August 12, 2020 in Blend momentum

Announcing Blend’s Series F funding led by Canapi Ventures

Announcing Blend’s Series F funding. Celebrate Canapi Ventures joining our exceptional existing investors as we drive transformation in consumer lending.

I’m proud to share that Blend has raised an additional $75 million in our Series F financing, led by Canapi Ventures, as we continue our work to enable financial institutions to provide better lending experiences and help consumers access the capital they need. We are also pleased to have existing investors General Atlantic, Temasek Holdings, 8VC, Greylock, and Emergence Capital participate in this round.

Canapi Ventures has tremendous expertise helping banks and credit unions identify top technology partners that can accelerate their growth, and we’re thrilled to have them on our side as we continue to drive transformation in consumer lending.

Building on existing momentum

Today’s news is a testament to our strong partnerships with our customers and our ongoing commitment to creating a simple, transparent consumer lending experience. We’ve seen impressive momentum since our last round of funding, and even amidst the challenges of the past few months, we have added new customers, new products, new features, and onboarded more than 100 new employees. Blend is now enabling more than 250 financial institutions to collectively process more than $3.5 billion in consumer loans per day. We’re not done. With this raise we can increase our dedication to solving for an end-to-end digital mortgage and complete homebuying journey in support of our customers’ success.

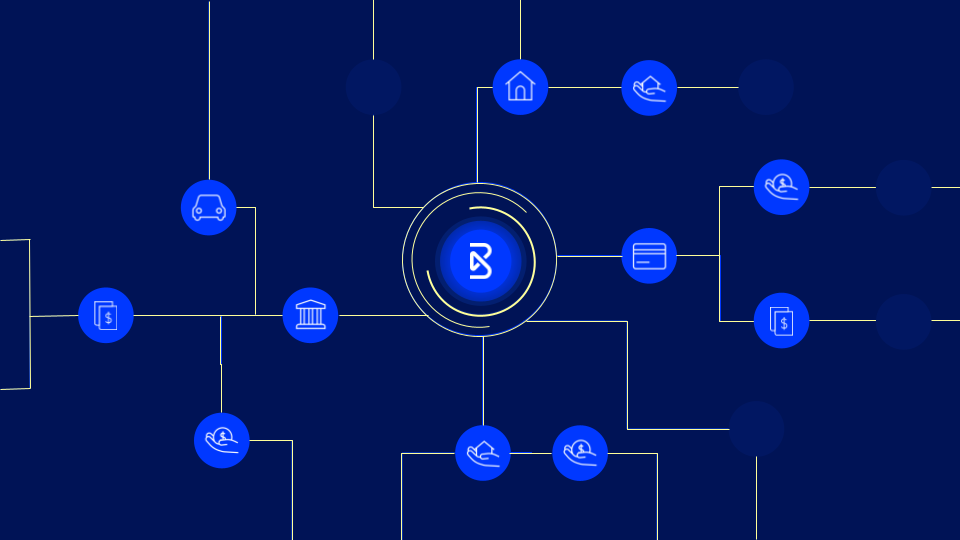

Over the course of the last year, we’ve also announced our expansion into consumer banking, streamlining consumer loans and deposit account openings by enabling financial institutions to provide instant pre-approvals and personalized product offers. This funding will allow us to accelerate our product development and deliver a best-in-class platform for consumer banking, enabling banks and credit unions to be there for every financial milestone in their customers’ lives. We’ll also be able to devote more resources to the worthy cause of increasing access to financial services and building toward a more equitable future for the industry.

It’s our goal to help top financial institutions serve their customers frictionlessly. In the new age of seemingly daily changes around us, enabling our customers to achieve digital agility and stay ahead of their customer needs is a big undertaking. This new round of funding will enable us to continue to invest heavily in our platform, building alongside our partners as we work to solve whatever challenges come their way.

We’ve made substantial investments over the past year to provide our customers with more product capabilities and greater flexibility to adapt quickly to changing market conditions. In recent months we’ve built features to help our mortgage customers manage unprecedented refi volumes, delivered a seamless end-to-end digital mortgage experience to consumers by accelerating the launch of our digital closing product Blend Close by 6 months, added new features to make loan teams more productive, and enhanced Blend’s reporting capabilities. We’re more committed than ever to serving our customers who are helping millions of their consumers find much-needed savings by refinancing their homes.

We also unlocked our platform with M&T Bank to configure — in just 72 hours — their digital mechanism for processing applications for the Small Business Administration’s Paycheck Protection Program (PPP) loans. And we’re always looking ahead to understand and anticipate what our customers may need as we continue to adapt to market conditions and rate changes.

Blend’s Series F funding is a gateway to continued success

It’s an exciting time to be part of the solution in digitizing financial services, but we know we are just getting started — and none of this would be possible without our customers or dedicated team members. It’s a privilege to build the future consumer lending experience along with so many great partners and colleagues, and I look forward to continuing to provide a resilient, flexible platform designed to support any banking product for many years to come.

See how to enable digital agility for your organization

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.