May 6, 2020 in Mortgage Suite

How a platform approach to mortgage software improves the LO experience

Although we understand the experiential difference between a Digital Lending Platform and, well, everything else, lenders frequently ask us to explain what we mean. Since it’s better to show than to tell, we’ve written two brief stories detailing the potential impact Blend’s platform approach to mortgage software can have on those who use it, from their perspective.

Note that although these stories are fictionalized accounts, we’re confident that you can expect an experience with Blend that hits these highs and more.

For this story, we’re focusing on loan officers. Explore how we combine a suite of tools and services, including on-the-go lead capture and origination, a collaborative application experience, and the ability collect e-signed disclosures, into a cohesive platform that supports a more intuitive, goal-oriented loan officer experience.

Transforming business as usual for mortgage software

As a loan officer, I’ve helped people get mortgages for the last decade. We’ve always done things the same way at our bank, so I’ve grown accustomed to using the tools that came with our LOS. Recently, we were asked to start using a new technology. My initial reaction was not great, since previous changes to our mortgage software had forced me to substantially change my workflow.

The intention was to minimize the time we are spending on administrative tasks, optimizing for capturing more new business and aiming to move borrowers through the loan process seamlessly. I was a little hesitant to start using it, as I was unsure of how a new technology would facilitate this. But I figured I would give it a shot.

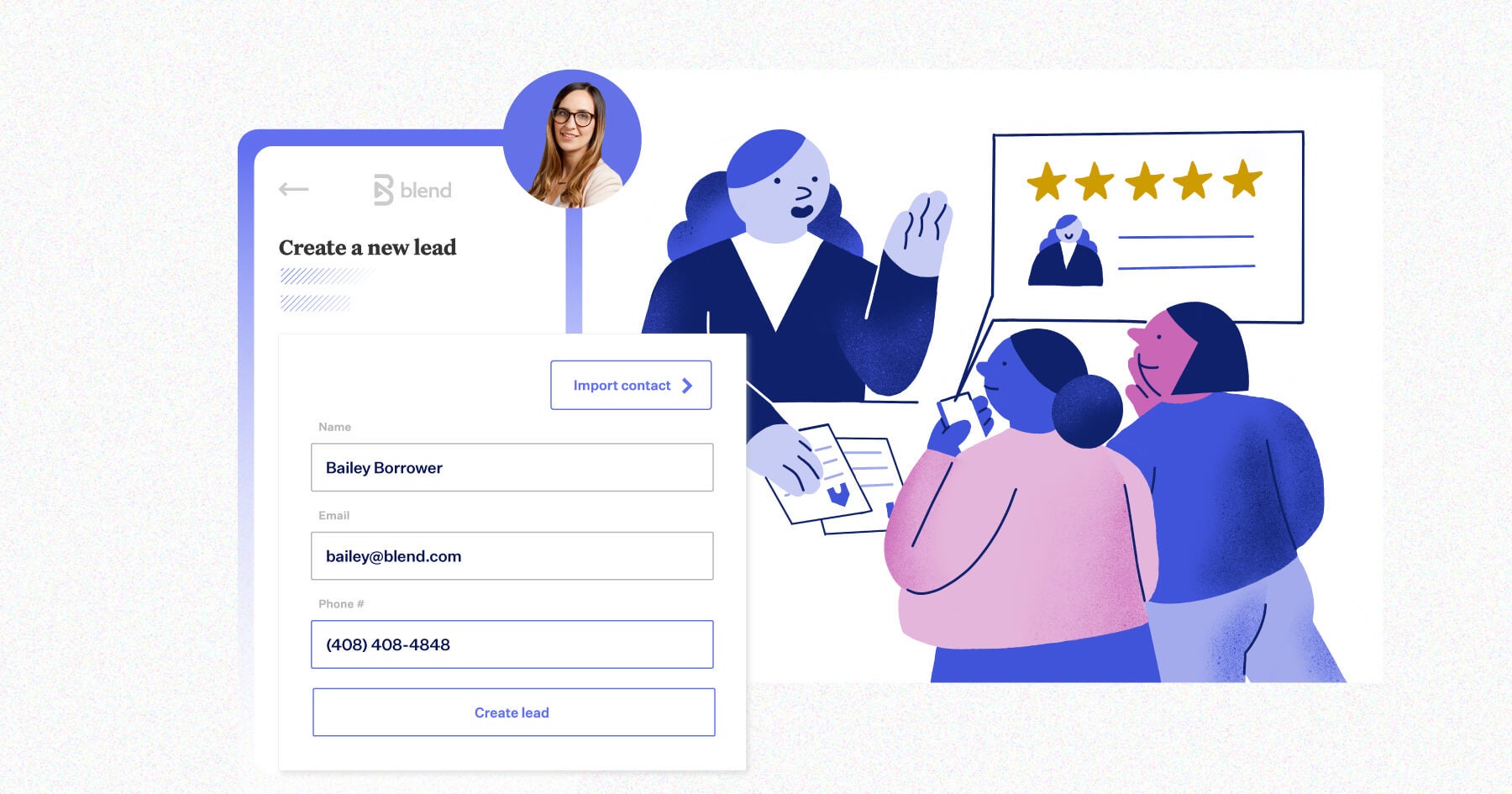

Typically, I get most new business when I’m out in my community. If I meet someone who’s looking to purchase a new home, I collect their information and give them a call when I’m back in the office. The other day, I ran into an acquaintance, Andy, at the grocery store.

A few minutes into catching up, he mentioned he had recently found a house he was interested in buying. He hadn’t chosen a mortgage provider, and he asked if I was still working as a loan officer. As I was telling him about the rates my bank was offering, I suddenly remembered I had a new tool at my disposal: a mobile app.

I opened the app and told Andy he could get started on the application right away. I texted him the application, and he pulled it up on his phone within seconds. Driving early borrower commitment was a win, as my typical method usually meant some drop off from potential leads I met out in the field.

Put the power of Blend in the palm of your hand with Blend Loan Officer. The app enables loan officers to create and qualify leads, track applications, send pre-approvals, and sign disclosures, all on the go.

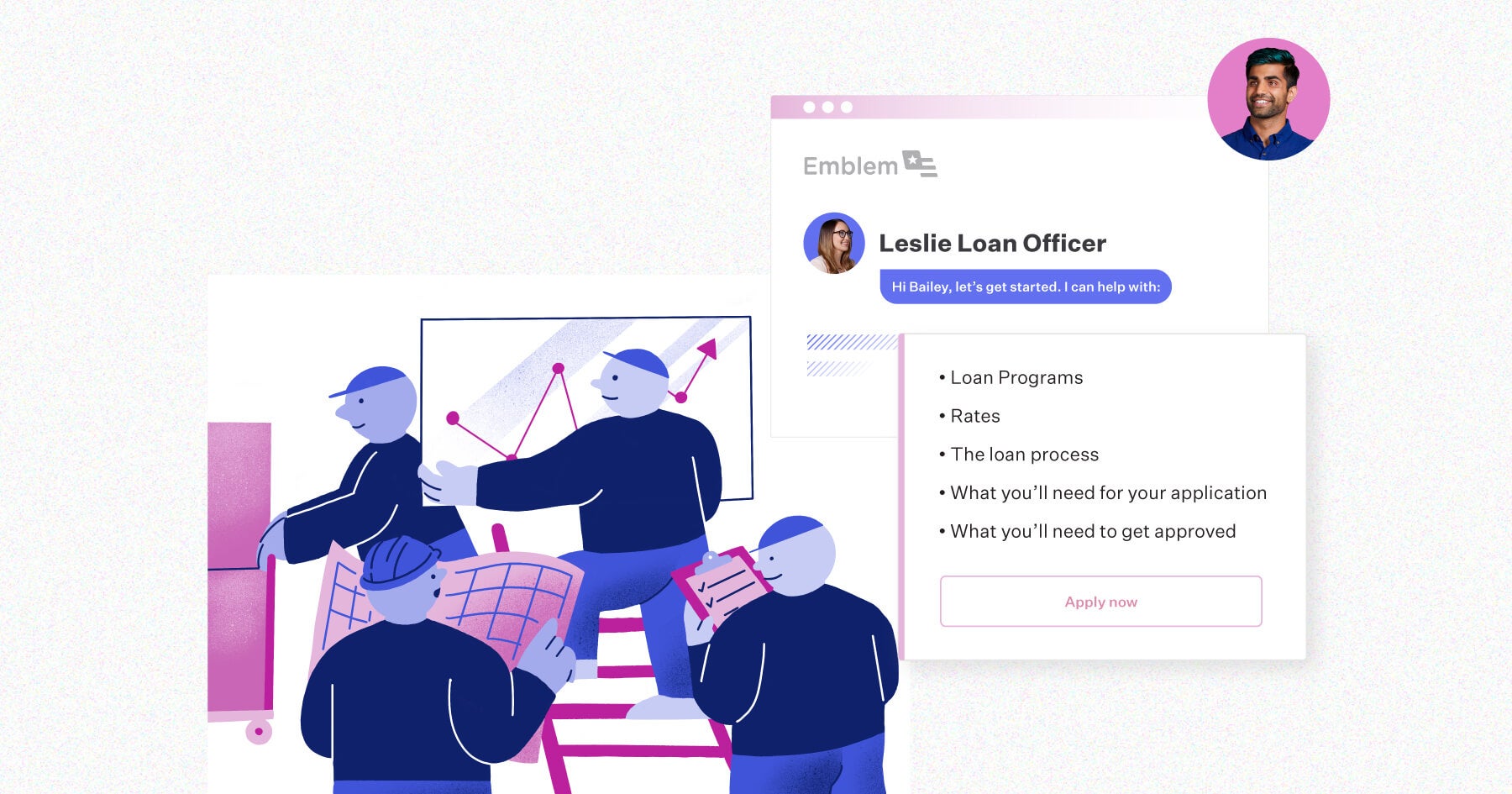

When it comes to completing the application, borrowers either come into the office so we can work on it together or they’ll do it at home, depending on their preference. When they do it on their own, I have no visibility into where they are in the application or if they have reached a sticking point. If it’s taking a borrower a particularly long time, I’ll usually email to check in.

This new technology allowed Andy to apply online from home, and I was able to follow along with his progress. When it prompted him to connect his bank accounts for asset verification, he called me to ask if he needed to connect all of his accounts. After getting his approval, I was able to hop right in to his application, particularly the section he was stuck on. I answered his question and showed him how he could connect more than one account, all without having to wait for our scheduled in-person meeting. The guesswork I usually do to help borrowers was completely eliminated.

The online application flow ensured Andy didn’t leave anything blank or miss any steps. Borrowers commonly miss some small part of the application, which means I have to call them and retrieve the information before the process can continue.

The Blend Workspace helps loan officers stay on top of their pipeline, follow along with borrowers as they apply and provide remote support with Co-pilot, and meet compliance requirements.

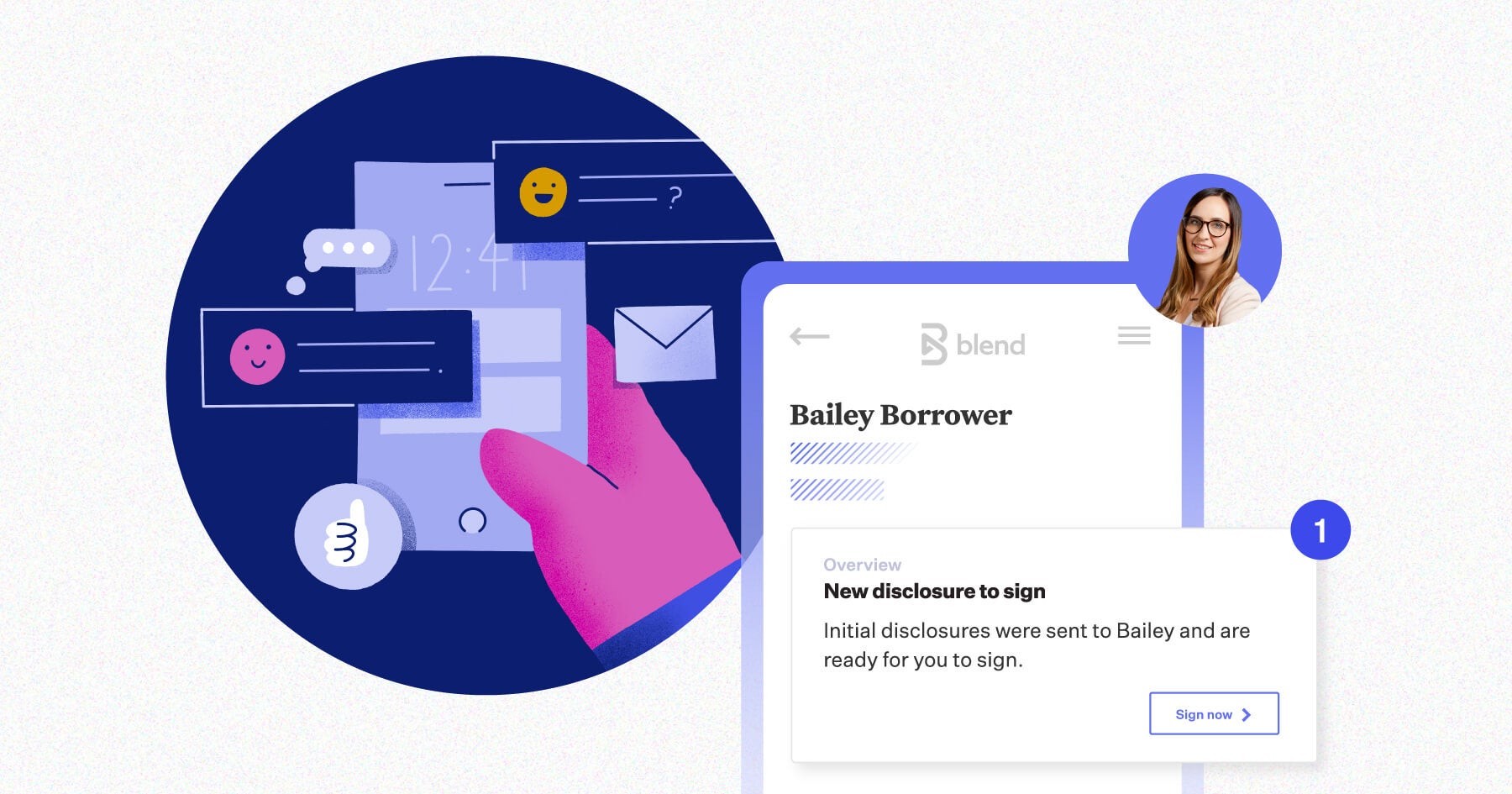

When it comes to disclosures, I’m accustomed to sending them by mail, which means printing stacks of paper, only after they’ve been painstakingly collected and reviewed. The borrower receives them, signs them, and sends them back. Thankfully, this experience was much less painful.

Since Andy provided me with eConsent and acknowledged the disclosures as part of his Blend application, I was able to pass along the necessary documents electronically. The eco-friendly side of me was very happy, if nothing else. With a simplified review process and instantaneous delivery, I was also much more comfortable that the process would go smoothly.

Blend allows lenders to collect eConsent when applying, which means borrowers can receive and sign disclosures electronically in the same system they’ve been using since the application.

Despite my initial skepticism about an overhaul to my workflow, this new technology has proven to be an aid to my success as an LO. I spend less time on manual tasks, and by taking away friction points for my borrowers, the suite of tools has helped me close a larger percentage of loans.

Spending more time on what matters

Julia’s story highlights how Blend’s Digital Lending Platform improves the loan officer experience. With features that enable automation and increased borrower commitment, loan officers are able to focus on advising customers and close more loans faster.

Check out our parallel story to explore the impact Blend has on the borrower experience.

See why a point solution can’t compete with the platform experience. Download the infographic.

Explore the power of a Digital Lending Platform to transform mortgage software experiences for all.

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.