May 16, 2022 in Challenges and solutions

The complete guide to banking business strategy in 2022

How to harness the power of technology advancements, exceed customer expectations, and deploy smarter strategies for growth at scale.

Blend

While it may be a challenging time to be operating in the financial services industry, opportunities for growing your business are in abundance.

The long-established products and services of old, delivered through physical distribution networks via traditional sales and marketing techniques, are no longer fit for purpose. However, you can find a way to level-up against digital-first providers and pioneering banks that are not held back by legacy systems or decades-old processes.

You also have new opportunities to become more customer-centric. Based on their interactions with companies in other sectors, today’s consumers expect you to offer around-the-clock availability, friction-free experiences, and personalized offerings. And they are no longer prepared to wait weeks or even months for an account to be opened, a loan to be granted, or a mortgage to be approved. Adapt to meet these expectations, and you can thrive.

Finally, global uncertainty is compounding fluctuations in historically cyclical financial patterns. But fostering resilience can help you grow. Learn to adapt against a backdrop of uncertainty.

Whether optimizing for competition, customers, or consistency, digital strategies that scale are the foundation for success. Let’s explore why.

Compounding the need for digital

All of the above opportunities can be unlocked through digitalization, which promises greater convenience, improved customer experiences, reduced overhead, and faster time-to-market, among other benefits. And the pioneers are proving its worth: Accenture research has found that a small number of digital-focused banks (the top 12%) are benefiting from significant financial returns. In fact, the report goes on to find that digital-focused banks are achieving their success through higher operating leverage that squeezes more profitability out of every dollar of assets.

The rest of the industry is certainly taking note. Sixty-seven percent of banks believe they will lose market share within just two years if they fail to transform themselves digitally.

Unfortunately, many banks are failing to act on this realization. Research suggests that less than a third of banks are currently implementing a digital strategy.

It’s time for that to change.

How can you use the growth/scale distinction to prioritize digital development strategies?

It can be easy to fall into the trap of confusing growth and scale, but there’s an important distinction to be made between the two.

- Growth

is revenue-focused and happens when resources grow at the same pace as revenue. - Scale

is still about growing revenue but without an associated growth in cost. It’s about increased returns, greater stability, lower cost per customer acquisition, and improved efficiency and productivity.

If you’re able to scale digitally, you can not only experience growth but also reduce wasted resources and cut costs.

With this in mind, scale is a key consideration when developing your digital strategy. Here are three scale-aligned areas to focus on:

1. Scale by recommitting to your customer obsession

Companies that lead in customer experience outperform those that don’t by nearly 80%. That’s because customers who enjoy positive experiences are likely to spend 140% more than customers who report negative experiences.

Along with the fact that it costs up to 25 times more to win new business than it does to keep existing customers, this illustrates just how important the customer experience is to your ability to scale. By focusing on delivering exceptional experiences to your existing customers you can capture additional revenue while minimizing new expenditures.

It’s time to better meet customer needs

If you recommit to your customer obsession, you can deliver the service that consumers are crying out for. By creating seamless, hassle-free banking experiences for customers across all channels and all product lines, you can build customer relationships that last beyond a single interaction.

But this doesn’t automatically mean making everything digital.

Customers want:

- Flexibility

They want a choice of channels, but also the ability to switch from one to another on their terms — and without disrupting or fragmenting their journey. - Convenience

They get frustrated when applications take too long, and they are put off when they are asked to spend their valuable time sourcing paper-based documents to support their application, especially for “simple” products such as deposit accounts. - Human support when things get difficult

They want you to be there for them at the moments that matter, and they want to be understood. Fifty-one percent of consumers expect that banks will anticipate their needs and make relevant suggestions before they even make contact.

Putting it into practice

The mortgage team at University of Wisconsin Credit Union (UWCU) has been able to establish a reputation among its members as a company at the forefront of innovation.

Members are using the technology provided to them at high rates and finding the features easy to navigate. In fact, 83% of applications that are started online are submitted.

Meanwhile, Blend’s consumer single sign-on and asset pre-fill is giving borrowers the “show me you know me” experience they were looking for. The UWCU member base quickly showed their enthusiasm for the new feature, with twice as many applicants utilizing data connectivity for assets as a result.

2. Scale by future-proofing your offerings

Demand for your products is constantly fluctuating, which impacts the economics of selling it. While you may have a full suite of offerings available at any given moment, the amount of internal resources dedicated to any one depends mostly on its current profitability. When the perfect storm of low cost products being in high demand hits, it’s important that you are ready to pounce.

Doing this successfully typically requires the physical reallocation of people as well as adjustments to process. However, a more scalable approach minimizes the need for what is essentially continuous reinvestment into products as demand changes.

This requires a deep understanding of new market requirements and the agility to launch new products in a timely manner. To achieve this, many financial institutions end up choosing one-off point solutions that may help them get a single product to market quickly, but can leave them with a siloed infrastructure that leads to inconsistent experiences. It’s the exact opposite of future-proofing your business.

How can you secure your future success?

A better approach is implementing a solution that can support all lines of business.

Having one system that supports all products helps ensure there is consistent access to them at all times.

What’s more, it simplifies the transitioning of resources, because each product is situated within the same system. It also minimizes the amount of human capital change required to do so. Ultimately, this will:

- Enable your organization to consistently meet customer needs

- Help you succeed more effectively against the competition

- Ensure you have a diverse product portfolio that secures your future success

Putting it into practice

Our partnership with Elements Financial is a great example of what can be achieved with a scalable technology investment. Four years ago, the company came to us to help them elevate their member experience for mortgage and home equity. We achieved great success, and so they asked us to expand our partnership with the addition of a portfolio of new products: the Consumer Banking Suite.

It’s paid off. With Blend, the average member’s mortgage application-to-fund time decreased by five calendar days. Streamlined applications may be a contributing factor in the growth Elements has realized: approved applications for deposit accounts, vehicle loans, personal loans, and credit cards have increased by 11% on average.

What started as a tool to improve experience for mortgage and home equity is now enabling Elements to originate loans across products on the same platform. One investment has scaled alongside the team’s needs.

Learn how to apply a future-oriented strategy to a key lending product: home equity

3. Scale by fully embracing (the right) technology

The path to digital shouldn’t require you to rip and replace your technology on a regular basis, yet it’s a situation we see all too often.

Cloud-based platforms offer an alternative. They can help you scale through integrations that connect the old with the new, delivering a consistent, unified experience. Automatic software updates remove the burden of stressful and inconvenient upgrade procedures, which can be a drain on lenders’ IT teams. Overheads are reduced too — lenders may no longer need to invest in their own server, networks, and other expensive infrastructure.

Perhaps most importantly, a good cloud solution provides cumulative value, not a one-off benefit that then tapers.

That’s partly because the technology scales with you — constant innovation on the bank side is matched by the same on the tech side. But it’s also because there’s a multiplicative effect of combining feature sets. If you have a point solution that does one thing well, and then a separate one that does something else well, you likely aren’t benefiting from synergies across the two. However, when a single system has multiple features and/or products, the value is magnified.

What should you look for in your cloud solution?

Two key features will help you get the most from your cloud solution:

- Automation

Despite what you may have heard, automation isn’t about replacing human workers. It’s about unlocking human potential. Good cloud solutions do this by removing manual and often repetitive processes and automating them conveniently and efficiently. - Machine intelligence

Software that uses machine learning, predictive analytics, and business intelligence is not only able to collect data, but also identify and analyze it. This enables features such as instant decisioning and verified pre-approval and can offer machine-powered recommendations that create a personalized feel for customers and help you close more loans.

Putting it into practice

New York-based M&T Bank joined forces with Blend to help it drive continuous improvement and to achieve the agility it needed to navigate times of change. When unprecedented demand for a unique product offering emerged, M&T leadership turned to Blend to scale their delivery.

“Partnering with Blend meant we could move quickly enough to be there for our customers when they needed it,” said Chris Kay, who leads M&T’s consumer and business banking divisions. “The team’s dedication to making this work on a short timeline is a testament to the type of partner Blend is, and the way your platform could adapt to this new situation and scale rapidly was especially impressive.”

Learn how to unlock digital agility with Blend

How Blend can help

At Blend, we don’t consider ourselves a vendor. We are a partner. We believe in getting to know our financial services customers, in understanding their needs and challenges, and in working hand-in-hand to help them get the very best out of our software.

We are here to help you scale digitally by focusing on the three scale-aligned areas we’ve discussed above.

We help you recommit to your customer obsession

Blend’s cloud-based platform has been built with elevated customer experiences in mind. It offers:

- Digital applications that are easy to navigate:

Blend’s conversational interface is designed to guide customers through the application process. - Speedy applications

Because Blend connects to external data sources, customers benefit from pre-filled fields and automatic data verification. - Omnichannel support

Blend allows your customers to start and stop the application process across devices, with human support available right at the moment that matters.

Blend also helps your lending teams to nurture customer relationships, building longevity and boosting long-term revenue at the same time. You can use the platform to create a consistent experience across all lines of business — signifying your commitment to your customers.

We are building to a future where, when a customer chooses to open a deposit account for example, they are recommended natural next step products such as a credit card or a car loan — and they can apply for those products in the same environment. This will create a natural, consistent flow that mirrors consumers’ typical purchasing patterns.

Ultimately, we believe this will result in more loyal — and more valuable — customers.

We help you future-proof your success

Thanks to its expanded suite of out-of-the-box offerings and configuration capabilities, Blend’s cloud-based platform supports any consumer banking product.

Its comprehensive component library, pre-built templates, drag-and-drop workflow building, and integrated data services help product teams take ideas to market faster but in a consistent and structured way.

Ultimately, it gives the agility you need to provide the right product at the right time for your customers, supporting your position as the go-to advisor for every financial need.

In addition, we are consistently adding new modular features that help you put emphasis on the highest value-add experiences in alignment with market trends. For example, we recently released a standalone income product after hearing from customers that the fragmented offerings available were not meeting their needs.

We help you embrace the right technology

Blend’s cloud-native platform allows you to do business wherever you are. With automatic updates, you can be sure you always have the latest version of our software with the best functionality.

And that’s not all. Using machine intelligence, our platform can:

- Verify data automatically, and pre-fill fields on the application using data from the borrower.

- Aggregate data from tax offer platforms and payroll providers.

- Fix common sources of friction by analyzing applicant data and documents to flag and surface issues.

All this can improve the overall waiting and processing time, leading to happier customers and happier bankers too. And the right technology is only right for you if it is also committed to growing with you. Our customer-first approach puts you at the center of our roadmap.

Ready to scale successfully to grow every line of business?

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.

Turning Home Equity Into a 2026 Growth Engine for Share, Loyalty, and Revenue

See how banks and credit unions can turn home equity into a 2026 growth engine with rapid, digital journeys that compete with fintechs and strengthen loyalty.

Read the article about Turning Home Equity Into a 2026 Growth Engine for Share, Loyalty, and Revenue

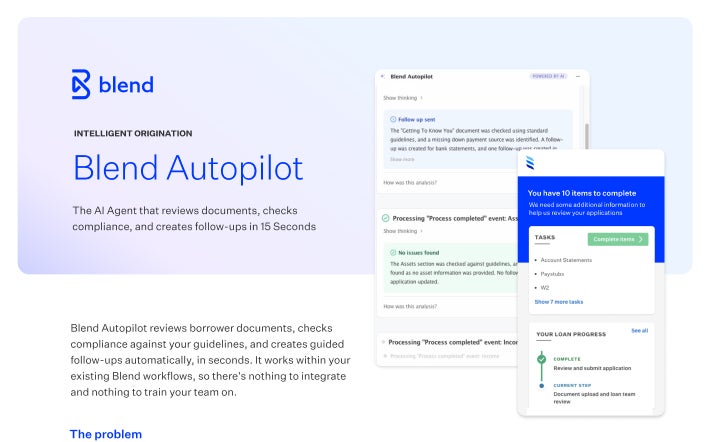

Blend Autopilot: AI That Keeps Loans Moving Forward

The AI Agent that reviews documents, checks compliance, and created follow-ups in 15 seconds.

Start learning about Blend Autopilot: AI That Keeps Loans Moving Forward

From Upload to Underwriting in 15 Seconds: Introducing Blend Autopilot

Meet the AI agent that reviews documents, generates needs lists, and keeps loans moving forward in real time, no business hours required.

Read the article about From Upload to Underwriting in 15 Seconds: Introducing Blend Autopilot