December 17, 2020 in Mortgage Suite

Making the most of your mortgage loan origination software with Blend

Integrating a unified digital lending platform with an LOS helps lenders maximize the value of their tech stack.

Today’s standard origination tech stack includes a staggering number of tools and systems, anchored by mortgage loan origination software. These stacks often include multiple point solutions, which can result in fragmented experiences for both borrowers and loan officers: switching back and forth between systems and relying on inefficient, manual touch points along the way. Add a complex use case to the equation — start an application on a phone, for example, and finish on a computer — and more challenges mount.

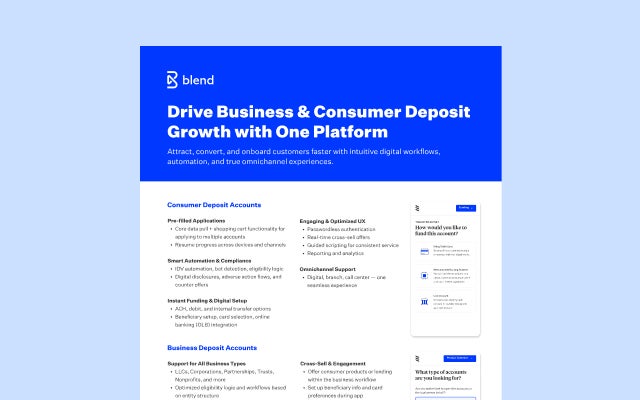

We enable lenders to maximize the value of their origination stack, including their mortgage loan origination software. By providing flexible omnichannel experiences and improving workflows, Blend’s mortgage automation platform supports a more efficient origination process for lending teams while creating a seamless experience for consumers.

How integrating mortgage loan origination software with Blend transforms workflows

Compared to having loan officers spend time facilitating data entry within an LOS, Blend offers an alternative, modern workspace. This enables loan officers to serve as a helpful resource and trusted advisor — freeing them from babysitting form field information and facilitating back-and-forths for required documentation. With Blend’s unified platform, the loan origination process is more efficient, consistent, and organized.

Through flexible integrations, Blend enables improved workflows and highly customizable solutions. Our digital lending solution offers out-of-the-box integrations with many LOS, including:

- Ellie Mae Encompass

- Black Knight Empower

- MeridianLink LendingQB

- Wipro NetOxygen

- Byte

- Accenture MortgageCadence

- Fiserv Mortgage Director

It also connects simply with a variety of core banking systems, data verification providers, pricing engines, CRMs, and document generation providers.

Blend provides transparency and a comprehensive toolkit for loan officers to utilize throughout each borrower’s user journey. From lead management and qualification to final commitment, our digital lending tools support better pipeline management, incorporate verification processes, and make it easy to pull real-time pricing and fees.

A better borrower experience with Blend’s unified platform

Unlike many point solutions, we’ve built a system that follows the natural interactions between the loan officer and borrower — so the process feels like a comfortable conversation. In some instances, point solutions require the loan officer to speak with the borrower and discuss terms over the phone, send the borrower an application, and then talk it over again. This time-consuming back and forth can disrupt or delay the process, leading to missed closing dates and extension fees.

Blend’s mortgage software offers a unified, omnichannel experience that consolidates all of this communication into one place and improves tasks formerly done with a pen and paper. Whether a borrower wants to start their application online or in person at a branch, Blend delivers a seamless experience while helping lenders maximize the full value of their origination tech stack.

Future-proof your origination tech stack

If there’s one constant in the mortgage industry, it is change itself. Blend provides a flexible framework for integrations that lets lenders easily adapt to market shifts and technology advances. Blend’s technology allows our lending customers to customize their connectivity and easily introduce new technologies to their stack as needs grow and businesses scale. If change comes in the form of regulations and standards, like the extended deadline for the new URLA this year, Blend will support lenders every step of the way.

Integrating Blend with your mortgage loan origination software saves financial institutions time and resources, in addition to supporting better lending experiences for everyone involved.

See how Blend’s unified platform can maximize the value of your tech stack

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.