April 15, 2022 in Platform and services

Providing a one-stop shopping experience for digital banking tools

Explore how Blend’s strategic approach to partnerships and integrations makes our banking platform a one-stop shop for financial institutions.

All our insights, all in one place.

Subscribe for industry trends, product updates, and much more.

We all understand the convenience of a one-stop-shopping destination. Whether physical or digital, these storefronts save time and effort — both crucial commodities. The best of these experiences take the value one step further by carefully curating their selection of goods, increasing the likelihood that you are receiving the best possible product for your particular needs.

So why should it be any different when shopping for digital banking products and solutions to serve your institution’s needs?

Through partnerships and integrations, Blend offers a host of features commonly noted by financial leaders as being important to their operations, conveniently packaged for out-of-the-box results. Combined with a robust set of APIs supporting additional services and features, the era of multiple shopping trips for cloud banking services may be over.

Navigating point solutions can be inefficient and frustrating

The proliferation of digital providers has resulted in a surge of point solutions, each solving a very specific problem. Do you need to assess credit? There’s a tool for that. Are you looking to improve your data recognition? There’s another tool for that. But what happens when your primary goal requires five different solutions?

You would need to work with five different point solution companies. But you would also have to take the time to choose each company from their many competitors, who all claim to offer best-in-class services. It’s a daunting task for anyone to deal with, but has become the norm in an increasingly fragmented software ecosystem.

Wouldn’t it be nice if a trusted source could evaluate the best options for cloud banking services and then recommend a path forward?

Integrating a disconnected landscape of cloud banking services

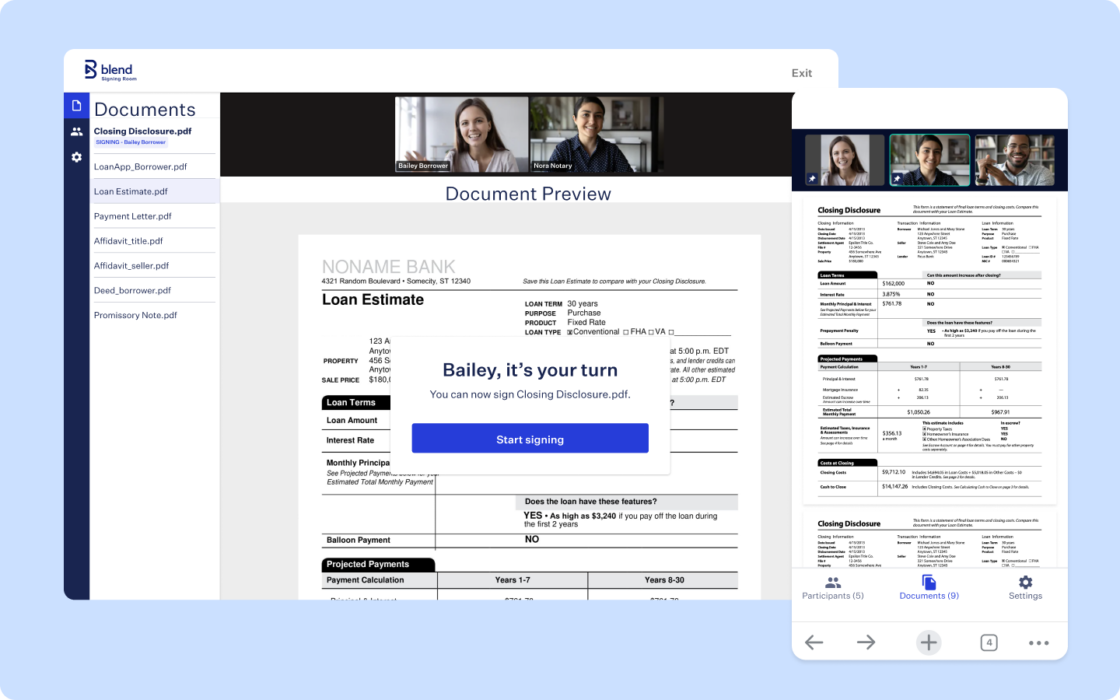

While there isn’t a superstore for all technology needs, Blend is quickly becoming a one-stop-shop for cloud-based mortgage and consumer banking needs.

Integrations are key to offering our customers the best possible experience. We thoroughly evaluate the many technologies available in the financial services space, simplifying and digitizing processes that have yet to be adapted and integrating complementary solutions to enhance the user experience. But we don’t simply cobble solutions together. Our team creates a seamless user experience for banking teams and consumers alike.

Our partnerships and integrations support our mission to remove friction from both consumer banking and home lending processes. We offer pre-built integrations with top providers, including core banking systems, CRMs, data verification providers, LOS, pricing engines, and document generation providers, as well as with the GSEs. Our APIs also enable rapid development of new integrations.

Partnerships

In service of simplifying workflows, there are several ways for financial institutions to connect to third-party providers through the Blend Platform. This can include integrating your preferred partnership via our public API, choosing from integrations built directly into the Blend platform, or even building custom integrations with our in-house experts.

What if you already work with a point solution company and don’t want to leave them, but still want to work with Blend to fill in other gaps? No problem.

We think of ourselves as an open stack solution. While we have the features you need to get the job done, we can also connect with your existing technology for a seamless customer experience. There are three different ways to integrate with Blend:

- First party MuleSoft build: MuleSoft provides the most widely used integration platform for connecting SaaS and enterprise applications in the cloud and on-premise. Blend has built a “connector” within MuleSoft so that anyone can easily build an integration into Blend. This leaves the power and control in Blend’s customers’ hands.

- Certified contractor build: Perhaps you don’t have an in-house technical team that can build and control an integration through MuleSoft. Our certified contractor build option is facilitated by Blend on your behalf. We’ve partnered with a certified contractor (TSP Integration Manager) to build the integration that connects your system to Blend.

- Contractor network referral build: If your integration is so nuanced and unique that it might be the only one of its kind, a contractor network referral build may be best suited for you. These integrations are built and contracted by our customers outside of Blend and then delivered to Blend for implementation.

If you only remember three things …

Technology removes friction from both the mortgage lending and consumer banking processes, making them more accessible and less painful for everyone.

Integrations make the magic happen, but the good ones are barely noticeable.

Working with several point solution companies can be complicated, costly, and time-consuming. But integrating with Blend’s cloud banking platform offers simplicity, one-stop-shop convenience, and the proactive capabilities that will power the future of banking.

Ready to see our integrations in practice?

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.