Compass Mortgage

embraces digital transformation with Blend

embraces digital transformation with Blend

Read the full story about Compass Mortgage

Proactive and personal journeys for borrowers. Connected and automated workflows for lenders.

Request demo

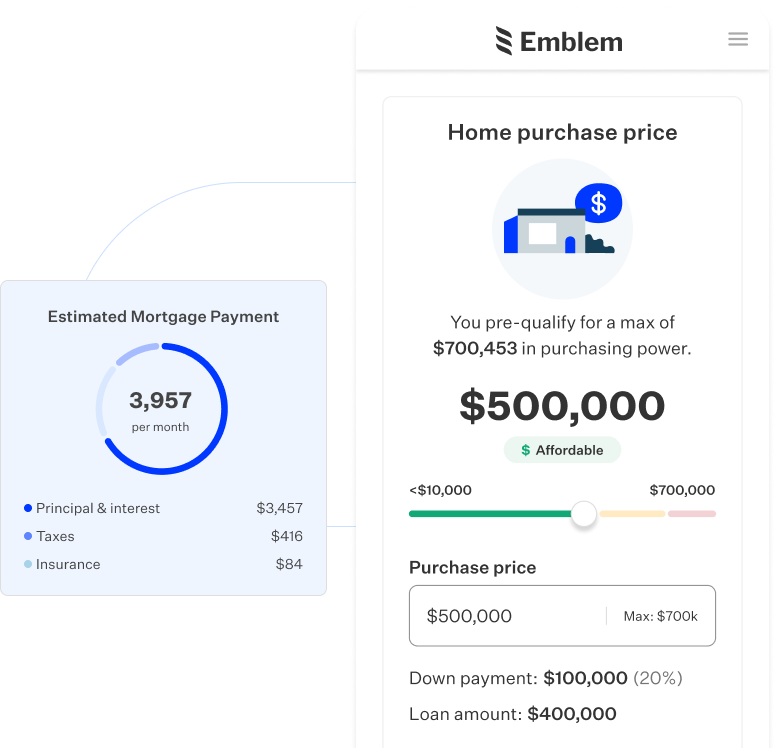

A dynamic question engine creates a personalized experience for each borrower.

Verifications across assets, credit, income, and employment are instant and automated.

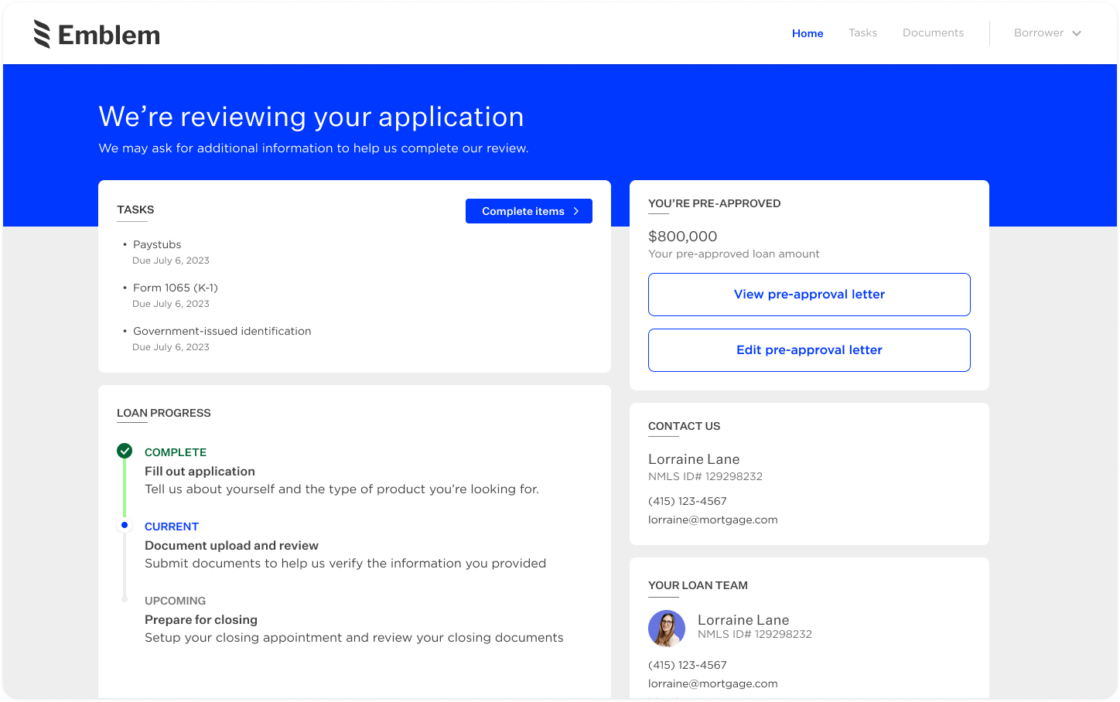

A central, secure portal for lenders and borrowers to access all loan documents and artifacts.

Upgrade your digital mortgage process to engage borrowers, increase your operational efficiency, and differentiate yourself from the competition.

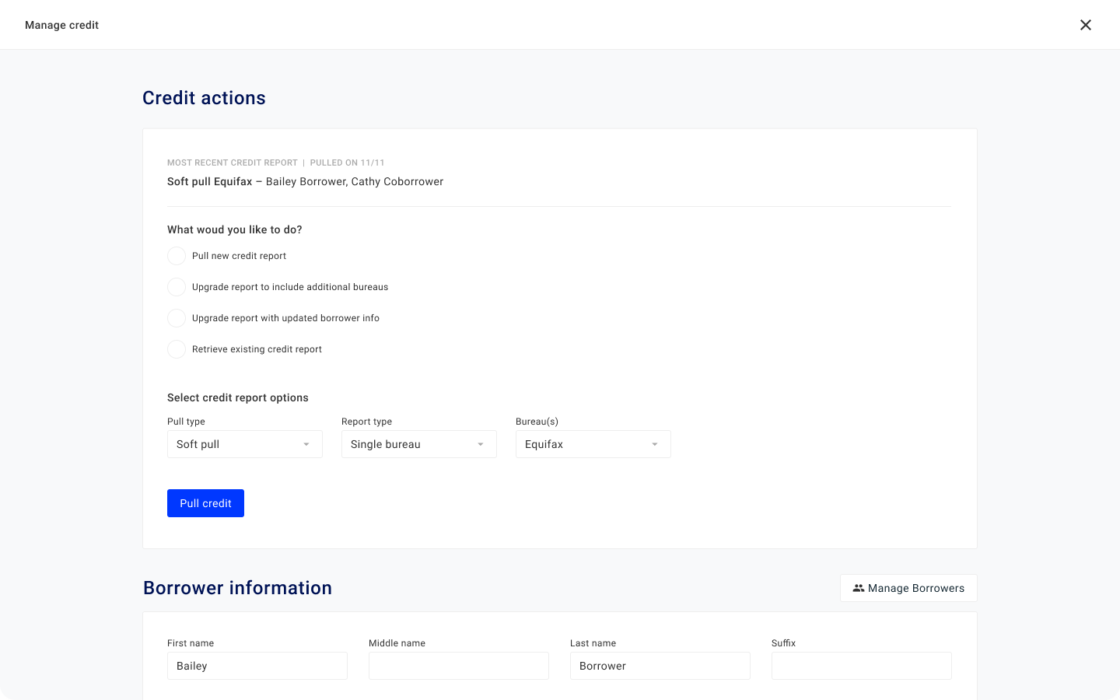

Help even more borrowers with instant, real-time income, credit, asset, and employment verifications.

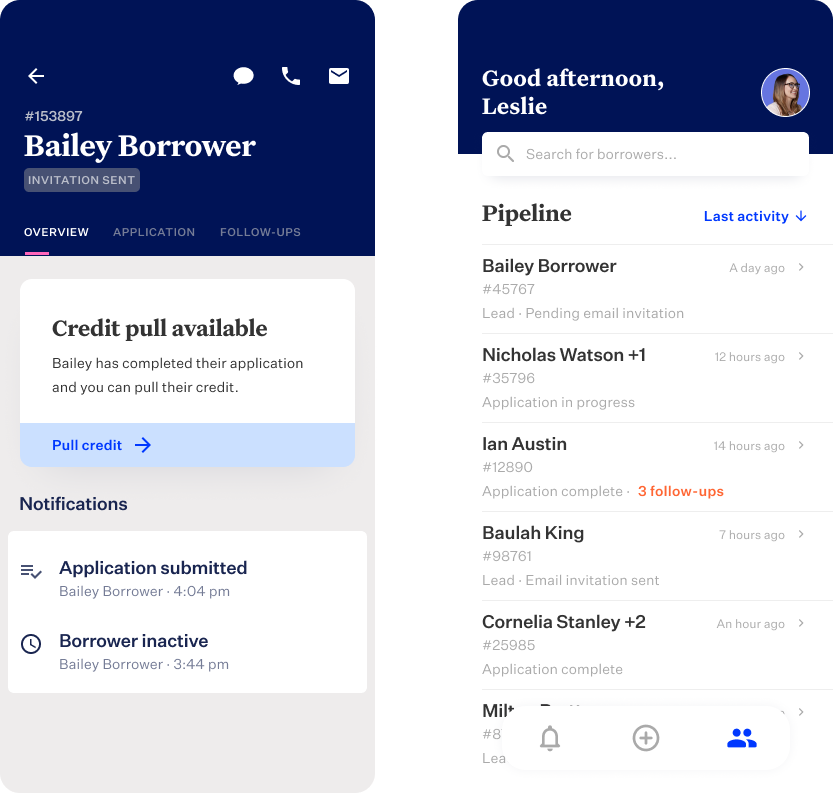

Support your loan officers with a library of tools to better serve each of their borrowers.

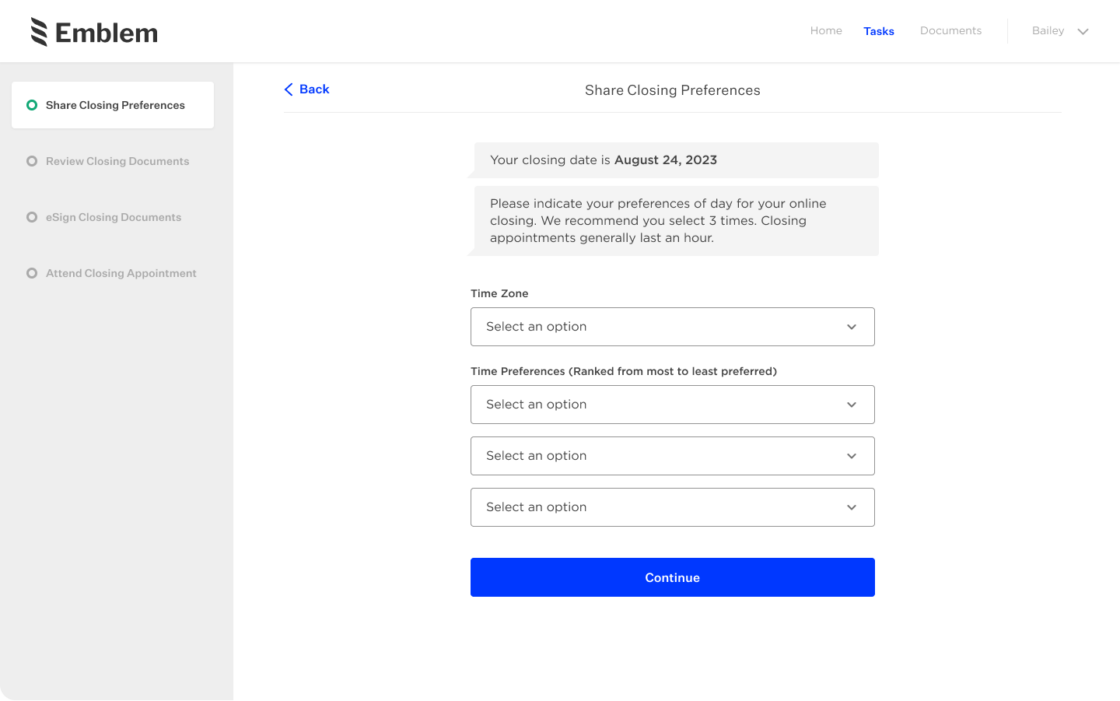

Provide a true end-to-end experience on the same platform borrowers started in.

Subscribe to get Blend news, customer stories, events, and industry insights.

Sign up for a personalized demo and get started in 4 weeks or less.