November 10, 2021 in Mortgage Suite

How to get the most mileage out of your mortgage CRM software

By connecting your CRM solution with a cloud-based platform like Blend, you can amplify your success.

Like the majority of today’s lenders, you’ve probably invested in mortgage CRM software.

Amplify your CRM knowledge.

Subscribe for industry trends, product updates, and much more.

It’s easy to see why. According to research, when used correctly, the most effective CRM platforms can increase conversion rates by 300%, improve productivity by 50%, and help mortgage providers earn a significant $8.71 for every $1 spent.

The top CRM solutions promise to achieve all this by helping you reach new customers, deliver more engaging content, close more deals, and provide a better level of service. While this can be incredibly powerful, there’s a limit to what your CRM system alone can help you achieve. However, by connecting your mortgage CRM software with a cloud banking platform like Blend, you can amplify your success. Here’s how:

Recapture abandoned applications

When you sync your mortgage CRM software with Blend, the days of applicants getting lost in the shuffle may be behind you. That’s because every application started in Blend creates a new lead in your CRM system, once you’ve updated your configuration setting. This brings a new level of visibility — for example, your lending staff can get access to helpful notifications directly on their preferred device when an applicant abandons an application. And your team can then reach those customers efficiently and effectively, either by using your CRM tool to send out an automated email, giving them a call, or writing their own personal email.

Improve conversions

By linking Blend with your CRM, you can increase conversion rates in a number of key ways. For example, you can use your CRM to create outbound campaigns that drive traffic to a Blend application. From here, the path to conversion is simplified. Blend connects with your CRM to pull data previously provided by applicants, which can then be used to pre-fill various fields. This, combined with Blend’s guided application flows, responsive design, and remote co-pilot assistance, makes the application process simpler for applicants — and can result in more loans that close.

Optimize your omnichannel strategy

Today’s most successful lenders are customer-centric, and this means they service their customers through whatever channel they choose — and at a time that suits them. Use your CRM as the starting point for updating customers on product options, using traditional channels like call centers, web, or in-branch communication. As the relationship develops, your team can centralize communication in the Blend platform, standardizing an array of touchpoints.

Deepen existing relationships

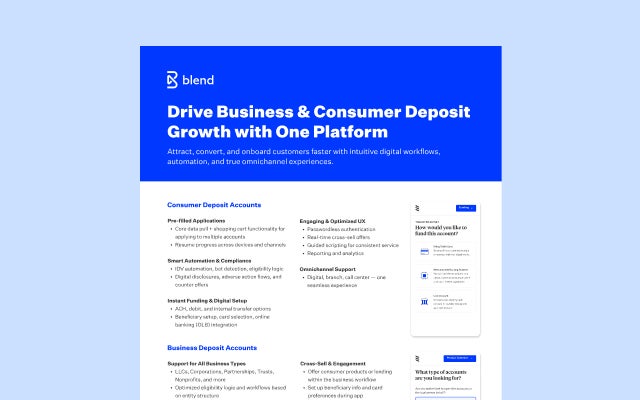

Blend doesn’t just help transform the mortgage experience — it covers major consumer banking products including credit cards, auto loans, home equity loans, and deposit accounts. Building on that same mortgage CRM integration, the power of your CRM data can stretch across your entire portfolio. You can even combine data from your CRM with that from Blend to determine who should receive pre-approval offers and the best place to reach them. Our platform makes it easy for your lending team to support consumers with the right offer at the right time.

Blend is built for integration

At Blend, we enable financial services firms of all sizes to deliver simple experiences for their customers by enabling seamless integrations with third-party software. In fact, we partner with many of the most popular CRM tools on the market.

The benefits are immediate. Drive prospecting campaigns linked to Blend applications. Fast, two-way data synchronization means you can access a customer’s financial profile throughout the lifetime of a loan. And, if something goes amiss, you can reach out to customers who abandon their application.

The power of our integrations stretches beyond mortgage CRM software. Unite your tools into one cohesive experience so your loan teams can operate more efficiently and provide better service to borrowers.

Integrating success: How Assurance Financial is synching with Blend

Louisiana-based lender Assurance Financial demonstrates a unique way of leveraging integrations. They have created a close connection between their digital assistant Abby — a clever skin of the Blend Mortgage Suite, powered by our cloud banking platform — with their CRM system.

“We want to personalize the experience, especially in how we transition our clients to one of our home loan experts,” said Assurance Financial CEO Kenny Hodges.

Abby creates a way for applicants to take full advantage of the 24/7 functionality that Blend’s mortgage software offers, but in a personalized way.

If at any point customers require an in-person touch — to answer a question, say, or clarify an application requirement — Blend’s mortgage tools allow loan agents to jump in with no interruption to the overall experience.

The integration is paying off. “Our Blend files are going through the system three days faster on average,” said Assurance Financial Operations Manager Scott Alexander.

Ready to see how Blend can help you make the most of your mortgage CRM?

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.