January 5, 2021 in Mortgage Suite

Go beyond simple mortgage processing software

Generate more efficiency for your team with Blend's Digital Lending Platform.

Operational leads at financial institutions are constantly striving to maximize productivity. The length of an average mortgage loan cycle is dependent on many factors, but the processing phase is brimming with opportunities to improve. Lenders that use mortgage processing software programs usually rely on a large and often complex system of solutions which can, ironically, create more work for the processing team.

New to Blend? We have you covered.

Subscribe for industry trends, product updates, and much more.

This inefficiency is especially painful during the initial application stages. Without a consolidated technology approach, a borrower’s manual data entry is followed by manual processor follow-ups, with some jumping from system to system required. Verification is fundamentally important, but the process can be substantially more straightforward than this multi-software process would have you believe.

With Blend’s Digital Lending Platform, lending teams can fast-track the application while consumers enjoy a unified experience defined by easy processes and convenient follow-ups.

Altogether, Blend’s Digital Lending Platform can drive more efficiency for your mortgage processing teams than traditional mortgage processing software programs.

How digital lending platforms deliver better efficiency than mortgage processing software programs

Fully digital applications help lower the time spent on follow-ups and chasing paper documents — in addition to improving other time-consuming manual processes. Automation capabilities can streamline the application process further and help decrease the time to close. Compared to traditional mortgage processing software programs, the benefits of a digital lending platform can deliver better ROI for your financial institution. A few advantages to consider:

1. Optimizing the application process

Blend’s platform sets specific expectations upfront, which can save borrowers and lenders valuable time. For instance, if a Letter of Explanation is required, the system indicates this at the beginning of the process and provides a template to help expedite the required steps.

By collecting and verifying important information up front, processing teams are set up for better success. The application process is also totally digital — so there’s no need for lending teams to scan or make physical copies.

2. Using automation for performance gains

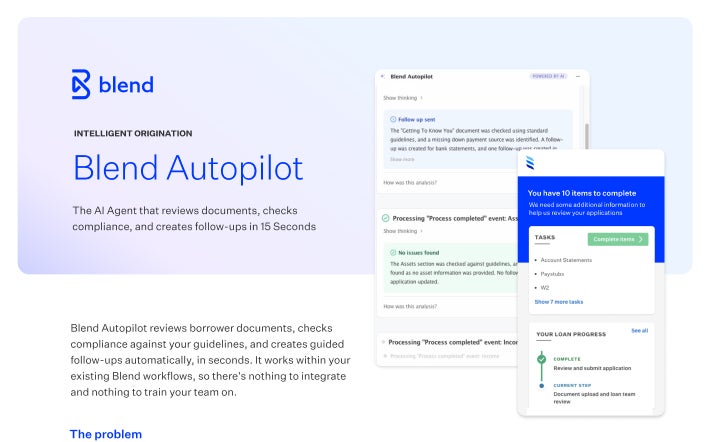

Most mortgage processing software programs do not incorporate automation like Blend Intelligence, which predicts the required documents for certain types of loans and requests them. These automated workflows save time and effort from the loan officer and create a smoother sequence for the processor.

In addition, Blend automates most verifications and allows consumers to link source data. As a way to expedite the process, lenders can automatically request third-party verifications and transfer results directly to their LOS.

3. Providing a seamless, modern user experience for consumers

From the perspective of the consumer, Blend’s Digital Lending Platform improves the overall experience by making it more organized and consistent. Rather than multiple moving parts, the consumer can rely on one single portal for the entire lending process — from application to close.

A streamlined application process means less unnecessary delay, while waiting for documents — a promise that mortgage processing software programs can’t make. A comprehensive digital lending platform, like Blend, will guide the processor through packaging and can help ensure all of the correct information and documentation is ready to go.

Driving ROI with Blend’s digital lending platform

This year brought lending teams a variety of challenges: new work-from-home norms, a drop in refinancing rates, and the subsequent refi boom. With Blend, financial institutions were able to respond to the sharp increase in loan volume without hiring more staff.

In part, this was possible because Blend’s digital solution makes it easier to work remotely with less scanning and physical paperwork. As our customers can attest, Blend’s unified platform increases lending teams’ productivity and allows them to keep up with the rise in demand. While other lenders were scrambling to adapt, UW Credit Union and the Republic Bank doubled their loan volumes without a single additional hire.

At UW Credit Union, loan officers have been handling a dramatic increase in loan volume. Using Blend, they doubled their monthly average of both loan applications and closings. Processors went from 23 to 42 loans per month, and underwriters ballooned from 33 to 124 loans per month. Meanwhile, their time from processing to close dropped with Blend from 35 days to an average of 22.

Republic Bank has seen similar improvements using Blend. Their team has doubled production, reduced turnaround times by 17%, and decreased underwriting touches by 16% — all without new staff.

Blend’s Digital Lending Platform provides key benefits for both lenders and consumers — making it an easy choice compared to mortgage processing software programs. By streamlining and automating processes to decrease each loan’s time to close, lenders can increase efficiency and lower the required operating costs simultaneously.

Find out how Blend can drive more efficiency for your mortgage processing team

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.