August 29, 2023 in Mortgage Suite

North Easton Savings Bank: A community bank on the leading edge of innovation

See how Blend’s Home Equity solutions made it possible for a community bank to modernize the customer experience while retaining customer-first values.

North Easton Savings Bank has been providing quality, home-grown banking solutions to the Southeastern Massachusetts community for over 150 years. An integral piece of the local economy in the towns they serve, the North Easton team knows that community banks are the heart and soul of their corner of the world.

“The bank believes that their employees are stewards of the organizations – and that, like employees from generations past, it’s their job to focus on the future and work to create better banking for the next generation.”

Dan Horgan

First Vice President, Residential Lending

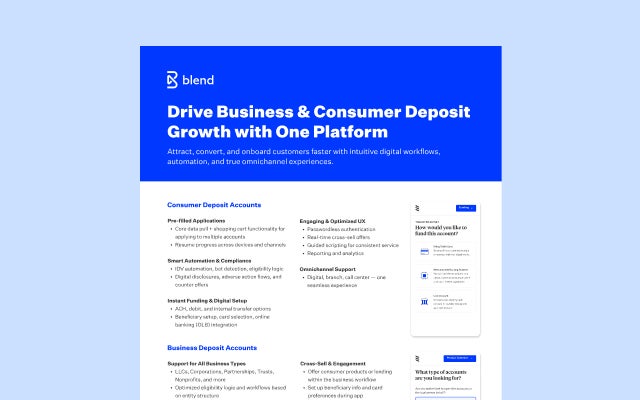

With a mission to create the new standard of community banking, NESB has been searching for a technology partner to innovate a premium, modern home equity solution that the North Easton team can implement — all while allowing them to continue focusing on customer and community relationships.

Banking in 2023 and beyond: easier, better, faster

Horgan’s team works together to analyze how people use their platforms and services, and they find solutions to make it easier for customers to bank with North Easton. “Our goal is to make it convenient to bank with us while also offering full-feature accounts found at larger institutions. We require our digital banking platforms to operate at the same speed as today’s leading non-bank retail platforms.”

Big banks may have initially set the bar with regard to digital and mobile offerings in the evolving financial services landscape. But Horgan believes, through partnerships with fintechs like Blend, that community banks are poised to meet — or even surpass — the big banks by offering a robust range of bespoke, innovative financial services in addition to the community care and involvement that has always been North Easton’s hallmark. And that’s where Blend’s Instant Home Equity solution comes in.

Speed with soul

Given the current market landscape, the North Easton team decided to invest in a redesign of the home equity user experience and product offering. There is approximately $11T in untapped home equity across the nation. And as Horgan pointed out, if a customer has a 3-4% mortgage rate, it’s more advantageous for clients to keep the mortgage and utilize a home equity product. In this manner, customers are able to get the best of both worlds: Keeping their great mortgage rate while utilizing home equity to fund current credit needs.

Unfortunately, a historically manual process with too many roadblocks along the way has made most home equity solutions, even digital ones, too long and complicated.

“In the immediacy, the market needs an easy-to-acquire HELOC product. It’s the consumers’ equity, it’s their money — it shouldn’t be hard to access.”

Dan Horgan

First Vice President, Residential Lending

The North Easton team was looking to reduce their reliance on manual steps, improve answer and approval time, and provide an overall better customer experience. With an intuitive UI/UX, and a mobile solution where 85% of activity takes place on the app, the North Easton team saw an opportunity to use Blend’s Instant Home Equity solution to say yes to more people, more quickly, and on their own terms.

Horgan believes that while a product’s speed can make all the difference for modern consumers, it’s “speed with soul” that sets community banks apart from their national competitors.

A solid platform and partnership for success

Horgan and the North Easton team have been able to find modern digital success with Blend. “With quick answers and quick approvals, Blend’s Instant Home Equity will make it possible for us to provide a faster solution and a better customer experience. In terms of speed and efficiency, it will be like going from a dirt road to a four-lane highway.”

There is a common industry perception that smaller community banks need to be bigger and have more resources in order to adopt the innovative, competitive technology that larger banks can afford. Or that they have to rewrite, rip out, or recreate legacy tech stacks.

But by finding the right technology partner, banks like North Easton are changing that. Speaking to Blend’s Instant Home Equity and the potential to leverage the Blend platform for other banking products, Horgan said,

“We’re really bringing it with this new home equity solution. It’s a modern platform that delivers a modern, mobile-first experience. It’s built to go forward, not to carry all that legacy nonsense. We’re not just refitting it or moving around some information blocks. This is entirely new, and that’s really important to us.”

Dan Horgan

First Vice President, Residential Lending

Being able to compete with national banks or even newer, non-banks is critical for the North Easton team. But at the end of the day, Horgan believes that community banks exist to invest their time and resources locally, so that customers can improve their quality of living, working, and raising a family. Accessing Blend’s technology will allow North Easton Savings Bank to have a big bank platform, rooted in community bank values — now, and for future generations to come.

Are you ready to modernize your Home Equity experience?

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.