December 9, 2020 in Challenges and solutions

Four features of the best lending software solutions

It’s easy to get overwhelmed when exploring lending software solutions. For organizations using a variety of point solutions or seeking a better way to spin up new loan products, the best answer is often a unified platform that seamlessly supports multiple LOBs and products.

But not all digital lending solutions are created equal. We’ve compiled some of the most important software features that will set lenders — and their customers — up for success.

What should I be looking for in a lending software solution?

Each of these elements deliver or contribute to concrete benefits for financial institutions. Consumers enjoy consistently excellent experiences, while lenders see shorter loan cycles through a host of time-saving features that drive ROI.

1) Flexible and customizable role-based tools

Loan transactions rely on a variety of actors that include mortgage loan teams, branch bankers, referral partners, and others. With role-based tools, each of these lending professionals gets a custom digital workspace with access tailored to their unique role in the loan process. Personalized workspaces facilitate task completion including application intake management, consulting referral partners, or following up with customers.

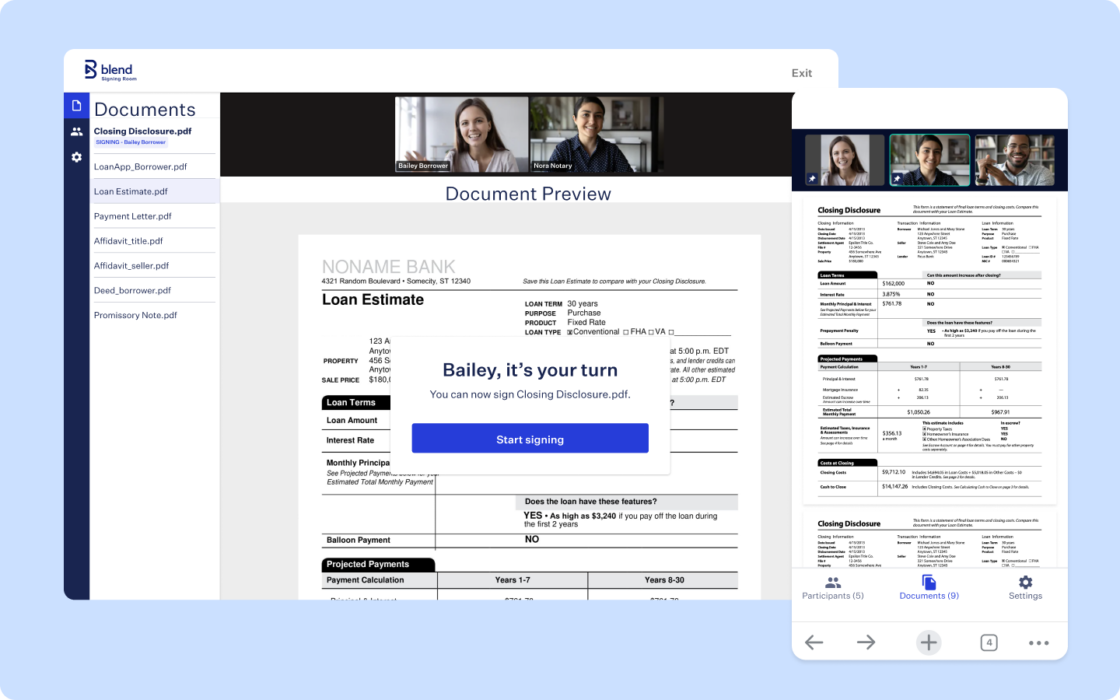

Regardless of the tasks or responsibilities, lending software solutions with role-based systems help organizations accelerate the loan application process and see shorter loan cycles. Blend’s role-based framework simplifies working with complex teams and integrates ordinarily siloed work streams — all within a unified digital lending platform.

2) Integrations that meet your business needs

A comprehensive digital lending platform connects a network of components and systems in order to move loans from application to close. These systems include core banking systems, CRMs, data verification providers, LOSs, pricing engines, and document generation providers.

Blend facilitates all of these connections through our pre-built or custom integrations. In addition to our white-labelled “powered by Blend” solutions, we also offer API integrations. With this option, lenders complement existing systems with the features they need. In any case, flexible integration options are key to ensuring that you get the most out of a lending software solution.

3) Immediate benefits paired with a commitment to continual improvement

You’ll likely expect that a digital lending platform should plug in to provide benefits out of the box — but truly differentiated solutions also embody a philosophy of continual improvement. A digital lending platform should improve your stack while also offering a way to move forward and become future-proof. For any given loan product, a lender may require the new system to work immediately, but a need for short-term results should not mean a compromise on long-term stability.

Rather than ripping and replacing, Blend works to evolve your system architecture based on a migration path that suits your needs in the short term while allowing comprehensive expansion to help you stay future proof.

4) Time-saving strategic automation

A great lending software solution should support data-driven workflows powered by automation. Various time-draining tasks, including those done with a pen and paper, can be improved with intelligent automation.

And a great digital lending platform should have built-in support for streamlining tasks that would otherwise provide bottlenecks for loan applications. During the application process, for instance, Blend uses machine learning to automate out redundant tasks and consolidate workflows. These automations benefit lenders by reducing application times while cutting costs on labor.

Go beyond features with a long-term partnership

Beyond the product surface level, purchasing a lending software solution is ultimately a decision to enter into a relationship. The best digital lending platforms acknowledge this relationship as a partnership that grows and strengthens over time. This is distinct from many point solutions, which can work well for the short term but ultimately stall growth over time. Blend’s lender partnerships are built upon three principles:

- Accessibility: our partnerships are true collaborations. Blend is with you every step of the way.

- Transparency: financial empowerment begins with full insight into the lending process.

- Simplicity: accomplish more by doing less. We focus on results by simplifying tedious details.

Why Blend?

More than a piece of software, we believe the best digital lending platform should come with a partnership dedicated to your success. Today, Blend supports the success of some of the world’s leading lenders — including Wells Fargo, M&T Bank, and US Bank — and processes over $3B in loans per day.

Blend’s unified digital lending platform enables lenders to deliver best-in-class experiences. With flexible and customizable role-based tools, integrations that simplify workflows, and time-saving features, Blend’s lending software solution maximizes agility, efficiency, and results.

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.