October 6, 2022 in Blend momentum

Shifting home equity into self-driving mode

Explore how Blend Builder is powering Instant Home Equity — and how it can power the future of banking.

Blend

Coming out of our exciting Forum Live launch event, I wanted to share how our giant step forward in origination reflects a parallel and comparably impactful adjustment to our product development strategy.

As markets shift, financial institutions must be equipped to pivot quickly if they’re going to maintain a competitive edge in an increasingly competitive landscape. Meanwhile, consumers are seeking flexible, tailored options to meet their financial goals. Are you meeting, or even anticipating, their needs? Digitally native competitors are, and market share numbers signal that it’s working.

Our product team truly takes this to heart — our commitment is to enable you to adapt better, compete better, and serve better. Instant Home Equity, which we showcased at Forum Live, is the perfect product to demonstrate exactly how we intend to satisfy that commitment.

We’ve dismantled the current home equity process. Think bespoke offers and pre-approvals in inboxes. Final approvals and funding in bank accounts in days. Workflows reduced to a few simple steps.

Powering all of this is Blend Builder, our low-code, drag-and-drop product development engine. But Builder isn’t just for home equity — it will fundamentally change what rapid delivery looks like as financial institutions offer products that meet any consumer need.

We’ll look at Instant Home Equity in more detail, but let’s first examine why we chose this under-accessed product as the perfect opportunity to showcase what instant-first development means for the future of banking.

Didn’t make it to Forum Live?

The moment for home equity is now

With high inflation, rising interest rates, and increased home values, consumers are feeling the pressure of limited economic mobility, but one factor is in their favor: national homeowner equity rose by 32.2% from the first quarter of 2021 to the first quarter of 2022, an increase of $3.8 trillion. And homeowners have responded with a surge in demand for home equity products. Our own data shows a 100% YoY increase in consumer demand for home equity.

Home equity loans and lines of credit are popularly used for home renovations, debt consolidation, and emergency funds — needs that benefit from rapid access to funding. As with other financial products, personalized, intuitive, and frictionless experiences are now table stakes.

Digitally native competitors are already capitalizing on these evolved expectations with solutions that take consumers through applications in minutes and deliver funds promptly. As they quickly snap up market share, banks and credit unions are being challenged to take action.

“Our focus wasn’t on improving the application — it was on nearly eliminating it.”

Introducing Instant Home Equity

We’ve incorporated our proven platform capabilities into an out-of-the-box home equity package so you can start realizing impact for your business and value for your customers now, without putting in years of engineering and infrastructure work.

Our focus wasn’t on improving the application — it was on nearly eliminating it. Not only will your customers get the proactive, personalized, and effortless experience they’re used to having with other services, they will also access their home equity faster.

Meanwhile, you can lower origination costs, drive pull-through, get loans closed faster than ever before, and even improve utilization, all while replacing rote work with automation.

Let’s dive in to exactly how it can work with a fictional customer we’ll call Bailey.

Shifting home equity into self-driving mode

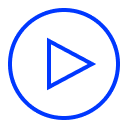

- Bailey is feeling unsure about her financial future when an email from her financial institution, Emblem Bank, pops up in her inbox: a pre-approval for a home equity line of credit.

- The application flow asks only for the information Emblem Bank does not already have, and Bailey completes it in minutes.

- In the background, Blend completes identity and income verifications, determines home value with an automated valuation model (AVM) integration, runs title, and obtains homeowner’s insurance and flood policies.

- Blend’s decisioning engine automatically validates her eligibility, approving her for the loan instantly.

- After electronically signing documents through Blend Close, Bailey receives the funds in her account within three days and is able to consolidate her debt.

Building the future of banking

The time for home equity is now, but this won’t be a blip in the lending landscape. We will continue to iterate on our new solution, adding features and integrations to further streamline the process. Thanks to our flexible platform, improvements to the product take minutes, not weeks, meaning you’re always equipped with the latest and greatest functionality.

But Instant Home Equity is just one manifestation of what Blend Builder and the platform that supports it can deliver.

The low-code product development methodology that accelerated the release of Instant Home Equity can unlock similarly unique experiences in reaction to shifts in the market or consumer preferences — on timelines unheard of in the industry and, frankly, impossible at most financial institutions.

You want to deliver on your promise of helping your customers maintain financial well-being — especially when it is needed most. And we want to make that possible by revolutionizing how you help them. Instant-first is one of the core pillars propping up our vision for the future of banking. Are you ready to make the future your reality today?

Ready to shift into self-driving mode?

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.

Blend Showcases Rapid Home Equity for HousingWire

Blend demonstrates how Rapid Home Equity can accelerate funding cycles by 35% with automated workflows and instant, personalized offers.

Watch video about Blend Showcases Rapid Home Equity for HousingWire

From Reactive to Predictive: Unlocking Deeper Member Engagement

Bridge the disconnect between member data and branch interactions to deliver proactive guidance.

Read the article about From Reactive to Predictive: Unlocking Deeper Member Engagement

The Home Equity Transformation in 2026

A roadmap for winning the 2026 home equity boom with faster decisions and automated workflows.

Start learning about The Home Equity Transformation in 2026