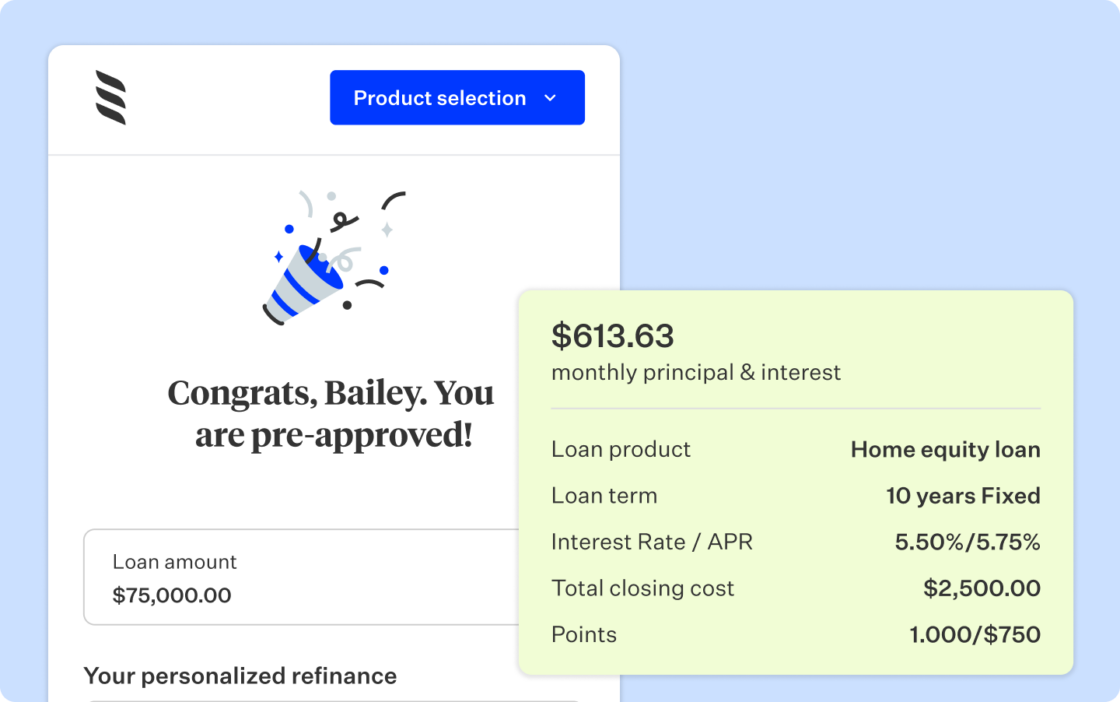

The future of refinance and home equity is here

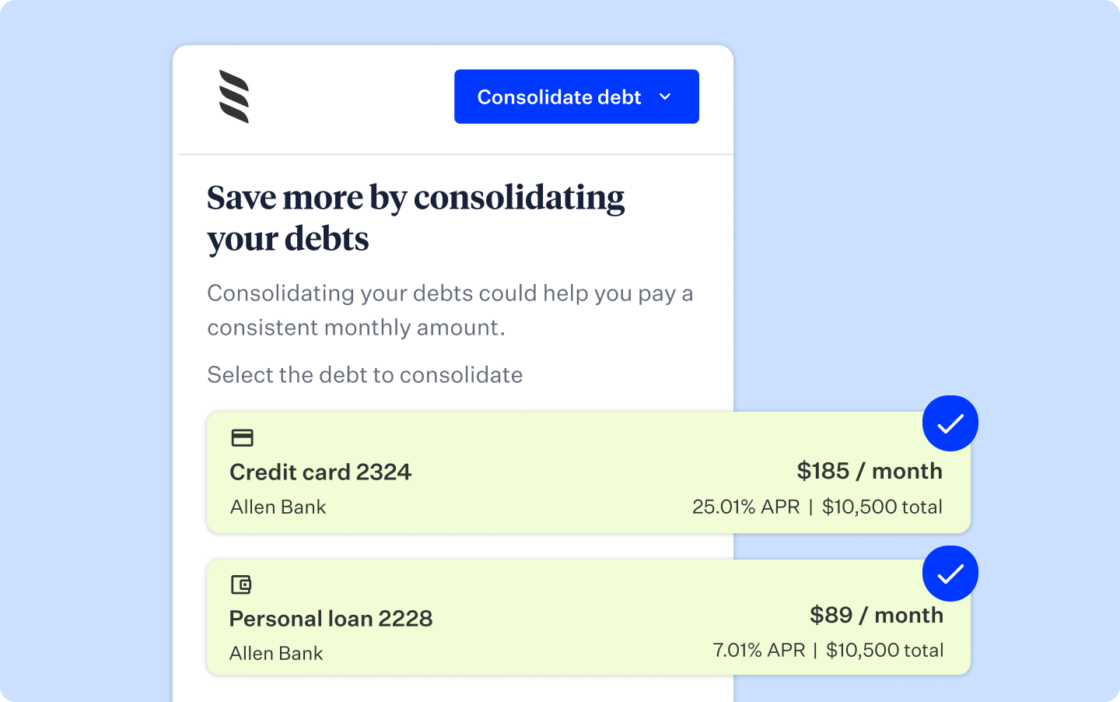

A game-changing solution that redefines refinance and home equity by flipping the traditional application process on its head.

Read the article about The future of refinance and home equity is here

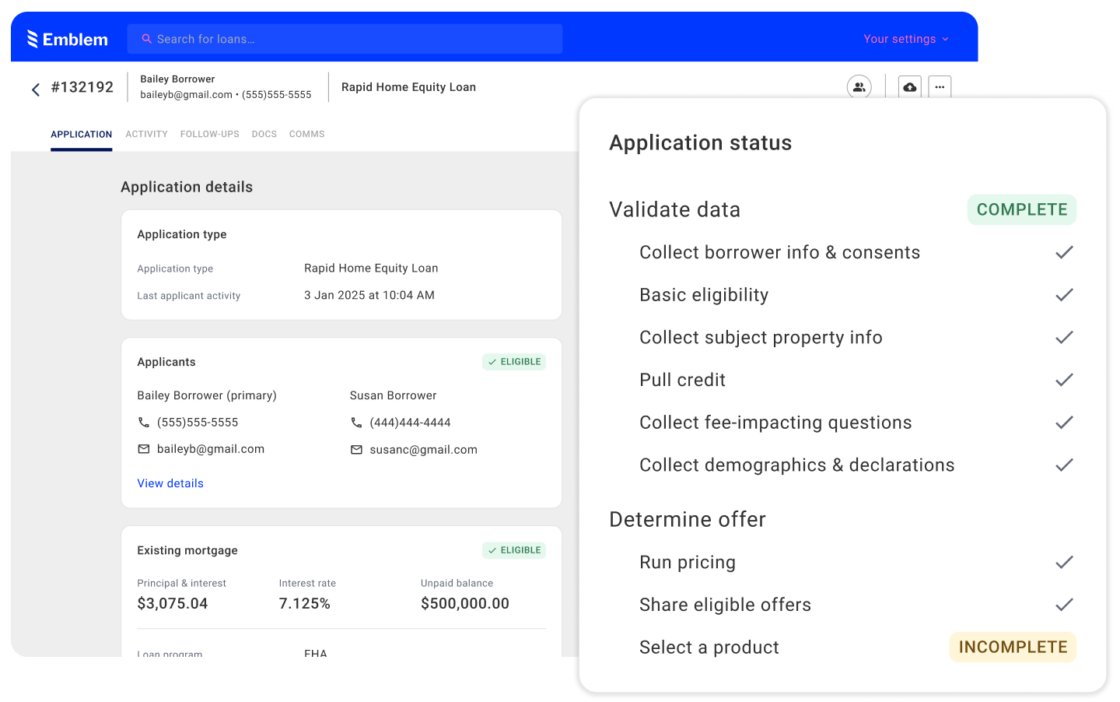

Stop losing customers to slow, complex Home Equity applications

Improve your Home Equity pull-through rate with automated workflows and limited manual touches.

Request demo

Subscribe to get Blend news, customer stories, events, and industry insights.

Sign up for a personalized demo and get started in 4 weeks or less.