PRMI

’s loan officers deliver the best customer experience

’s loan officers deliver the best customer experience

Read the full story about PRMI

Texas

Mortgage Suite

Encompass

Learn how Blend partnered with SWBC Mortgage to successfully roll out nationally to all branches in less than four months.

Ready to get started?

Get a demo

Texas

Mortgage Suite

Encompass

successfully rolled out nationally to all branches in less than four months

proven ROI in pilot phase with 28% reduction in loan cycle for loans during pilot

market awareness with new Turnkey® branding

Moving from the outdated, paper heavy and time-consuming application process to a digital mortgage application process was inevitable for SWBC Mortgage Corporation.

For the better part of a year, SWBC Mortgage’s Chief Operating Officer, Debbie Dunn, and Vice President of Business Systems, Michelle Juarez, were on the hunt for a vendor that would fit their needs: a platform that prioritized a loan officer’s experience, had a clear ROI, delivered impressive results quickly, already had an integration with Encompass, and — above all — was delivered by a team they could relate to and work with easily.

“When we first started looking, no product was up to our standards. We didn’t want to work with a company that was just digitizing the current process. We also didn’t want to get left behind,” explains Dunn.

SWBC Mortgage protects their reputation as a customer-centric and value-driven company by partnering with only the best products and teams.

Their immediate comfort with the humility and intelligence demonstrated by the Blend team was foundational to their decision to move forward with Blend. Stewart credits their final decision to go with Blend as “the combination of aligned values and rapid product development.”

Since signing, they have continued to be impressed by the Blend team and culture. “I’ve talked with lending leaders who have chosen another digital mortgage vendor,” says Stewart. “Nowhere have I heard of a comparable synergy like what we have experienced with Blend. It truly is a partnership.”

After Blend’s 45-day integration process, national rollout was completed within a record-setting four months. “I’ve been rolling out in-house and external products for 30 years, and I’ve never experienced anything that went as quickly and smoothly as this implementation,” says Dunn.

SWBC Mortgage also measured their investment by the reduction in the average time from Application to Closing for the loans that were part of the two month pilot. SWBC Mortgage saw a 28% reduction in the loan cycle time for Blend loans.

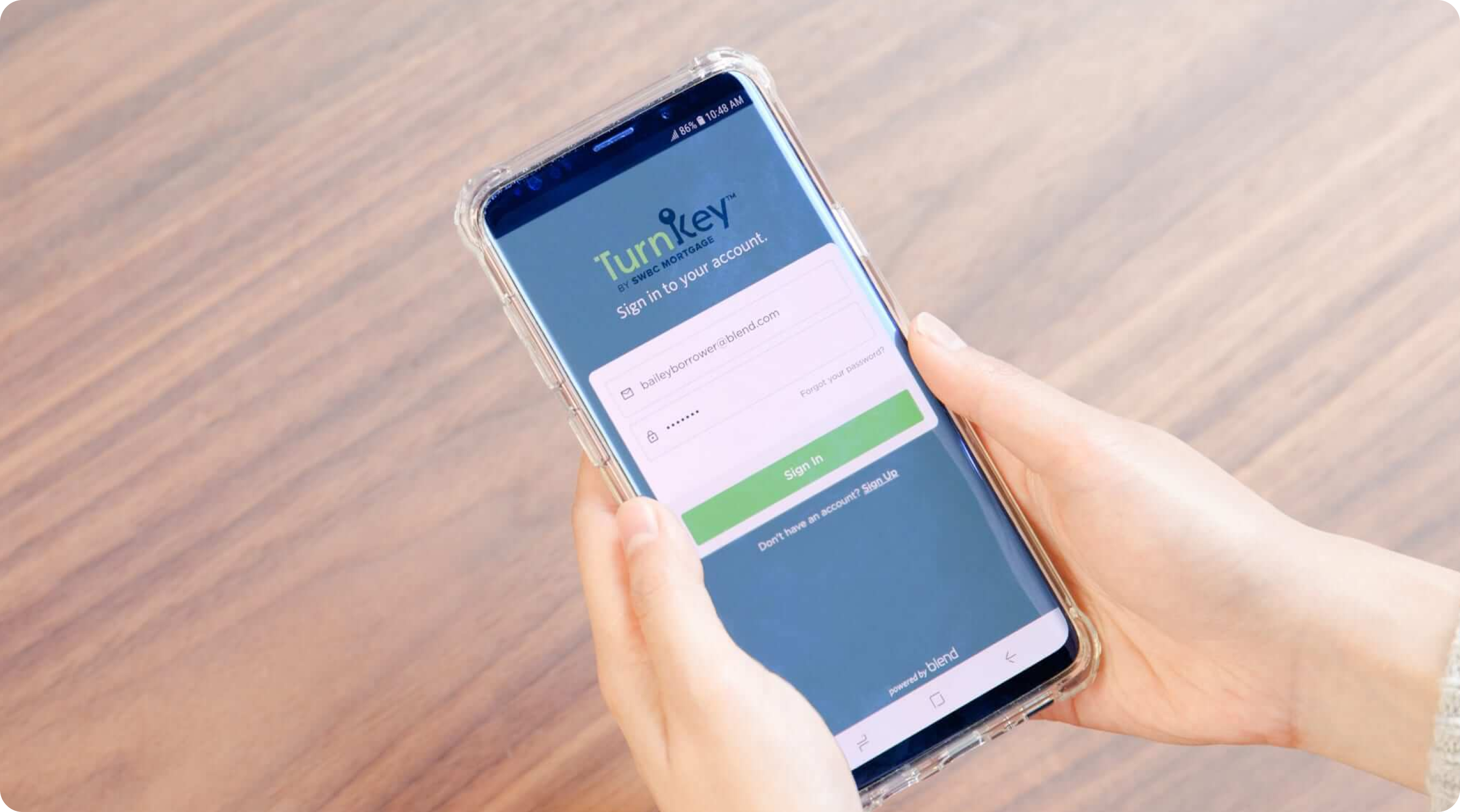

A hallmark of extra value gleaned by SWBC Mortgage is the branding of the product itself: Turnkey®.

Turnkey® is SWBC Mortgage’s solution to staying competitive.

“I think the other amazing thing about Blend’s team and product is that it gets better every week,” says Stewart. “We receive constant communications about features that enhance the overall experience. I’ve been in the mortgage business for more than 30 years, and I know too well how we as an industry are accustomed to technology companies overpromising and under-delivering. Our experience with Blend has been the opposite. We’re so thankful we found the right partner that understands where we want to go and is continuing to grow with us.”

Sign up for a personalized demo