The future of refinance and home equity is here

A game-changing solution that redefines refinance and home equity by flipping the traditional application process on its head.

Read the article about The future of refinance and home equity is here

Deliver seamless digital journeys from application to close.

Offer unified experience across lines of business.

A single platform powering our products

Elevate the experience of your members

Streamline your lending processes

Optimize workflows and improve lender partnerships

Bring best-in-class home lending experience

Reshaping the way we bank

All press is good press

Powering the future of banking

Better partners for better banking

Join us build something big

Enable borrowers to bypass much of the traditional application process by using connected data to eliminate borrower friction and make it easier to engage in the home lending process.

Deliver pre-approved offers tailored to each borrower’s unique financial profile upfront, providing transparent loan options and savings insights.

Automate qualification, pre-approval quoting, and loan options that enable borrowers to move forward with speed and ease – on the device of their choice.

Ensure every borrower follows the most efficient path to loan completion by intelligently adapting the origination process based on their financial profile and applying configurable business logic.

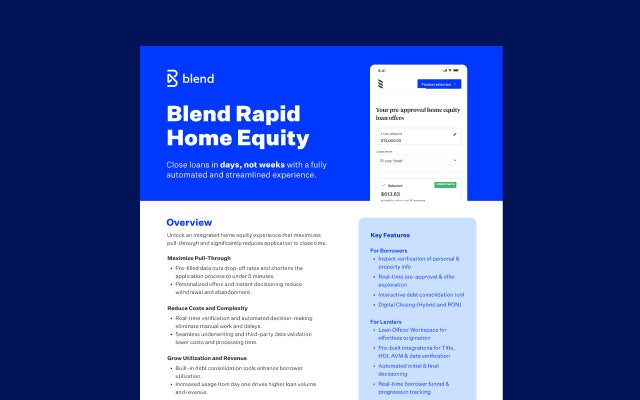

Unlock an integrated home equity experience that maximizes pull-through and cuts your application to close time in half.

Turn refinance opportunities into funded loans faster with a personalized, highly automated application experience.

Read our 2025 Strategy Guide for Lenders: Winning Refinance and Home Equity Opportunities in a Changing Market.

A game-changing solution that redefines refinance and home equity by flipping the traditional application process on its head.

Read the article about The future of refinance and home equity is here

Close loans in days, not weeks with a fully automated and streamlined experience.

Start learning about Faster approvals, lower costs, and higher engagement

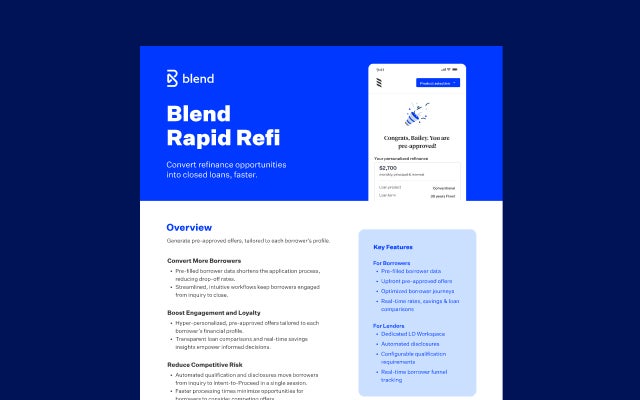

Convert refinance opportunities into closed loans, faster.

Start learning about Turn refinance opportunities into closed loans