May 9, 2023 in Blend momentum

Blend’s first quarter momentum

When our customers win, we win with them.

We’ve always believed that our customers are best positioned to win in a downturn when leveraging technology that helps save costs, grow market share, and innovate faster.

Today we are seeing this play out in practice with our Q1 earnings results.

The headline is: we’re growing our mortgage market share alongside our customers, we outperformed our total company revenue guidance, and we expect to see continued positive momentum in Q2 and beyond.

We credit this outperformance to our valued customers, who have shown their strength and resilience during an extremely challenging period painted by compressed margins and heightened competition.

The strength of our customer base

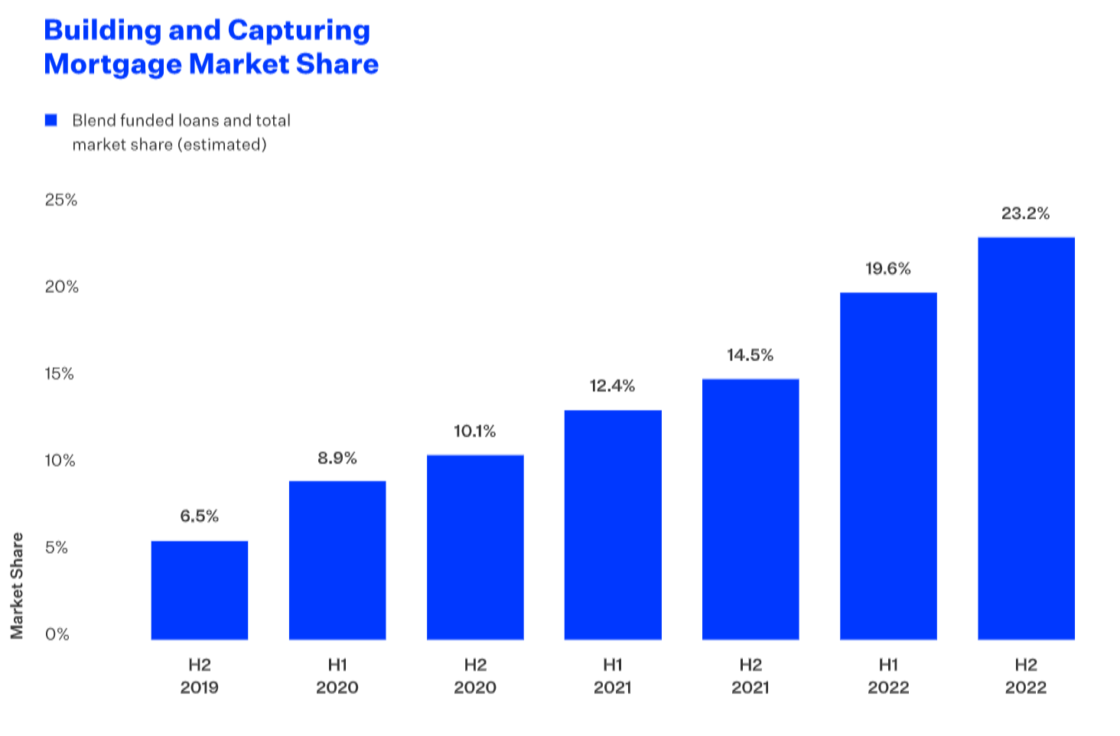

Despite the market headwinds, our mortgage customers continue to increase utilization, and are winning market share as a result.

We saw ongoing adoption of our Mortgage Suite add-ons, allowing more customers to benefit from our cost-saving features like soft credit pull capabilities and automated condition management.

This increased utilization is helping to drive the growth of our total funded loan volume. Blend’s mortgage banking software processed 23.2% of the total market originations based on Mortgage Bankers Association data in the second half of 2022, up from 14.5% in the second half of 2021.

This growth included two of our larger lenders, including Atlantic Coast Mortgage, who recommitted to Blend after using one of our competitors but coming back to us for the richer set of capabilities we offer and the benefits our platform delivers to them.

We’re also making early strides in growing our consumer banking suite. We closed the quarter with $5.2 million in revenue, up from $3.9 million in Q1 2023, and expanded our partnership with Navy Federal Credit Union.

This is one of our largest deals ever, at a critical time for institutions striving to grow deposits. Navy Federal will soon power a multi-channel digital account-opening process for new membership through the Builder platform, all made possible by Blend Builder.

We are also evolving our model by accelerating our time to value for customers, and by helping them serve their consumers better and cheaper than would otherwise be possible. We believe Blend Builder will provide a meaningful benefit here, as we leverage the power of Composable Origination to simplify and accelerate our deployments.

Pacing ahead of schedule on our path to profitability

On our total company revenue, we came in well ahead of expectations. We achieved $37.3 million, beating the top end of our guidance by 7%. We believe this validates the strength of our deepened wallet share, even with a small outperformance on loan volume. The growth in our Consumer Banking Suite also benefited from a stronger than expected home equity volume in the last month of the quarter.

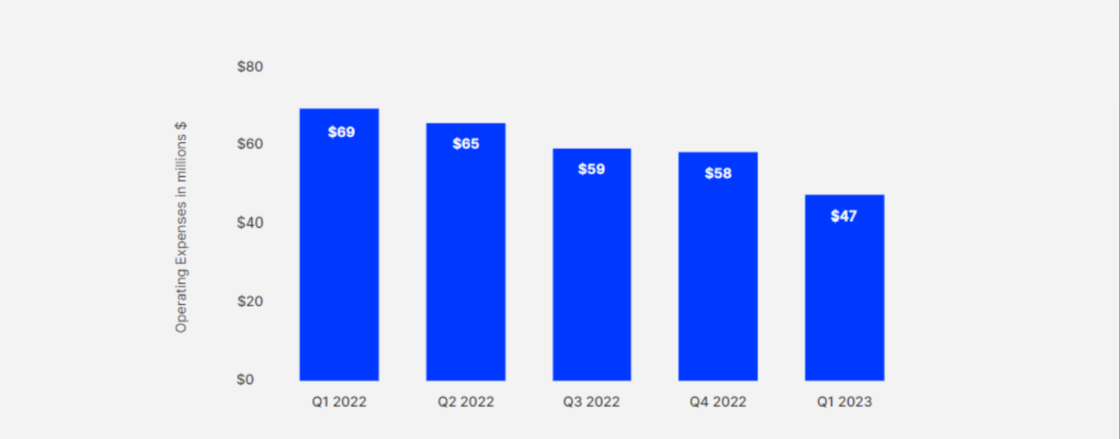

Our revenue momentum is also contributing to our accelerated path to profitability which is essential not just for Blend as a company, but for our customers, team members, and shareholders. The cost improvements we made earlier this year have strengthened our operations, without compromising investments in our customer base and product innovation. And this quarter, we’re beginning to see these cost improvements make a big impact on our bottom line.

We came in well ahead of our expectations on operating expenses improvements, with a sequential improvement of $11m from last quarter or $21m from the same period last year. We have over $307M in cash to continue to fund our operations, giving us ample runway and liquidity based on our current outlook.

Our software gross margin was approximately 75% in the first quarter, up from 72% for the same period last year. Our gross margin improvements reflect the continued cost optimization programs we’ve implemented, the benefit of higher margin Consumer Banking revenues, and the continued expansion of our mortgage product through innovation and the enablement of additional feature sets.

A brighter future ahead

Looking ahead, we’re conservatively optimistic about the tailwinds we’re observing. We expect Q2 platform revenue to be even better than Q1, and have increased our Q2 revenue guidance to reflect this.

We’re making material, visible progress towards our path to profitability. We are dedicated to our mortgage customers, who are showing their strength through these tough times. And we believe Blend Builder is the infrastructure to create massive value across the banking software stack for our customers.

Our customers need the innovation, speed, and cost efficiency of our technology now more than ever. We are a critical partner in helping them grow market share, and we won’t stop until every aspect of the way banks originate products becomes digital and data driven.

To learn more about our earnings results, visit investor.blend.com.

Nima

Forward-looking statements and Non-GAAP Financial Measures

This blog post contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which statements involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or Blend’s future financial or operating performance. In some cases, you can identify forward looking statements because they contain words such as “may,“ “might,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “would,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these words or other similar terms or expressions that concern Blend’s expectations, strategy, priorities, plans or intentions. Forward-looking statements in this blog post include, but are not limited to, statements regarding Blend’s financial condition and operating performance, including its outlook, market size and growth opportunities, capital expenditures, plans for future operations, competitive positions, technological capabilities, strategic relationships, Blend’s opportunity to increase market share and penetration in its existing customers, projections for a sharp decrease in mortgage loan origination volumes, other macroeconomic and industry conditions, Blend’s ability to create long-term value for our customers, and Blend’s expectations for revenue growth. If any of the risks or uncertainties related to the forward-looking statements develop or if any of the assumptions related to the forward-looking statements prove incorrect, actual results could differ materially from those projected, expressed, or implied by our forward-looking statements. The forward-looking statements contained in this blog post are also subject to other risks and uncertainties, including those more fully described in Blend’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2022 and its Quarterly Report on Form 10-Q for the quarter ended March 31, 2023. All forward-looking statements in this blog post are based on information available to Blend and assumptions and beliefs as of the date hereof, and Blend disclaims any obligation to update any forward-looking statements, except as required by law.

In addition to financial information presented in accordance with U.S. generally accepted accounting principles (“GAAP”), this blog post includes certain non-GAAP financial measures. These non-GAAP measures are presented for supplemental informational purposes only and should not be considered a substitute for financial information presented in accordance with GAAP. There are material limitations associated with the use of non-GAAP financial measures since they exclude significant expenses and income that are required by GAAP to be recorded in Blend’s financial statements. Management encourages investors and others to review Blend’s financial information in its entirety and not rely on a single financial measure.

This blog post contains statistical data, estimates and forecasts that are based on independent industry publications or other publicly available information, as well as other information based on Blend’s internal sources. This information involves many assumptions and limitations, and you are cautioned not to give undue weight to such information. Blend has not independently verified the accuracy or completeness of the information contained in the industry publications and other publicly available information. Accordingly, Blend makes no representations as to the accuracy or completeness of that information nor does Blend undertake to update such information after the date of this blog post.

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.