June 1, 2023 in Challenges and solutions

Consumer banking in 2024: Differentiate today and win tomorrow

7 new opportunities to shape the future of consumer banking

Trends come and trends go, especially when it comes to consumer expectations. But some new behaviors are here to stay. And some financial institutions are already shifting their focus and building new strategies to succeed in 2024 and beyond.

Looking at research from analysts including Forrester, IDC, Gartner®, Aite-Novarica Group, and more — along with the insights and acumen of our leadership and product teams — we’ve identified seven opportunities for leaders at financial institutions to leverage in service of winning primary financial institution (PFI) status with their customers.

1. Show up for your customers, both digitally and IRL

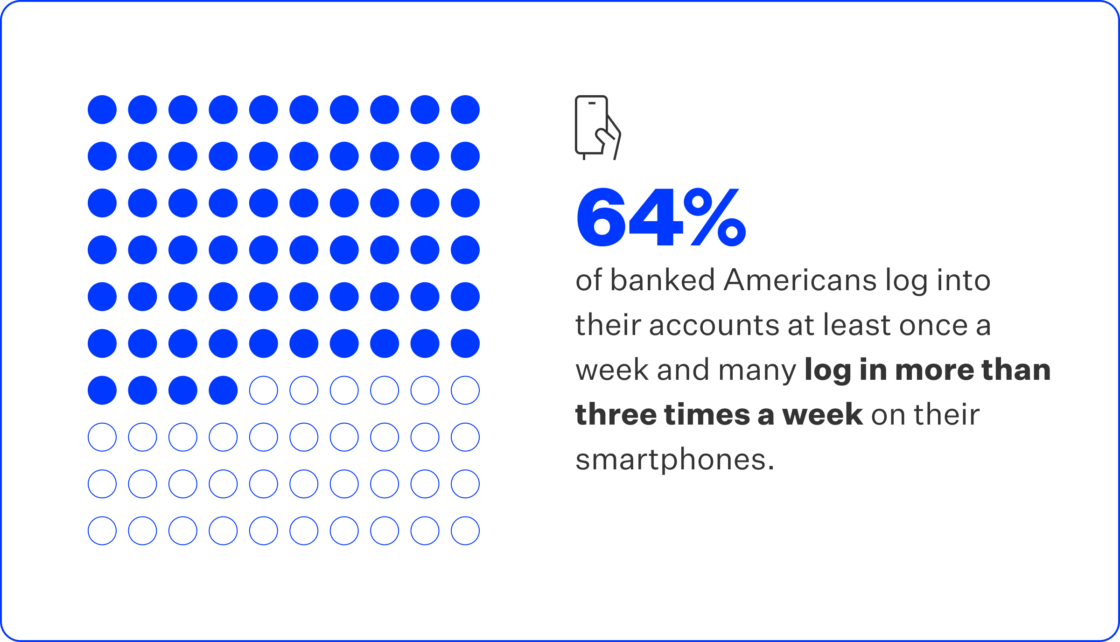

64% of banked Americans log into their accounts at least once a week and many log in more than three times a week on their smartphones¹. But consumers across generations also visit banking branches for face-to-face interactions and utilize call centers for more immediate assistance. While consumer activity is increasingly digital, people are still channel hopping and looking for human guidance.

Unfortunately, many of today’s FIs lack the integration between processes and channels that would allow for bankers to pick up where a customer leaves off. Interrupted engagement and disjointed customer experience — results of this lack of visibility across products and channels — leads to consumer abandonment, the antithesis of PFI status.

One way to integrate processes and channels is to adopt what is known as “platform banking architecture.” Systems like this integrate with legacy software, are often modular in design, and simply put, can send and receive information between the various components that make up your tech stack.

All of this means that previously disconnected bankers, back offices, and customers are now synchronized with intuitive, interconnected origination experiences across a banks’ entire portfolio of products. Some platforms, like the Blend Builder Platform, also include features specifically designed to support banker engagement, such as scripted and intuitive banker workflows.

Curious how you can enable front-line bankers to show up for your customers?

2. Free yourself from the constraints of legacy systems with core banking solutions

According to a recent Forrester report, nearly 15% of surveyed FI leaders are moving their tech budgets away from transforming core systems and toward digital engagement solutions². But replacing human intervention with rampant digitization in an effort to save money is risky.

For many FIs, this will prove to be a mistake as they lose out to competitors with access to agile core infrastructure. It’s inflexible, legacy technology that hamstrings FIs most: siloed data, complex infrastructure, and lengthy processes that often include manual workflows.

The winning FIs are adopting a number of new core banking solutions that have emerged over the past several years: modern packaged software solutions based on flexible, open, service-oriented architecture.

Now, what exactly does that mean? Service-oriented frameworks power distributed teams to share programs and information in real-time. This enables more functionality that is less complex and more cost effective.

Packaged software includes a collection of programs and products. For financial institutions — looking at Blend’s Consumer Banking Suite, for example — this manifests as a comprehensive solution across all products and services, providing the same, reliable experience for customers whether they’re applying for a personal loan, deposit account, or any other consumer banking product.

3. Kickstart your race to PFI status with a deposit accounts solution that converts and activates

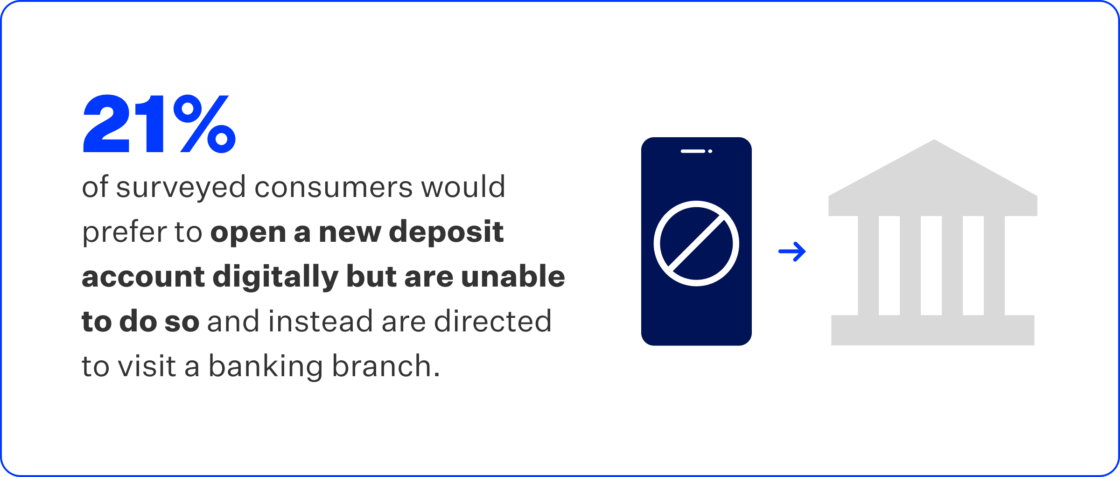

According to a report from PwC in 2021, 21% of surveyed consumers would prefer to open a new deposit account digitally but are unable to do so and instead are directed to visit a banking branch. This digital gap needs to be bridged.

Consumer expectations of financial providers are now shaped by their larger tech-driven experiences — from Amazon to Netflix and just about everything in between. Consumers want fast, simple experiences — with at least the option for fully digital completion.

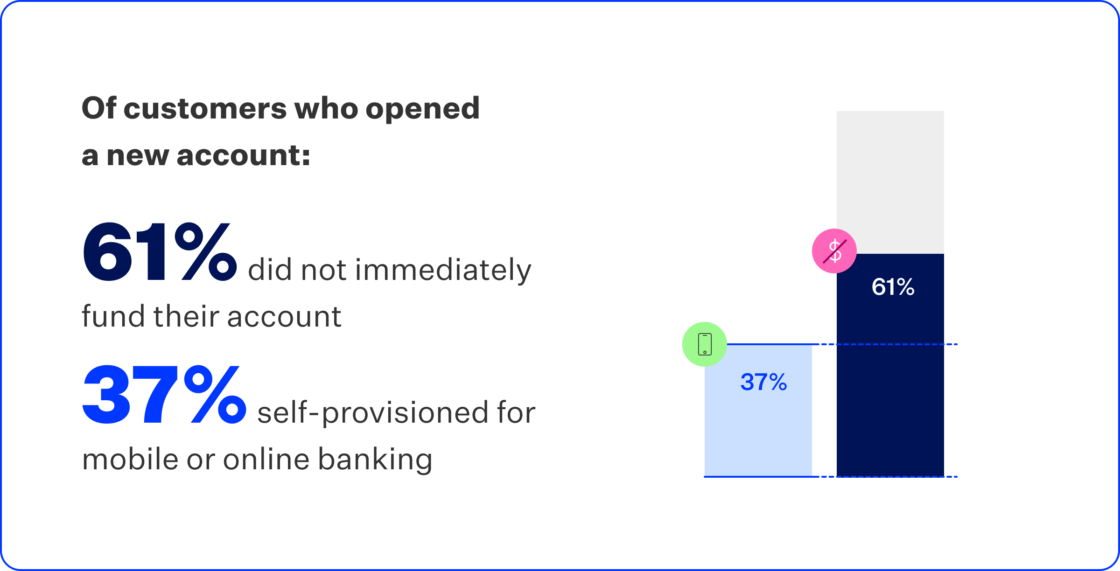

Furthermore, conversion is just one step, as FIs also need to consider onboarding and activation. Of customers who opened a new account, 61% did not immediately fund their account, and only 37% self-provisioned for mobile or online banking. Adding online and mobile banking with bill pay, switching over or setting up direct deposit, and providing digital wallet setup should be available to this new customer right away.

A successful deposit accounts solution guides consumers through every step of the customer journey — conversion, onboarding, activation — building trust and gaining PFI status along the way.

4. Beat the competition with unique value-adds aligned to your customer base

Today’s consumers have the flexibility to customize and individualize what they purchase across most industries, and they are increasingly expecting this level of personalization from their financial institutions. However, most FIs have limited resources to deliver bespoke products, thanks in large part to rigid legacy systems.

Rather than trying to solve for everyone, first start with the customer segments you know best — or perhaps, the segments you want to prioritize. Starting out with a narrower cohort allows you to test product differentiation in smaller tiger team projects before committing to delivery at scale.

As an example, if commercial clients are a top priority this year, consider investing in a value-add product like Earned Wage Access (EWA). Sometimes referred to as early pay, instant pay, or on-demand pay, EWA can be a very powerful and potentially differentiating offering.

In a 2022 survey of employees at midsize and large organizations outside of the financial sector, 53% of respondents strongly agreed that offering EWA has given their organization a competitive edge in the labor market³. Another 92% of respondents either agreed or strongly agreed that offering an EWA program has helped their organization retain workers.

5. Future-proof your value propositions and align with consumer climate concerns

More than 80% of Americans are at least somewhat concerned about climate change⁴. And 86% of consumers try to live in ways that help protect the environment at least some of the time. One way that consumers are taking action on this is by switching banks — moving their business to a more climate-conscious, sustainability-focused financial institution.

Needless to say, many FIs are looking to retain these customers and demonstrate their commitment to environmental, social, and governance (ESG) standards. Some FIs are now applying ESG standards to their decision-making processes and leaning into an operational position that prioritizes sustainability. Other FIs are more directly implementing strategies to reduce their carbon footprints and regularly reporting on their progress to demonstrate shared values with consumers.

Another approach is to put your money where your mouth is: create financial incentives for environmentally friendly activities, like lower interest rates for companies investing in renewable energy. In fact, IDC predicts that by 2025, 50% of lending portfolios of tier one global banks will be clearly linked to sustainability⁵. What is the carbon footprint of your current portfolio?

6. Empathize with your customer and deliver CX excellence

Earning trust is crucial for modern financial institutions. And it goes beyond simply keeping customers’ money safe. Dependability is essential for banking, especially in our current macroeconomic environment.

Today’s modern consumers look for understanding from their financial institutions. They want to be seen and heard and guided through the many financial milestones of their lives. They want their bank — personified through the many interactions they have with your staff, whether in-person or digitally — to care about them.

The FIs who can empower and educate their teams to make that deep, trusted connection with their customers — those FIs are the ones that will ultimately win PFI status. But making that connection can be challenging. It requires that FIs go beyond traditional banking services and provide personalized experiences that cater to customers’ unique needs and preferences. It requires empathy.

7. Build with composable origination

We know that banking technology is critical. However, the complex and fixed nature of legacy infrastructure creates nagging issues: data exists in siloes, processes remain unchangeably lengthy, and workflows include manual processes that erode newer customer experience requirements. But there is a solution.

Composable origination — a flexible way to create and deliver end-to-end origination for any banking product — unlocks a new level of configurability, efficiency, and innovation for financial service providers.””

In fact, McKinsey & Company reported that composable banking technology can help banks reduce their time-to-market by up to 80%. And “Gartner predicts that those organizations pursuing composable finance will enjoy 30% higher revenues than traditional-minded peers by 2025.”⁶

And as it so happens, at Blend, we believe that composable origination is the future of banking.

Curious how a modular approach to origination can revolutionize your business?

¹Aite-Novarica Group report, Top 10 Trends in Retail Banking & Payments, 2023 | Balancing Stability and Growth Amid Economic Volatility (January, 2023)

²Forrester report, Predictions 2023: Banking | Banks Will Batten Down The Hatches But Prepare For The Upturn (October, 2022)

³Aite-Novarica Group report, Top 10 Trends in Retail Banking & Payments, 2023 | Balancing Stability and Growth Amid Economic Volatility (January, 2023)

⁴Aite-Novarica Group report, Top 10 Trends in Retail Banking & Payments, 2023 | Balancing Stability and Growth Amid Economic Volatility (January, 2023)

⁵IDC FutureScape: Worldwide Banking 2023 Predictions (IDC #US48660022, October, 2022)

⁶Gartner Press Release, Gartner Says by 2024 60% of Finance Organizations Will Seek Composable Finance Applications in New Technology Investments (December, 2022)

GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and is used herein with permission. All rights reserved.

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.