Navy Federal

empowers a timeless member experience across channels

empowers a timeless member experience across channels

Read the full story about Navy Federal

Utah

Mortgage Suite

Encompass

Blend has helped PRMI originate more loans and close loans faster, and industry pros are taking notice.

Ready to get started?

Get a demo

Utah

Mortgage Suite

Encompass

loan volume growth in 2019

applications that come through mobile

fastest time to submit

The team at Primary Residential Mortgage, Inc. (PRMI) has an acute understanding of the challenges facing distributed retail lenders. With offices across 49 states, they provide expert local knowledge, but market-driven financial pressures have necessitated an organizational shift. “Organizations like ours are looking for solutions that allow us to transact business more effectively, remove potential defects and stumbling blocks out of the process, and help us to create a better customer experience at a lower cost,” said Chris Jones, president of retail at PRMI.

How can a mortgage bank with 900+ officers across the country execute in a way that relieves the cost pressures challenging the market? The answer is enabling sales teams to operate more efficiently and effectively.

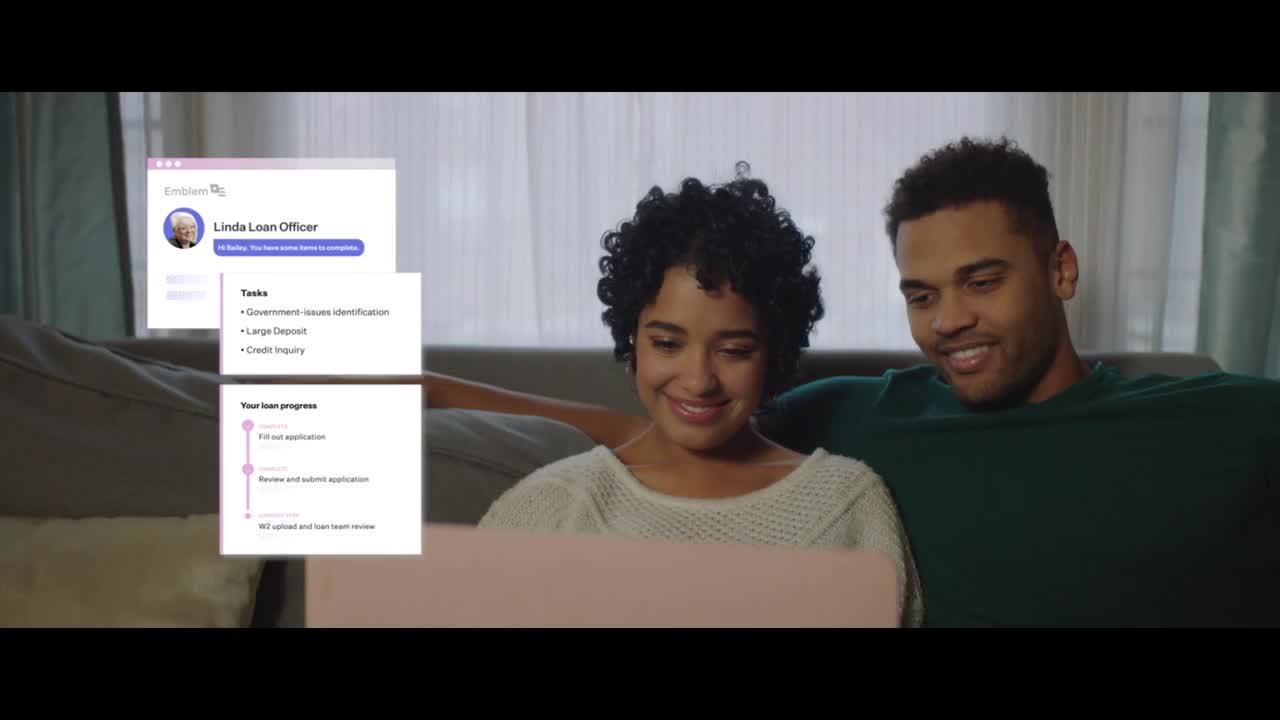

How do they do that? Equipping their LOs with Blend’s best-in-class technology

Because of the distributed retail business model PRMI employs, they needed a way to maximize each loan officer’s productivity. Many of them rely heavily on referral partners, spending time out in their communities fostering relationships. PRMI executives have always prioritized making it easier for LOs to do their job outside of the office.

“I have a responsibility for the success of our branches out in the field, and that success comes through our ability to create value for the consumer and the loan officer,” remarked Jones. “There’s potential to create a mobile experience that makes things so much simpler and so much easier for us to meet the consumer on their terms,” he continued.

The PRMI team creates a flexible environment where LOs are free to use the strategies that work for them, supporting from a managerial level with top-notch tools that enable customizable workflows. Ruth Green, EVP and COO, noted, “PRMI invests in technology that makes lending easy, both for the consumers as well as for us. We invest in technology that’s mobile, letting people do business the way that they want to do business, which is very much on the go.”

Blend has been the technology solution for PRMI’s on-the-go workforce. “Blend has evolved the role of an LO by taking away the part of the job that is sometimes very time-consuming,” said Linda Weir, branch manager. This evolution is appreciated by the LOs, who are freed to utilize their expertise as advisors to their customers.

LOs’ day-to-day duties have become significantly more streamlined. “It helps me not to have to manually touch every file every day because it’s working in the background while I’m working on the new ones,” said Weir. With these tasks taken care of, Weir and her team of LOs are able to spend their time developing relationships and working with referral partners to maximize the number of loans they’re originating. “Blend allows my team members to be able to work effectively from wherever they are,” she continued.

The LOs are set up for success. “Taking that mobile mindset and putting it into the originator’s hands is really powerful, because that’s where business is being done,” said Swope. “Starting a new loan from the palm of their hand is what it’s all about.”

Weir echoed this sentiment. “Blend really allows me to attract new business because most of my business comes from real estate agents, and the one thing that real estate agents want is communication. With Blend we’re able to give them quick communication.” When PRMI’s real estate agent partners have more time, they can sell more, which means more originations for PRMI.

Blend helped Swope follow through on LOs’ biggest ask: “Blend is doing such a good job at giving more of their time back to them. If you think about it, it’s taking and automating those non-value-add activities and allowing our originators to focus on the things that bring value to them and to their customers. That is so precious.”

As soon as Blend was deployed, the first LOs to use the platform were quick to see the benefits. “Once they realized the power of the technology and how it helps them do their job better and create a better customer experience, they became the biggest promoters,” added Jones.

The benefits to the LOs are paying off for PRMI as a whole. Green has noticed marked improvements for the business: “With Blend, we can speed up the transaction from origination to close and we can really eliminate a lot of the communication hurdles.”

Weir noted that wherever her team of LOs is, they can take an application instantly, meaning they never miss out on the opportunity to originate more business. Blend has helped PRMI originate more loans and close loans faster, and industry pros are taking notice.

When your loan officers are succeeding, people want to join your team. Because of this, PRMI’s sales organization has been able to recruit and retain best-in-class LOs. “Blend has some of the best tools for both originators and for processors,” voiced Green. This growth strategy will continue to serve the organization’s expansion.

Swope’s mind is on expanding PRMI’s presence: “When I look at Blend before and after, really what it’s done is it’s given us new capabilities that we didn’t have before. We can use the Blend experience to capture those customers.”

Green sees the Blend partnership as evergreen, looking forward to how the relationship will continue to shape the support PRMI provides their LOs. “I think Blend is a fantastic partner and as we move into a more digital lending environment over the next five years, they’re going to continue to deliver on the tools that allow us to do things more quickly and deal with more digital data rather than paper data.”

Sign up for a personalized demo