Meet the Suite

Credit Cards, Auto, and Personal Loans

Break down product and channel silos, accelerate innovation in lending, and activate growth with ready-to-deploy onboarding journeys.

Lending on your terms

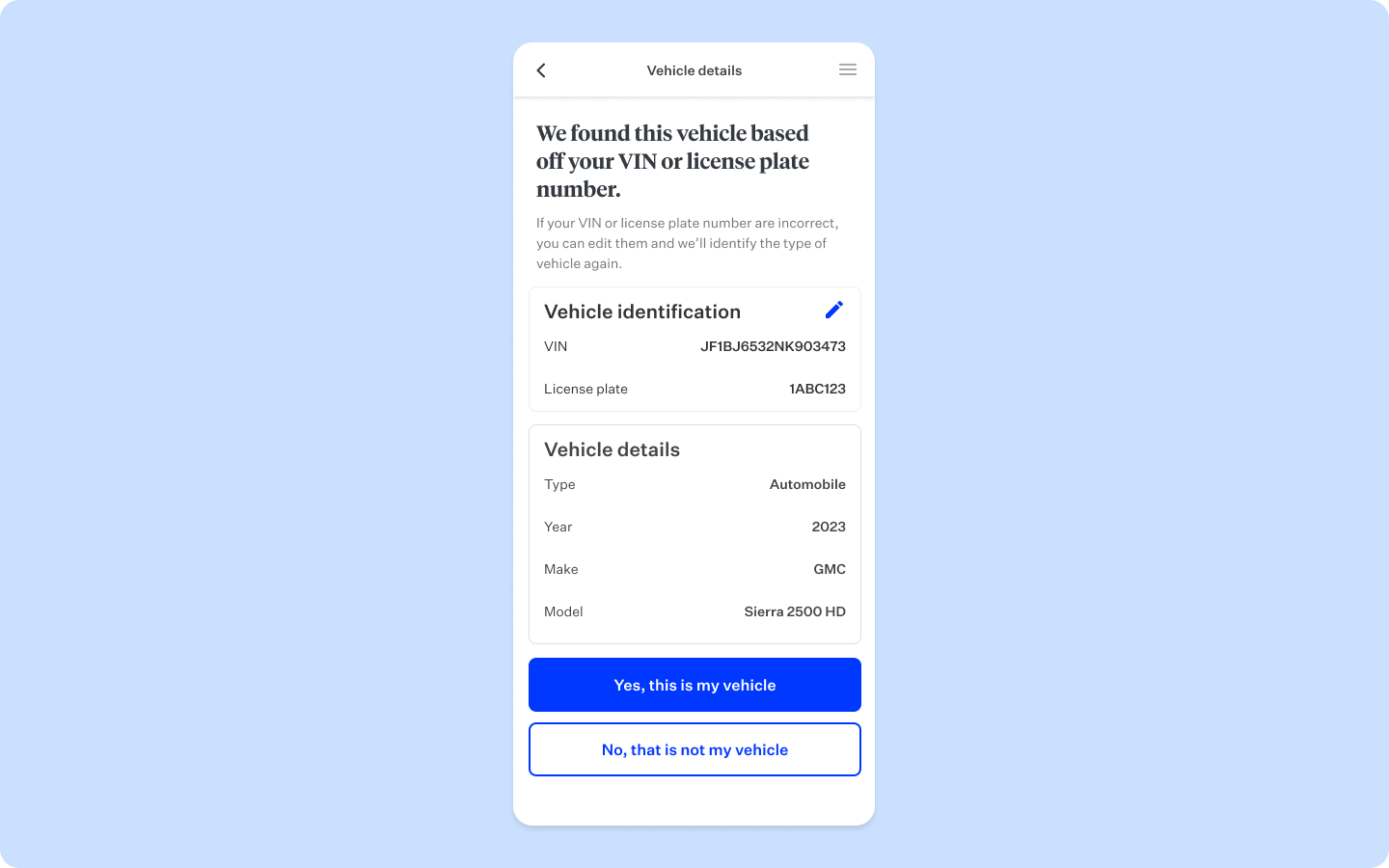

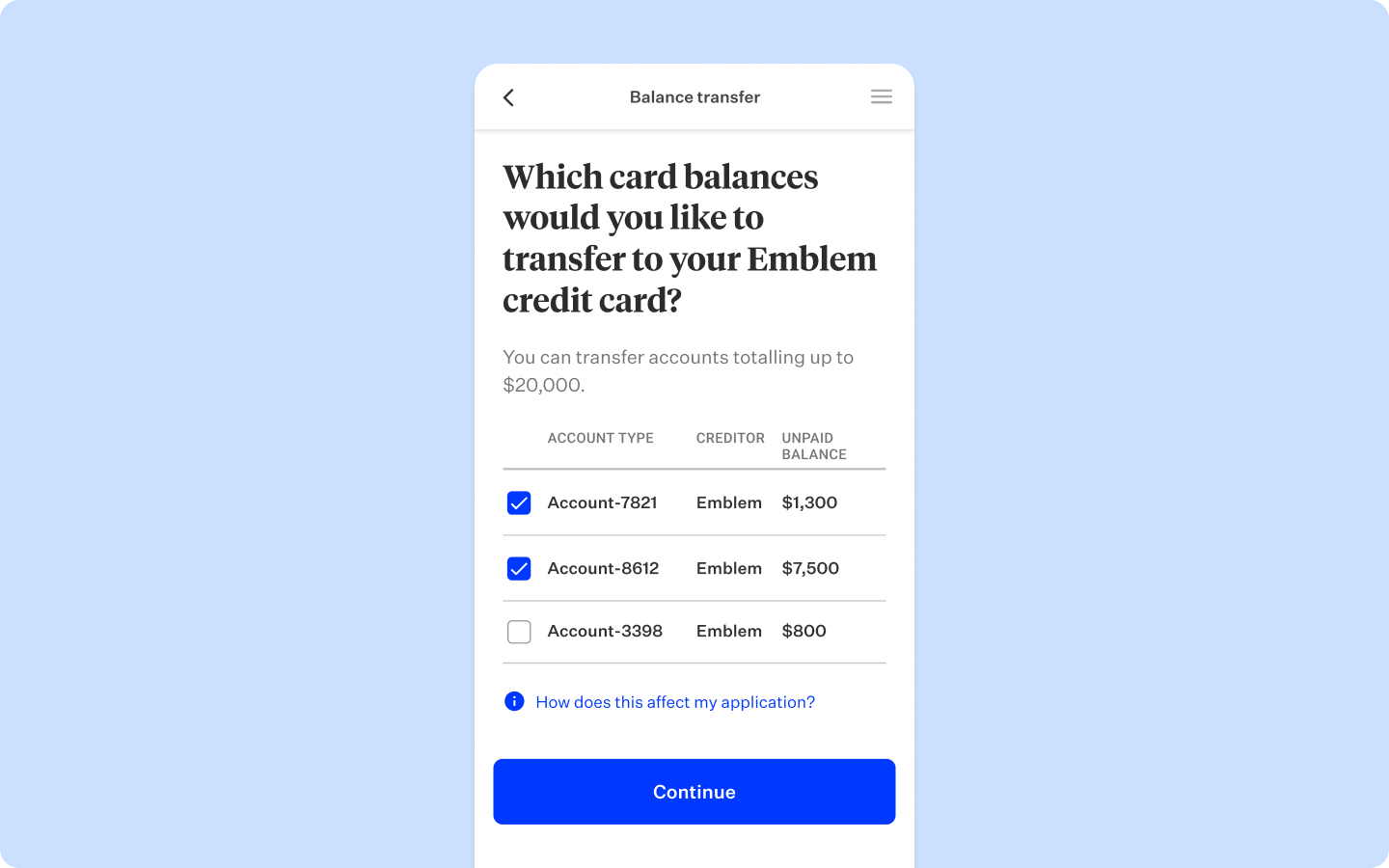

Balance the digital and human side of customer experiences with the intelligence of your lending policies baked into easy-to-navigate workflows for borrowers and bankers.

Growth drivers

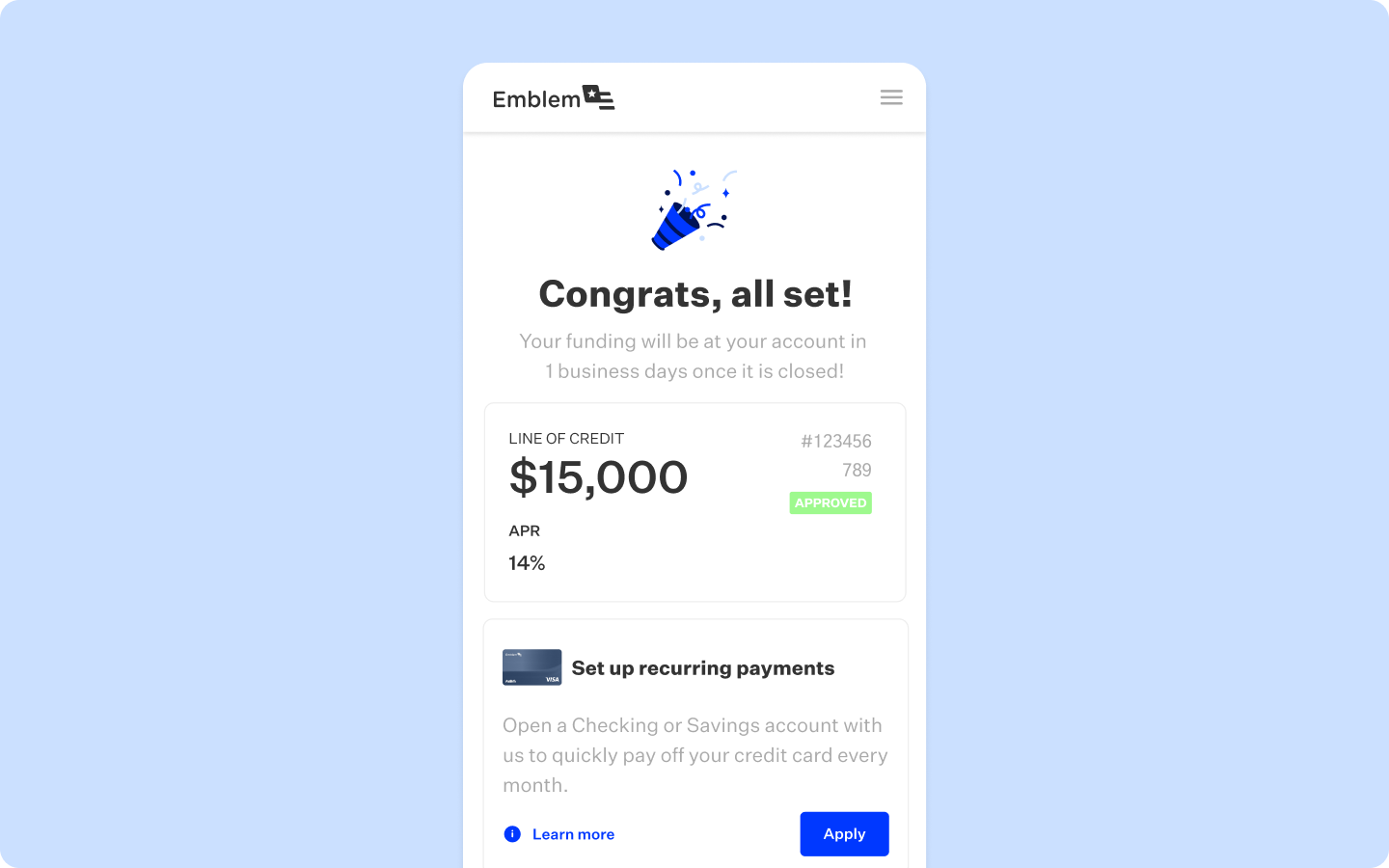

Improve conversion rates by removing workflow stops and interruptions, saving and resuming experiences, cross-selling offers, supporting campaigns and promos, providing immediate decisioning, and automating follow-ups.

Productivity levers

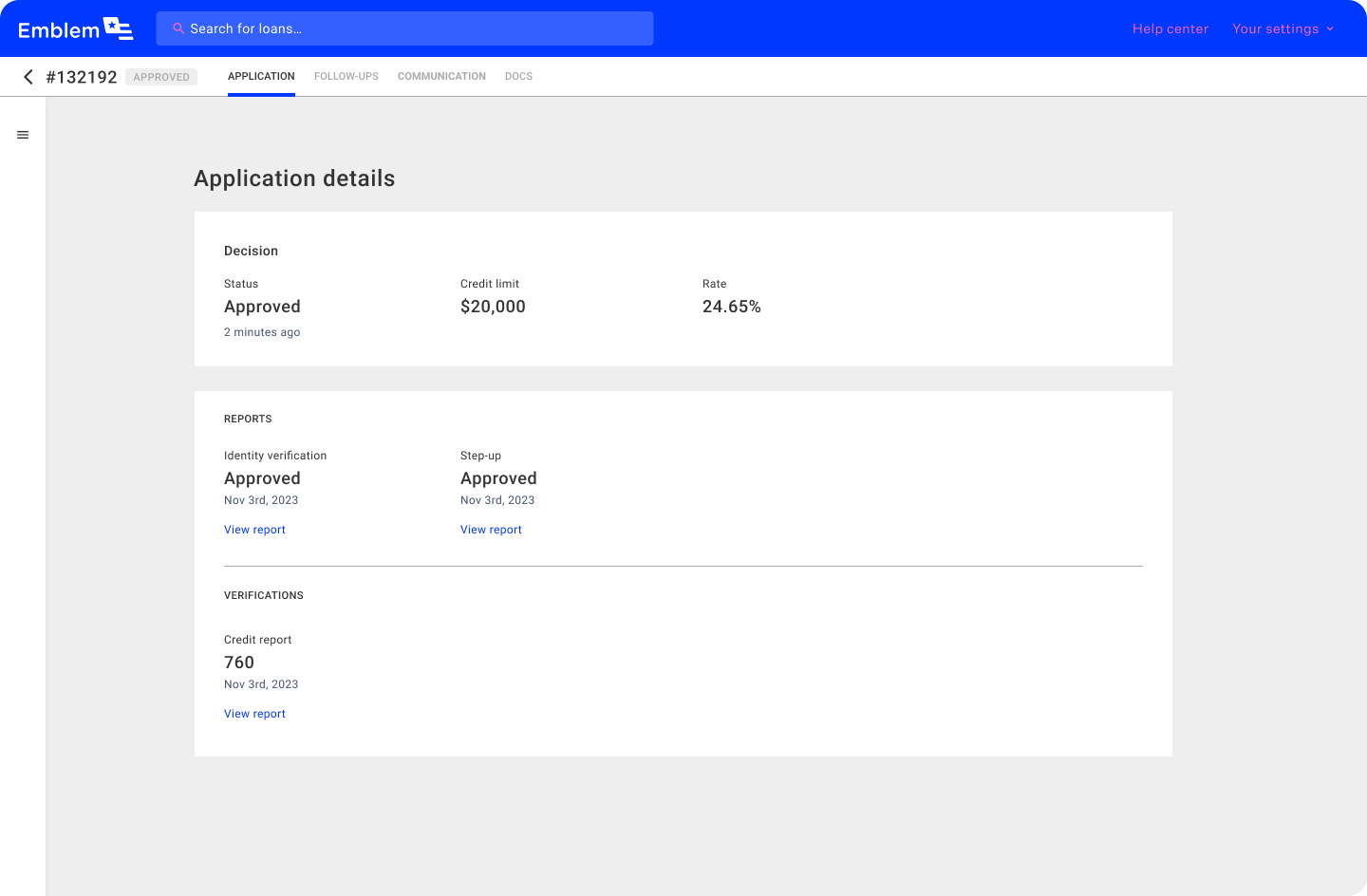

Synchronous connectivity between digital and banker workspaces enables customers and bankers to focus on the most productive work and avoid unnecessary data input and manual effort.

Speed and efficiency catalysts

Extensive ecosystem of native and third party integrations intelligently power workflow automations to reduce manual work efforts and accelerate loan origination and decisioning.

Experience elevations

Onboard loan products with speed and ease and provide consistent customer experiences through guided banker origination workflows, real-time feedback and communications, and intuitive journeys.

Innovation and insights

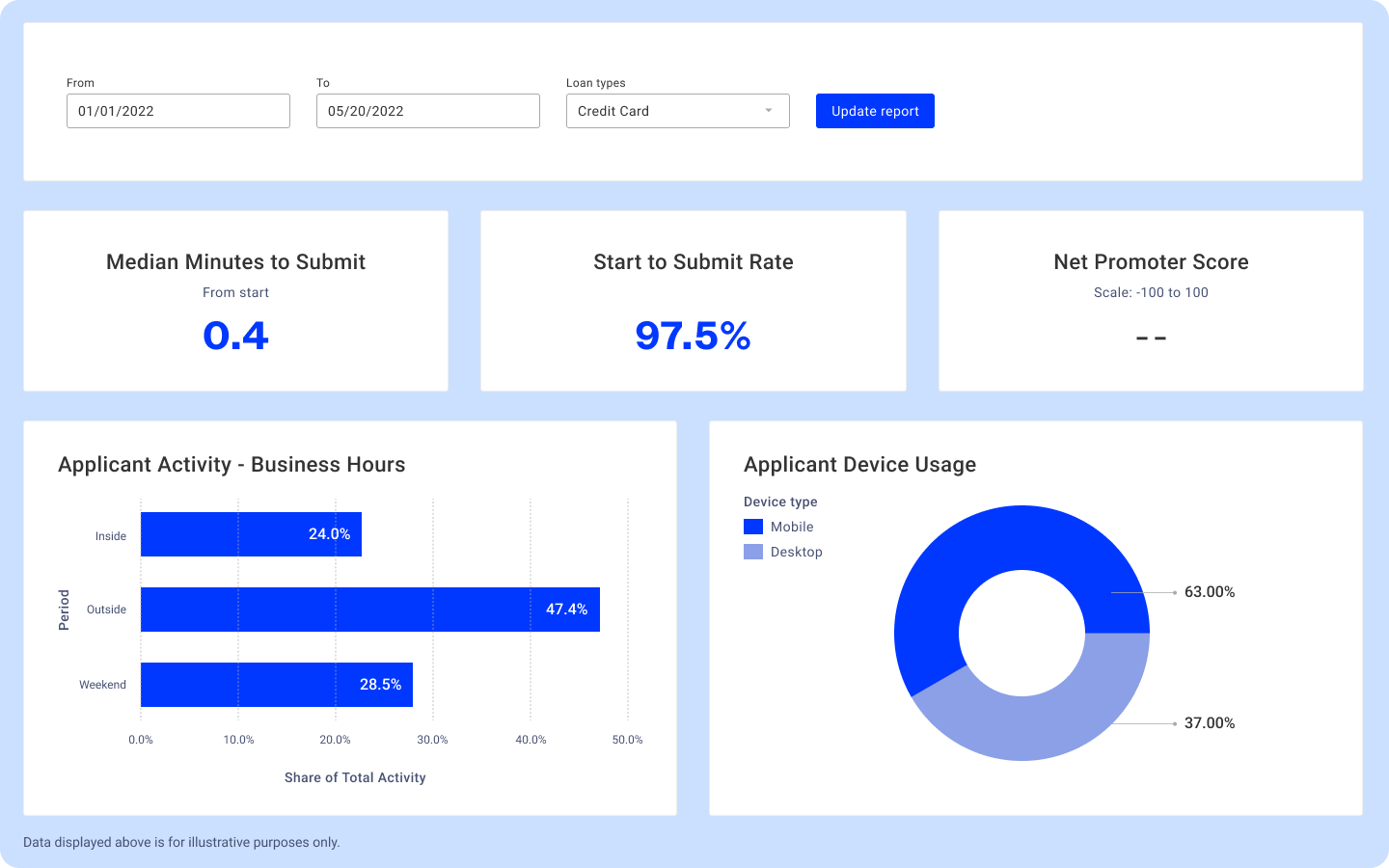

Configurable, low-code, drag-and-drop architecture enables rapid optimization of performance, and an easily accessible reporting and analytics dashboard ensures data helps inform your decisions.

Get to the finish line, faster

Originating a loan is your customer’s means to an end. Key features help accomplish their real goal, faster.

“We want a consumer solution for all products because we don’t want our members to have different experiences on different platforms.”

Ron Senci

Executive Vice President of Sales and Lending, Elements Financial

11%

increase in approved applications for vehicle loans, personal loans, and credit cards

60%

average reduction in application submission times for vehicle loans, personal loans, and credit cards

105%

average increase in deposit account application submission rate

Ready to make banking better?

Sign up for a personalized demo.