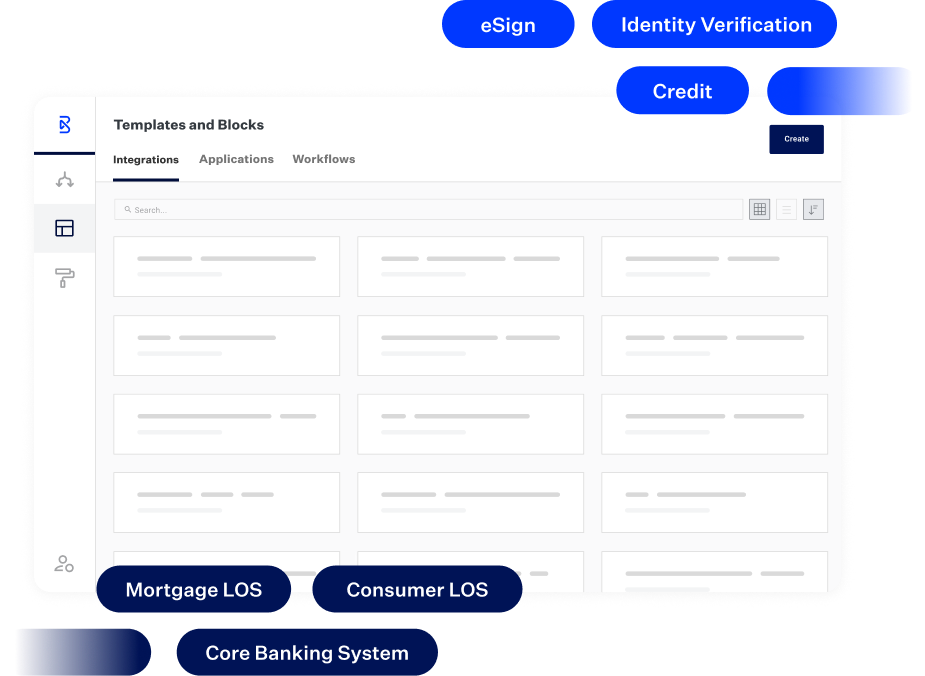

Your source for leading solutions. Built for integration.

Blend unifies trusted services in one platform to minimize friction so you can delight your customers and employees with seamless experiences.

Let Blend do the heavy lifting

Blend knows technology. We evaluate a wide range of digital service providers and choose the ones we trust will deliver value to our customers.

Power growth with process efficiency

Trade routine tasks for high-value service. Our integrations enable streamlined workflows so your staff can delight customers and capture long-term business.

Work with a partner, not a vendor

Instead of managing relationships with numerous point solutions, lean on us to modernize your lending and banking processes.

Don’t start from scratch

Connect your existing tech to Blend’s flexible, open-stack solution.

Partners and integrations

Alloy

Alloy automates your onboarding to reduce manual decisions, from KYC checks to fraud prevention.

Arch MI

Arch MI offers real-time quotes for Private Mortgage Insurance.

Astra

Astra enables consumers to fund newly-opened deposit accounts using a debit card.

Byte Software – Byte

Byte Software’s LOS provides mortgage lenders with powerful features to simplify loan challenges.

Calyx Software – Point

Calyx Software’s Point Loan Origination System covers the origination process from application to closing.

Canopy Connect

Canopy Connect enables end users to obtain evidence of homeowner's insurance within the Blend flow.

ClosingCorp

ClosingCorp optimizes closing processes and services for mortgage lenders as well as title and settlement.

CoreLogic Credco

CoreLogic Credco is a consumer reporting agency that provides merged and specialized credit reports.

Covered Insurance

Covered offers expanded access to top-rated national and regional insurance carriers across all 50 states.

Covius – Funding Suite

Funding Suite manages purchasing, analysis, and cost accounting for credit reports and more.

Credit Interlink

Credit Interlink offers valuation and credit platform solutions for mortgage related industries.

Dark Matter – Empower

Dark Matter’s Empower is a dynamic LOS that originates mortgages, home equity loans, and lines of credit.

Start building with us

Ready to partner with Blend and grow your business? Get in touch so we can get to work — together, for the betterment of financial services.