February 11, 2022 in Challenges and solutions

How cloud based digital banking is transforming financial services

Get answers to all of your questions about moving to the cloud, embracing digital channels, and the specific benefits for financial services providers.

Blend

Cloud based digital banking platforms, which enable financial institutions to provide secure banking services online, are becoming more common. But increased popularity doesn’t always mean that a concept is widely understood. Cloud computing and digitalization of services can be complex and difficult to understand, no matter the industry — and that’s why we’re here to help.

Cloud based digital banking can improve financial institutions’ capability to:

- Deliver services

- Manage documents

- Store information

- Process data

All of which conveniently reduces the reliance on complex IT infrastructure or physical document management.

The benefits of cloud banking are difficult to ignore. Transitioning to the cloud can reduce time to market, increase scalability, and accelerate business growth for financial services companies. And as we’ll explore in this article, cloud solutions also have the potential to enhance customer experiences, reduce security risks, and lower operating costs.

What is cloud based digital banking?

Before diving into the cloud’s benefits for banking use cases, let’s start by defining cloud computing. Cloud computing is the delivery of services through the internet; it has changed the way that we communicate, work, shop — the list goes on. Instead of relying on devices that you sit at or carry around to crunch, process, and store data, the cloud allows users to save information to a remote database.

From servers to software, cloud computing services enable functionality that is easy to take for granted today. But 25 years ago when email was a novelty, our methods for data storage, back-up, and retrieval looked very different. Now with the cloud, companies can deliver software on demand and easily create and test new applications.

There are two types of cloud services that are helpful to differentiate: software-as-a-service (SaaS) and platform-as-a-service (PaaS).

SaaS

- Also known as: web-based software, on-demand software, and hosted software

- By hosting the software or app in the cloud, SaaS companies make their service accessible from the internet versus downloading it to one device

- Examples: Salesforce, WebEx, Dropbox

PaaS

- Shares some similarities with SaaS

- Instead of delivering software over the internet, it’s a platform for creating software that’s delivered online

- Gives developers the ability to focus more on building software without worrying about software updates, storage, infrastructure, or operating systems

Regardless of the specific service type, cloud based digital banking aims to enable financial institutions to better meet consumers where, when, and how they like. With these capabilities in place, innovative and responsive financial firms are processing transactions in real-time, scaling quickly, and offering increasingly exceptional customer experiences.

What are the specific benefits of the cloud for financial services firms?

The case for updating technology and modernizing processes at this point is well-established: digitally native consumers; fluctuating and unpredictable market conditions; the threat of increased competition; a desire to provide the best tools for on-the-ground staff in support of customer-first excellence. Cloud lending solutions offer many benefits that align well with these calls to action, built on the cloud-specific features outlined above.

1. A modern delivery mechanism

When an organization is striving to modernize its practices, it can be easy to get stuck in a “to rip and replace or not” mindset. Some financial services providers are working with technology systems that were designed over 40 years ago with multiple solutions layered on top of legacy infrastructure — the cumulative result of collecting solutions as needs emerge.

“Banks don’t need new core banking solutions; they need new paradigms to deliver core banking capabilities,” wrote Jost Hoppermann, Forrester’s vice president and principal analyst. We believe that cloud banking is that paradigm.

2. Material reduction for material impact

Historically, financial service firms have had to purchase, construct, and maintain costly information management technology and infrastructure. Cloud solutions replace server centers and value-light IT tasks with intuitive access through existing technology (everyday computers, phones, tablets, and so on). Not only can this reduce the physical footprint required of a lender, but it can also reduce overall costs.

3. Collaboration and innovation, amplified

With the cloud, lending teams can collaborate consistently, no matter where they’re working from. Since files and data are stored securely online, staff can make updates quickly and easily even when away from their desk.

Responsive cloud banking platforms can also help lenders remain agile with rapid access to new features, pushed automatically as they’re developed. And when the need or opportunity arises, PaaS allows teams to test on the fly and pivot quickly. It can also minimize innovation redundancy by removing the silos that exist when legacy infrastructure is an amalgam of disparate systems.

What are the digital capabilities that cloud technology can unlock?

In addition to the benefits supported specifically by the cloud, there are a variety of advantages enabled by outstanding cloud banking solutions. These elements aren’t fully dependent on the cloud, but excellent cloud computing and banking solutions set up financial service providers for greater results in these four key areas:

1. Enhanced customer experience

Our increasingly digital world is depriving people of traditional face-to-face interactions, and the financial services sector is not immune. Consumers are increasingly likely to choose the ease and convenience of logging onto a mobile app over making an in-person visit or calling in.

Fortunately, cloud technology can help enhance the customer experience and journey. When McKinsey surveyed businesses across industries, they found companies that implemented technology to improve customer experiences boosted satisfaction rates by 15 to 20% and improved conversion rates and growth by 20%.

“Companies that implemented technology to improve customer experiences boosted satisfaction rates by 15 to 20%.”

Advantages for customers that are specific to the financial services sector:

- Disable (or enable) a debit or credit card from a mobile device

- Make remote deposits that are fast and secure

- Get current account information

- Apply for digital-first loans, lines of credit, and overdraft protection lines

Assisted by user data and predictive analytics, cloud lending software delivers more efficient and customized interactions. Digital offerings can increase customer satisfaction by helping lending and banking teams see the holistic picture of their consumers, anticipate their needs, and better understand their behaviors. This sense of being “seen” by their financial services institution emulates real relationships, creating trust and connection between borrowers and lenders.

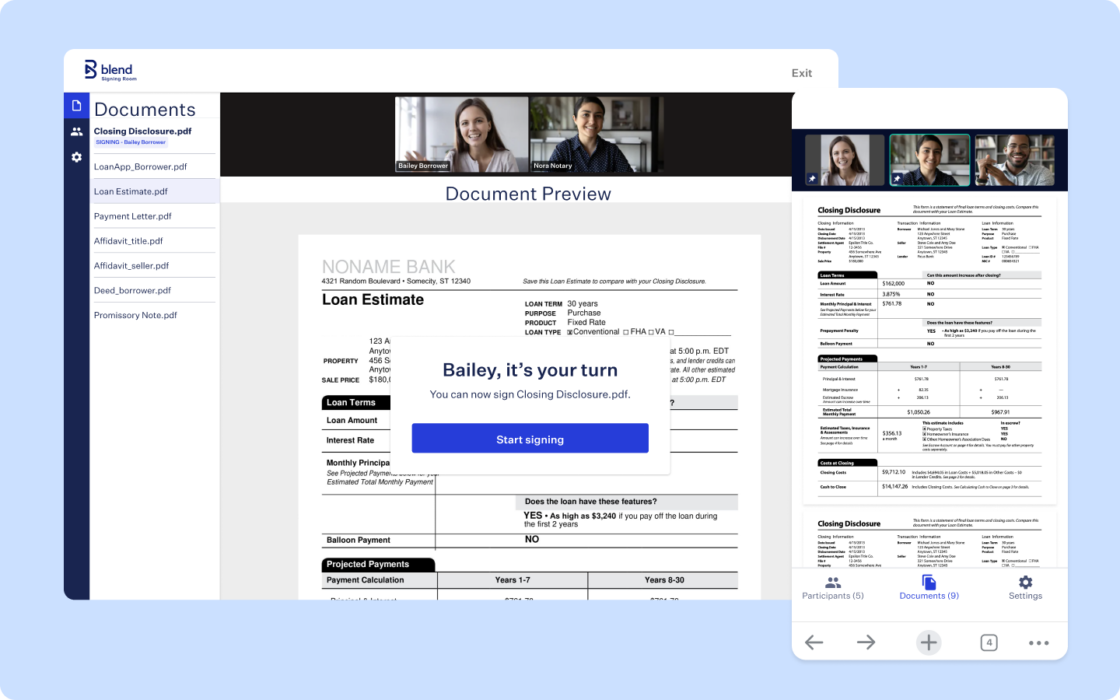

How Blend’s cloud banking platform improves customer experience

Blend makes the banking process seamless, transparent, and safe. The customer experience is cohesive and mobile-friendly, which can help reduce turn times and improve conversion rates for your business. Here are a few of Blend’s key features that elevate the customer experience:

A conversational interface…

that guides customers through the application in clear, easy to understand language.

Embedded data connections…

that allow consumers to automatically complete parts of an application, minimizing manual data entry while saving time and effort.

Automated document requests…

so consumers can complete tasks faster and accelerate the process.

Learn more about how Blend is improving the onboarding experience for customers.

2. Smarter, more timely personalization

How can financial services providers increase engagement and successful financial outcomes? By combining predictive analytics and user data to create a more customized user experience that anticipates customer needs and increases satisfaction.

Today’s consumers have come to expect personalized service at every level, and banking is no exception. According to Forbes:

- 83% of consumers expect products to be personalized within moments or hours

- 63% of early technology adopters expect products and services to be customized based on their personal data

Leaders at Microsoft also point out that “financial institutions are looking for new approaches to move their products toward more personalization that will improve customer acquisition and retention.”

Real-time, cloud based data analysis provides a level of personalization and engagement that can be more challenging with existing legacy infrastructure.

“Cloud based digital banking technology can enable targeted outreach based on past behavior and user-provided data designed to increase customer engagement.”

Staff at financial services firms can use embedded analysis capabilities to understand customer behavior, increase engagement, drive conversion, and build loyalty and trust.

As a result, customers can enjoy benefits such as:

- Specialized solutions that cater to their needs at the time

- Helpful information and financial advice in moments that matter

- Safety measures like personalized alerts for fraud prevention

Consumers will appreciate the added convenience, which can translate into establishing a trustworthy, long-term relationship with their financial business.

3. Agility for faster market responsiveness

Many financial organizations have difficulty automating and connecting the processes that impact customer experiences. But the features of cloud based infrastructures allow organizations to respond to changing market conditions with agility, elevating customer experience, scalability, and productivity.

With cloud technology, lenders can innovate, change course on the fly, and face whatever comes next. Deloitte asserts that “[there is] better integration of business units through sharing data, driving integrated decisions, and moving more quickly to solve customer problems.”

How Blend helps organizations be more nimble

Whether spurred by new features added through software updates or adaptable workflows that can be configured to suit your business needs, rapid changes and upgrades are possible with Blend. In addition, our team is driven by a customer-first approach. We’re here to innovate with our customers, pushing the boundaries of what our cloud banking platform can offer. This level of flexibility is by design — it’s built into the very fabric of our underlying technology.

Case Study: How Blend helped M&T Bank process and fund 10,000+ SBA loan applications during the COVID-19 pandemic

4. Greater ROI and long-term savings

Why should financial providers pay for computing capacity they don’t need?

The cloud enables firms to take advantage of cost efficiencies by scaling capacity up or down as needed, eliminating unnecessary costs. Cloud based banking also typically doesn’t require physical IT infrastructure or maintenance fees for legacy technology.

These cost efficiencies can enable financial institutions to reap higher profits: for example, by tapping into the increased flexibility and efficiency that cloud based banking tools offer, loan teams and other production staff can produce more loans per month while operations leads manage fixed (or even reduced) origination costs.

How Blend improves efficiency to ensure ROI

Blend’s cloud banking platform adds efficiency for all parties. Taken broadly, there are four main areas of improvement: digital application experience, document verification, follow-ups, and borrower communication. At Blend, we conducted a survey to measure the return on investment (ROI) for our Blend Mortgage customers. The results showed a potential 10x ROI for an estimated average savings of $824 per loan on top of reduced processing times, which also supported an increase in loan volume.

Blend powers the future of banking

The Blend Consumer Banking Suite is a comprehensive solution for consumer banking. Whether customers are applying for a personal loan, deposit account, or any other consumer financing, Blend’s cohesive platform can make the process easier.

Here are just a few of Blend’s benefits for financial firms and customers:

- Offer a unified digital experience with an easy-to-use interface

- Convert more customers with real-time decisions and automated requests

- Streamline applications with data connectivity and pre-fill features that reduce manual input

As a result of using Blend, financial organizations can:

- Boost productivity and agile responsiveness to further scale the business

- Mitigate risks, strengthen security, and offer customers peace of mind

- Enhance personalization that improves the customer experience and drives a lifelong relationship.

Interested in reading more about how you can develop high-converting customer journeys and bring new products to market faster than ever before?

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.

Lessons from 2008: Why Better Data Won’t Prevent the Next Banking Crisis

See why the 2008 financial crisis wasn’t due to a lack of data, but a lack of systems to act in real-time.

Read the article about Lessons from 2008: Why Better Data Won’t Prevent the Next Banking Crisis

Stop Asking LOs to Choose RON: 5 Tips to Make Adoption Stick

Move beyond pilot programs with 5 leadership strategies to scale digital closing and drive ROI.

Read the article about Stop Asking LOs to Choose RON: 5 Tips to Make Adoption Stick

5 Ways Blend Customers Transformed Their Operations in 2025

The best measure of innovation is what customers achieve. Learn how Blend customers delivered breakthrough results that redefined operational transformation.

Read the article about 5 Ways Blend Customers Transformed Their Operations in 2025