Power the winning trio with mortgage tech

Uncover the key to the mutually beneficial loan officer, borrower, and real estate agent relationship: Your mortgage technology.

Start learning about Power the winning trio with mortgage tech

Originations

Create a home loan process to reach a wider borrower audience from pre-application to close.

Request demoWith features that enable customers to feel understood, your borrowers will know they're in the right hands.

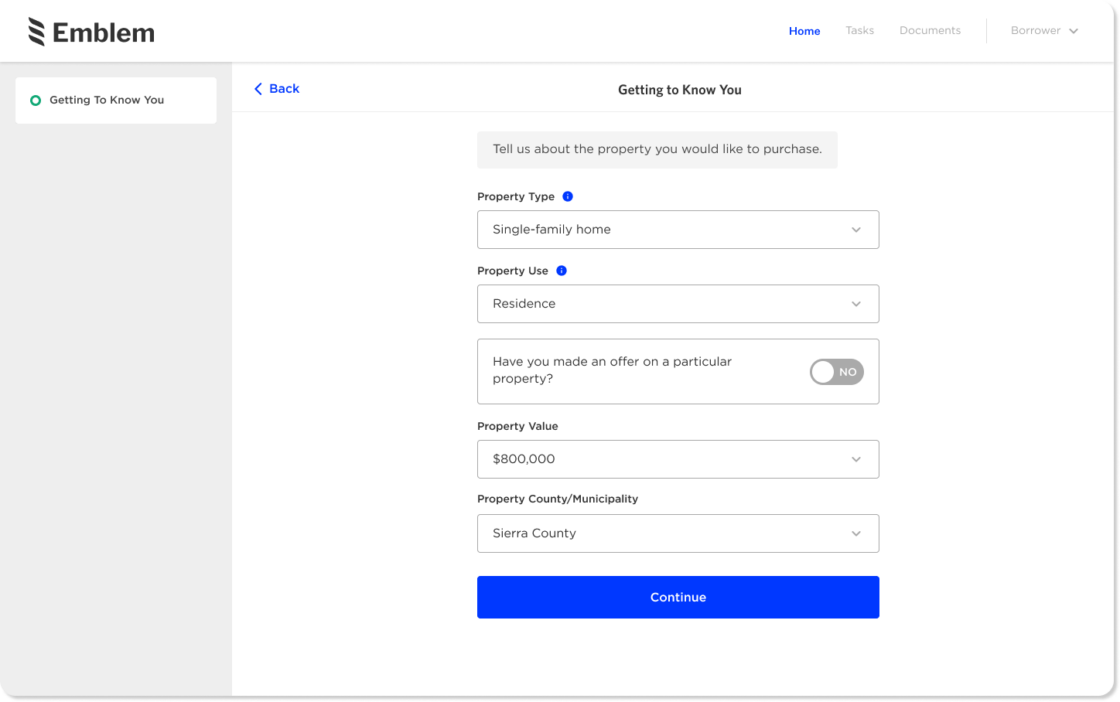

Provide an easy and intuitive application process through a borrower loan app with educational, dynamic questioning and self-serve capabilities.

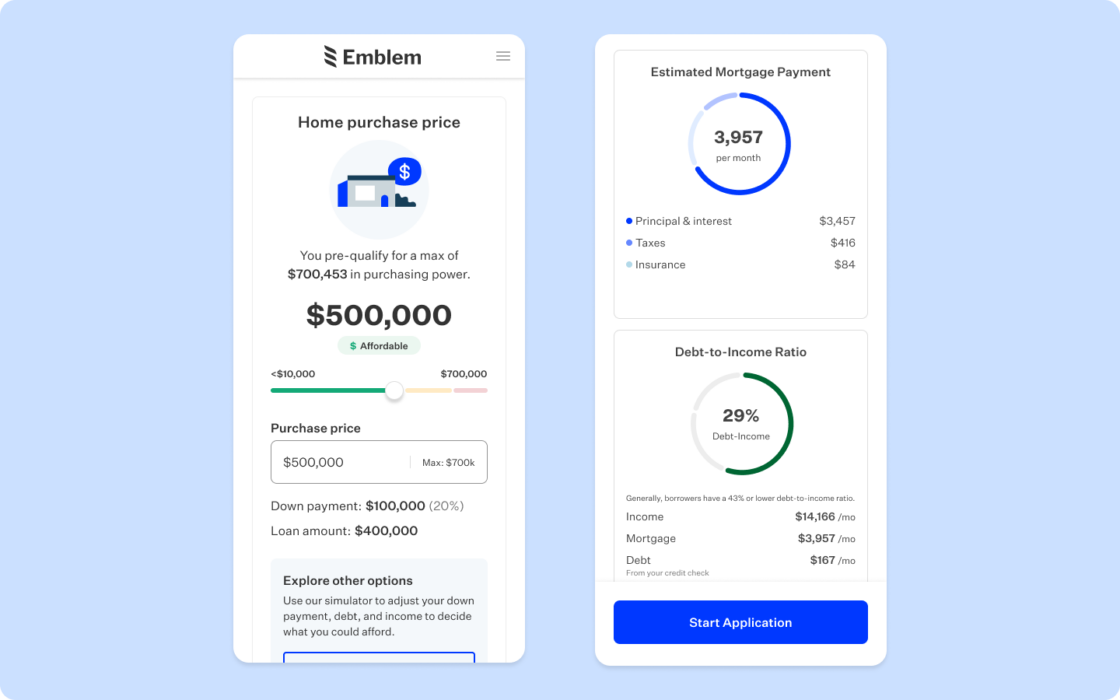

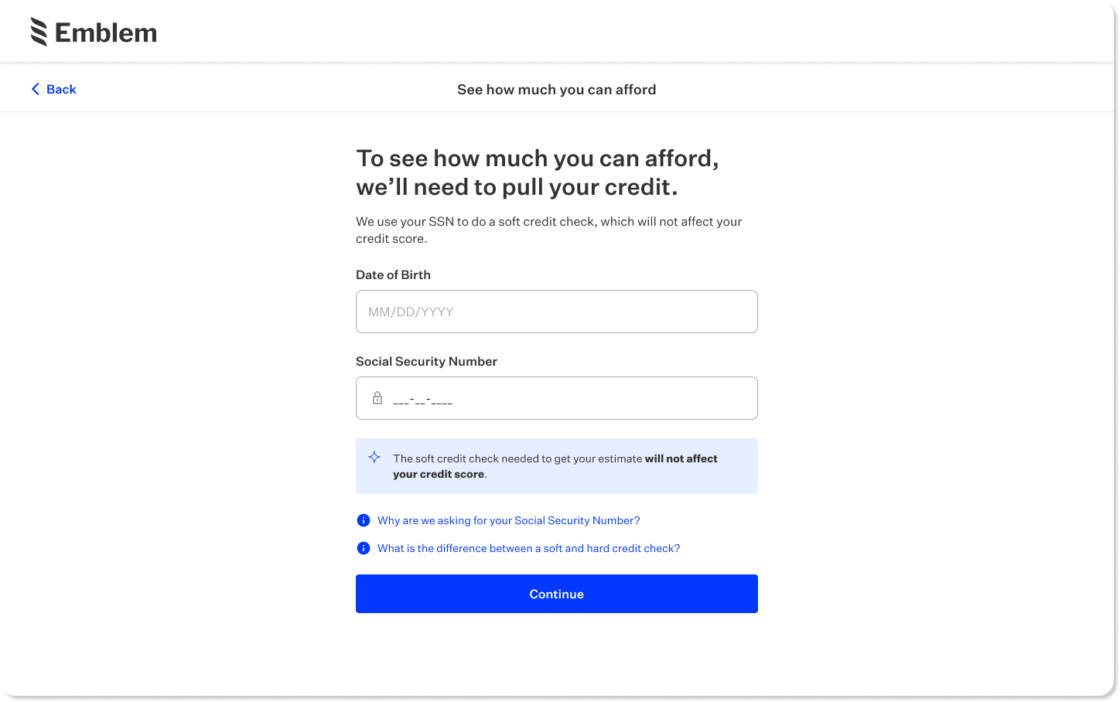

Establish trust and qualify leads even before application with our loan scenario simulator and soft credit pulls.

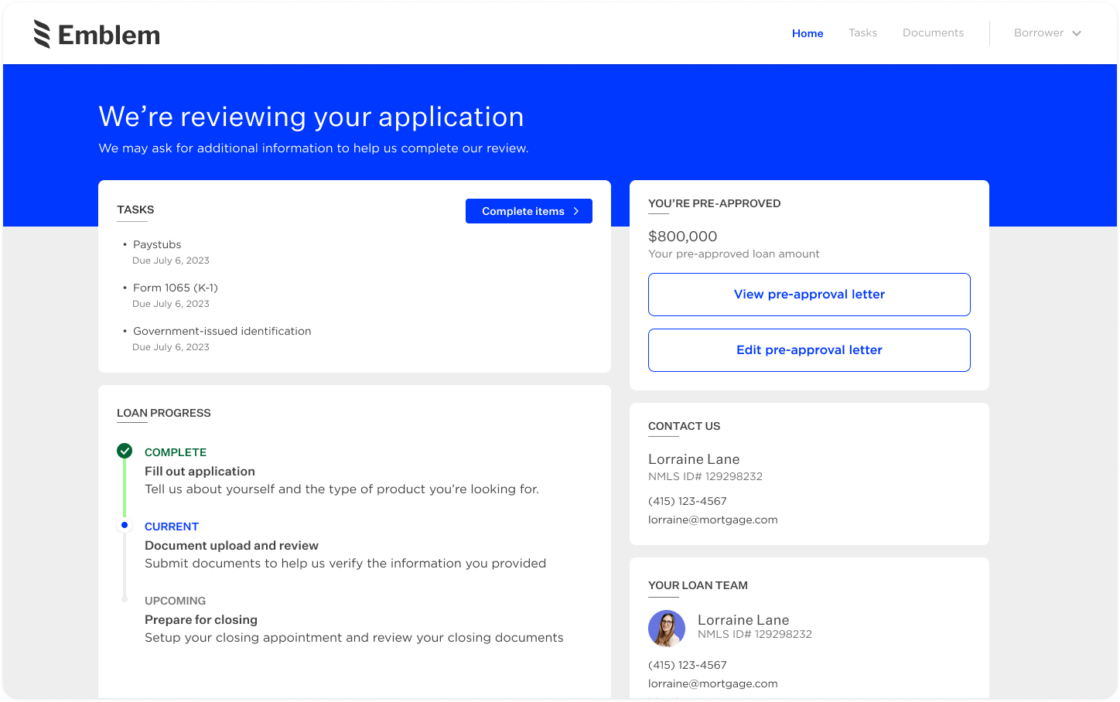

Stay on top of outstanding tasks and identify up to 65% of conditions upfront with triggered, automated follow-up notifications.

Give borrowers a great first impression with a soft credit pre-qualification that reduces friction, cuts costs, and protects them from tri-merge solicitation.

Subscribe to get Blend news, customer stories, events, and industry insights.

Sign up for a personalized demo and get started in 4 weeks or less