Be the winning bank

Gain efficiencies, increase customer lifetime value, and adapt to market shifts.

Start learning about Be the winning bank

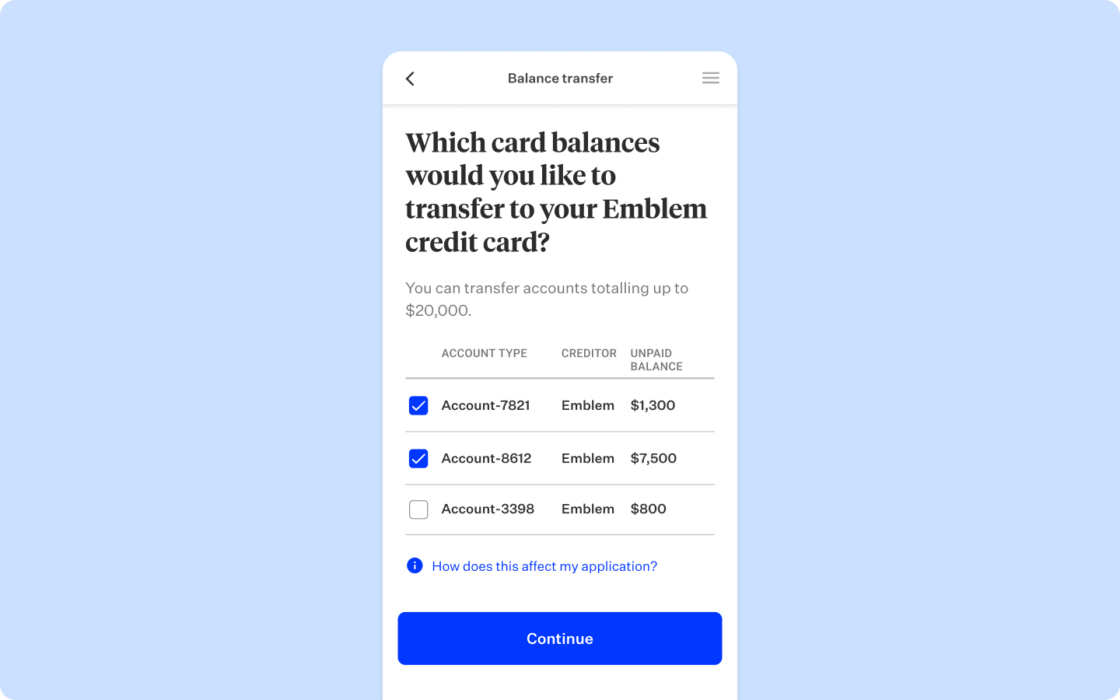

Break down product and channel silos, accelerate innovation in lending, and activate growth with ready-to-deploy onboarding journeys.

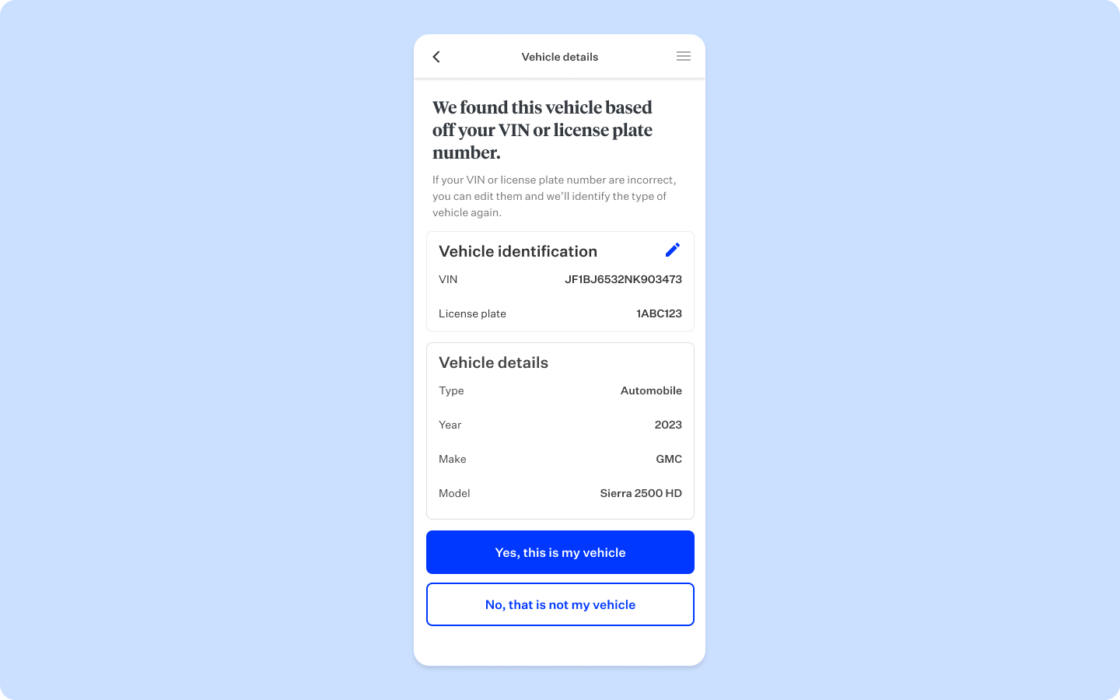

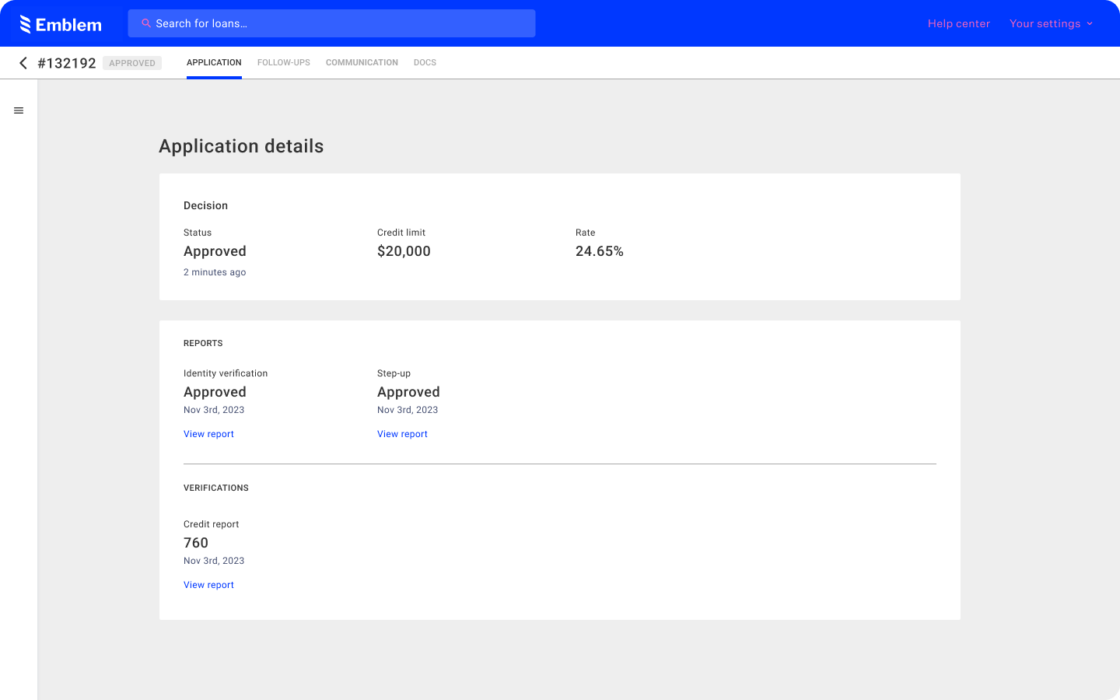

Balance the digital and human side of customer experiences with the intelligence of your lending policies baked into easy-to-navigate workflows for borrowers and bankers.

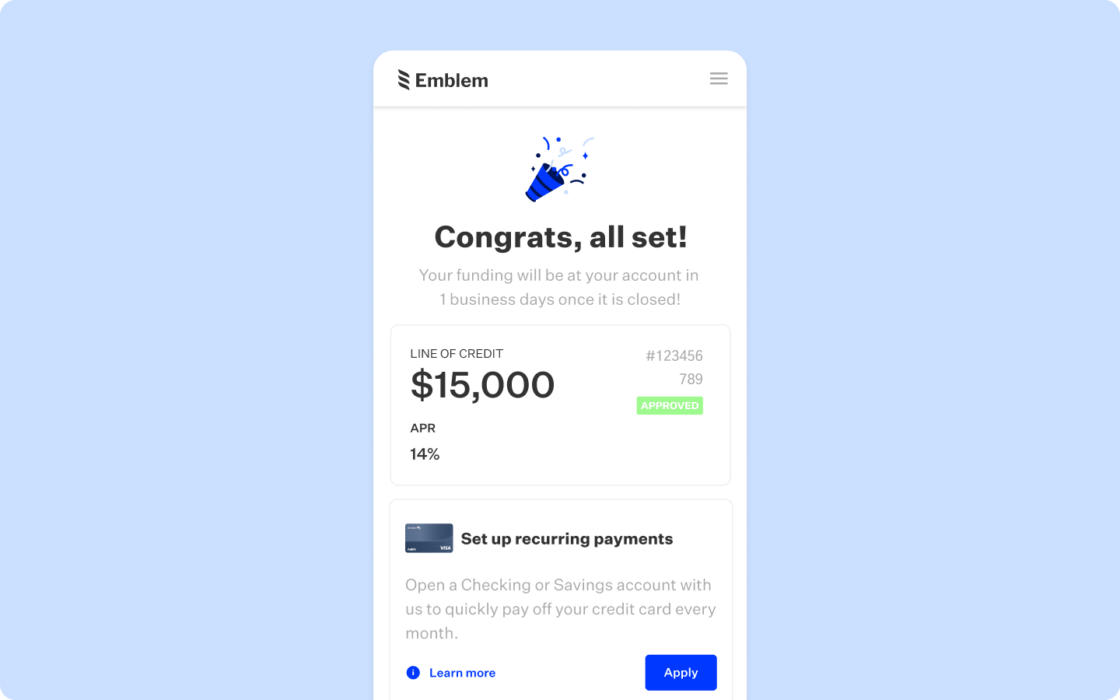

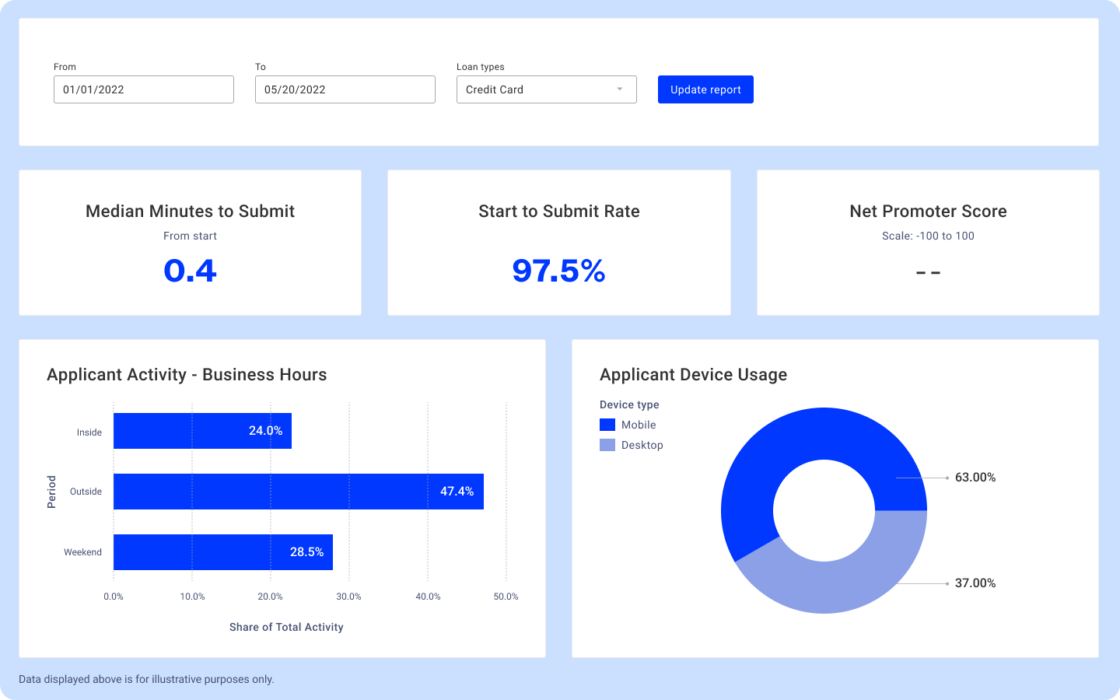

Improve conversion rates by removing workflow stops and interruptions, saving and resuming experiences, cross-selling offers, supporting campaigns and promos, providing immediate decisioning, and automating follow-ups.

Synchronous connectivity between digital and banker workspaces enables customers and bankers to focus on the most productive work and avoid unnecessary data input and manual effort.

Extensive ecosystem of native and third party integrations intelligently power workflow automations to reduce manual work efforts and accelerate loan origination and decisioning.

Onboard loan products with speed and ease and provide consistent customer experiences through guided banker origination workflows, real-time feedback and communications, and intuitive journeys.

Configurable, low-code, drag-and-drop architecture enables rapid optimization of performance, and an easily accessible reporting and analytics dashboard ensures data helps inform your decisions.

Subscribe to get Blend news, customer stories, events, and industry insights.

Sign up for a personalized demo and get started in 4 weeks or less.