May 29, 2020 in Mortgage Suite

How to close more mortgage loans with higher application submit rates

For banks and lenders looking to close more mortgage loans, the simplest solution focuses on the start of the process: applications. If your organization is able to collect more completed applications, you’ll have a better chance of closing more files. In many ways, the important question isn’t “how to close more mortgage loans?” Instead, it’s “what can we do to increase mortgage application submit rates?”

How a Digital Lending Platform closes more mortgage loans with three key features

Blend’s Digital Lending Platform enables financial institutions to drive more closed mortgage loans. The numbers speak for themselves. Loan teams using our mortgage software report an increase of up to 67% in year-over-year volume. Additionally, up to 89% of borrowers who start an application in Blend submit it. This article takes a closer look at a few features that improve the customer experience from the very start of the process while also creating efficiencies for lenders: a conversational application interface, automated data verification, and One-tap Pre-approval.

No. 1. Self-guided application process with a conversational interface

To raise application completion rates, lenders can focus on improving the customer experience. Although there are many ways to put your customers at the center, two relatively simple options are creating a user-friendly application and providing real-time assistance.

It’s important to offer an interface that guides borrowers through the process while utilizing straightforward, easy-to-understand language. The Blend application flow is intelligent. Based on answers provided early in the process, Blend will automatically adjust what applicants see further down the line. As a result, users only see questions that elicit new information.

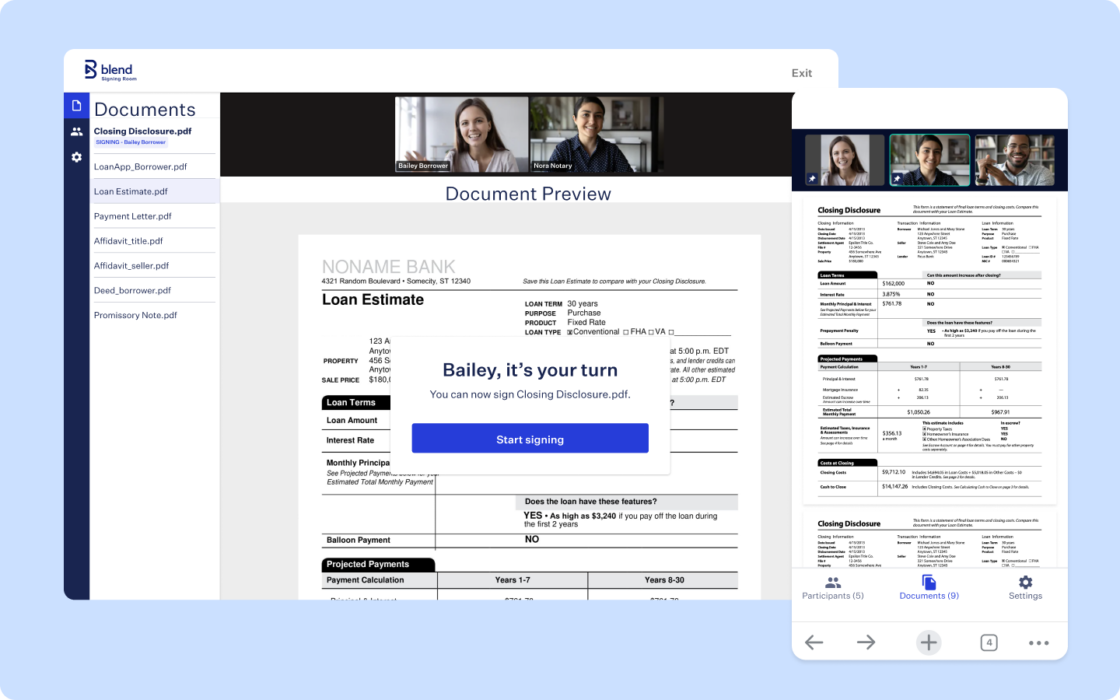

When it comes to real-time assistance, our application flow includes built-in answers to applicants’ most common questions. For those really tough questions that the built-in answers can’t handle, Co-Pilot allows loan officers to digitally step into an application, no matter where they may be. The 1:1 visual match of the application experience allows LOs to provide targeted and immediate support.

Without support, each of these unanswered questions could easily have resulted in a frustrated close of the browser. A rage quit. When a borrower exits during the application process, it’s not an easy task to get them back.

No. 2. Embedded data connections with automatic verification

Data verification accelerates the application process by removing manual downstream work. Blend’s platform allows borrowers to connect directly to their payroll, asset, and tax accounts in order to automatically complete parts of the application. These connected assets are automatically eligible for Fannie Mae D1C and Freddie Mac AIM.

Not only is it a more seamless experience for borrowers, but connecting assets within the application also leads to higher competition rates. The borrower doesn’t need to flip to their bank’s page and get derailed by another distraction.

Blend Verification not only provides a better customer experience, but it also streamlines the process for lending teams by limiting manual verification requests. When borrowers enter certain information, like employment income, Blend can automatically initiate income and employment verification via The Work Number by Equifax® at the time of application completion.

No. 3. Instant decisioning with One-tap Pre-approval

Banks and credit unions that prioritize their members’ experiences strive to remove any sources of friction when serving their customers. When shopping for a home, borrowers are more empowered in their search if they know exactly how much they can afford. Offering instant decisioning with a verified pre-approval allows borrowers to submit an application on Friday evening and attend an open house on Saturday morning.

Blend’s One-tap Pre-approval connects directly to consumers’ accounts and uses source data to instantly verify their information, which eliminates the need for the lender to review paper documentation. Instead of waiting days for a pre-approval letter, consumers are able to quickly assess their buying power and download a verified pre-approval letter.

The answer to closing more mortgage loans can be found at the start of the process. Surpassing customers’ expectations during the application process with instant decisioning and a seamless experience builds trust in your organization. The smoother the process and the faster you can get someone a decision, the better chance you have of closing the loan and building a long-term lending relationship. Adopting a mortgage digital transformation enables your organization to improve your application process and increase completion rates.

Ready to learn more about the benefits of mortgage software within a unified digital lending platform?

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.