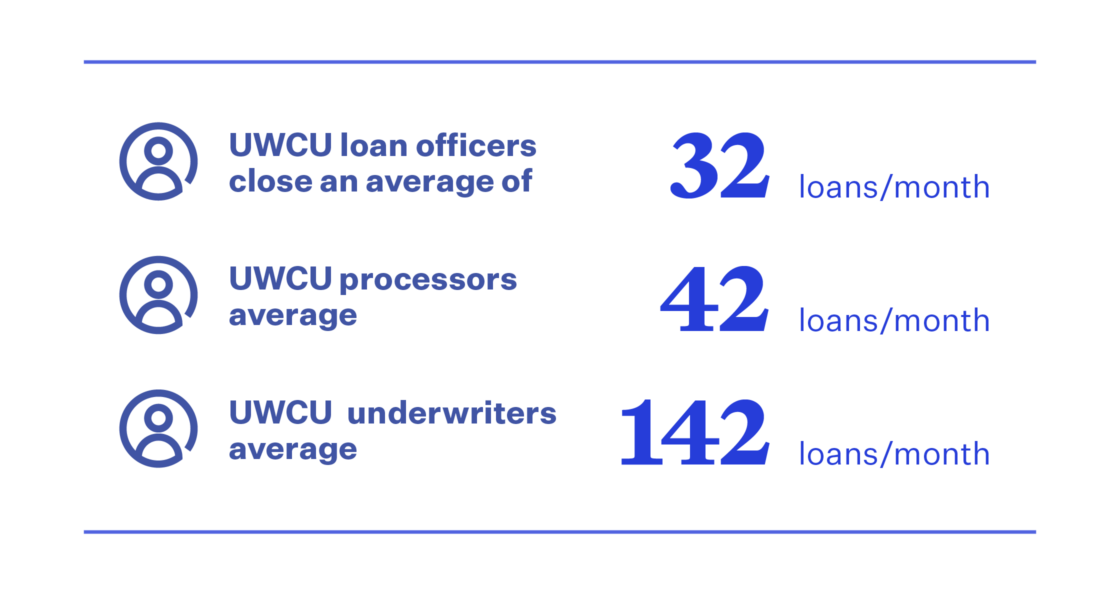

But this is only the start of the efficiency Blend helps drive in UWCU’s mortgage process. Since the start of 2020, UWCU has been able to handle twice the volume of loans without adding additional staff. Today:

This streamlined process became of paramount importance as the refi boom hit. UWCU was able to handle the volume surge from the boom effectively and close an additional 33% more loans per month above market growth rates while continuing to deliver the smooth digital experience they adopted Blend for in the first place. “With the current situation, Blend has really helped us seize the opportunity and serve our members’ mortgage needs in the pandemic crisis,” Rios reflected.

“The time savings through origination, processing, and underwriting has allowed us the opportunity to serve more members, capture more business, and streamline our process,” said Rios.

This streamlined process became of paramount importance as the refi boom hit. UWCU was able to handle the volume surge from the boom effectively and close an additional 33% more loans per month above market growth rates while continuing to deliver the smooth digital experience they adopted Blend for in the first place. “With the current situation, Blend has really helped us seize the opportunity and serve our members’ mortgage needs in the pandemic crisis,” Rios reflected.

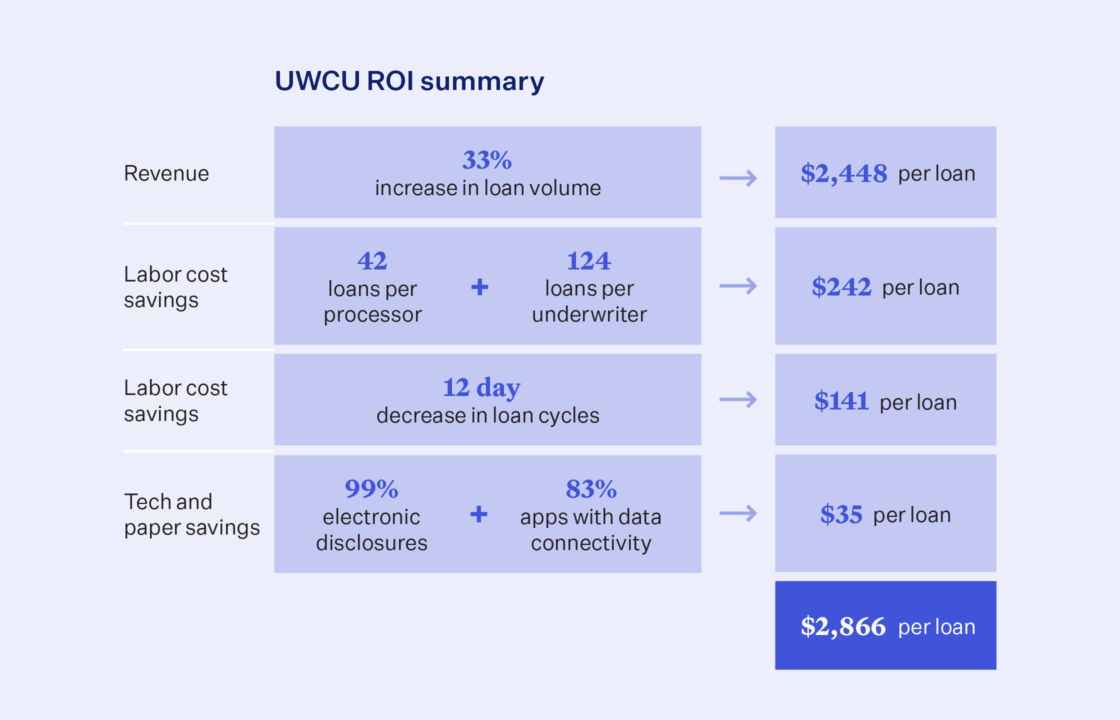

The uptick in efficiency and increase in volume prompted UWCU to take a closer look at the return on investment.

UWCU’s leadership underscored the value of the partnership, with Rios saying, “I think if you’re looking for a tool that’s going to help you deliver a digital mortgage experience to your consumer, save your staff time, improve your turn times, increase your efficiency, it doesn’t happen overnight and it’s a process. Results require a great partnership. That is what Blend has provided for us over the past couple of years.”

Rios is looking forward to continuing to deploy additional Blend capabilities and striving to deliver an ever-improving mortgage experience fueled by technology.

Next up is adopting Blend Close, giving members the option to choose a fully digital closing. “We know, based on our experience with Blend and the other features we’ve added that [Blend Close] is going to give us a big lift,” Rios noted.

With their passion for member service and a constant eye on new technological developments, Blend eagerly awaits what UWCU is able to deliver next to their customers.

Sign up for a personalized demo