As those in the industry know, many of the core banking systems still in use today were originally developed decades ago in the ‘80s and ‘90s. They were created to be systems of record, essentially acting as digital ledgers. And at the time, that’s all banks needed.

In the time since, banks’ and customers’ needs have changed drastically. Customers don’t want to be dependent on branches for basic transactions like depositing checks and applying for loans.

They want the convenience they’ve become accustomed to in the other areas of their lives.

Banks have tried hard to append and amend what they can to meet modern-day needs. But the foundation wasn’t built to hold the weight of all these new technologies. As a result, cracks formed and many are facing an uphill battle to stay current.

Patches for different problems help in the short term, but in the long term what happens is banks essentially create a V2 of the monolithic systems they’re trying to move away from. In order to avoid this, there needs to be a fundamental change in their approach to tech.

The best way forward we’ve found, and the path we’re betting on, is platform technology.

The paths forward

Even though we see platform tech as the best path forward, it’s not the only way. There are two other paths that are somewhat common:

- Internal builds

- Out-of-the-box solutions

An internal build is custom-built software that the company develops and maintains in-house. This option is attractive because it gives the builder complete control over the build, allowing them to make tools to their exact specifications.

On the other hand, since everything is built in-house, the process is usually very long and expensive. It’s common for these types of builds to take in excess of a year. The company is also solely responsible for any upkeep costs. There’s also the possibility that the tech used to develop these custom systems will be outdated and you’ll be back to square one in a handful of years needing to repeat the process.

Out-of-the-box solutions, on the other hand, are prebuilt tools from outside vendors. These are often also referred to as point solutions and are generally purchased for a specific use — income verification, online credit card applications, etc.

The primary benefit with out-of-the-box solutions is that they’re much quicker to implement, which is huge. In cases where speed is the top priority, out-of-the-box solutions are great. However, if there’s a desire to create more bespoke solutions, or experiences, it might not be the best option as you’ll have less direct control.

Each of these first two solutions certainly has its merits. And in some cases may be the right approach. What we like about taking a platform approach is that it includes most of the benefits of the first two approaches, while avoiding many of the challenges.

Why we chose platform

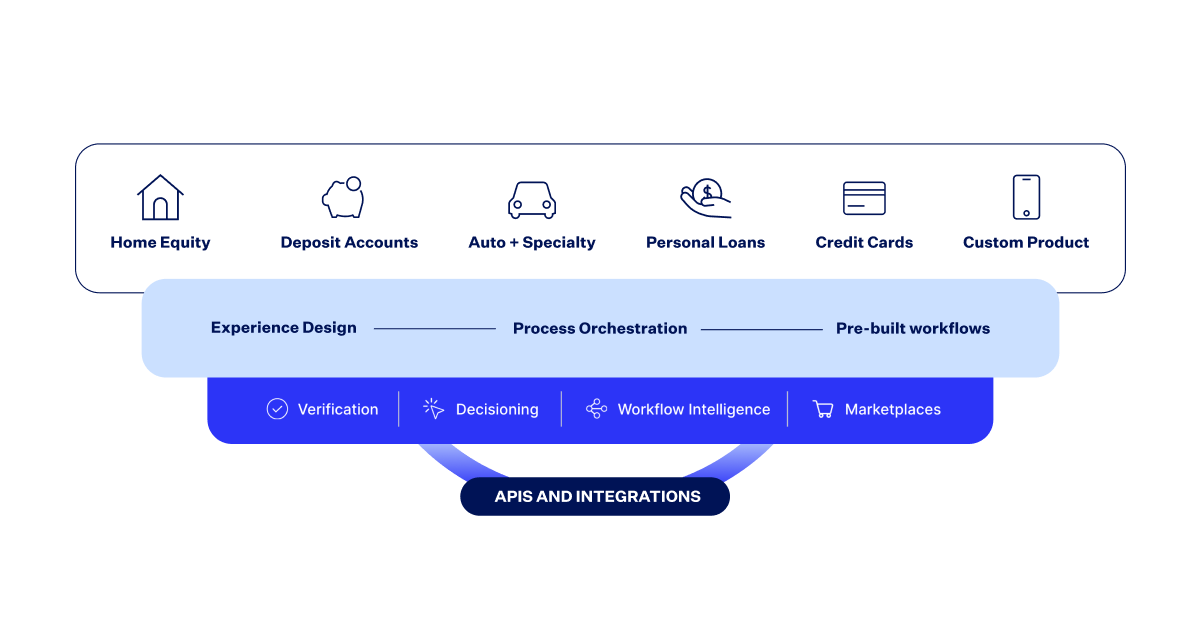

If you’re not familiar with platform tech it essentially works like Legos. Through a partner, you get access to different pieces you’re able to put together in the way you see fit to create the experience you want.

There are a few core attributes we think make platform technology best positioned to help alleviate current issues banks face when moving away from monolithic legacy tech and position them well to be successful for years to come:

- Modular design

- Continuous improvement

- Circular data sharing

Modular design

Having prebuilt pieces reduces the amount of time needed to build new products. Many platform tools also utilize low-code visual builders, which also speeds up production times. Further, the blocks are reusable, so teams aren’t saddled with duplicate work when developing new tools in the future.

Even more exciting is the ability to update modules across multiple applications with one single update. For example, let’s say a regulation changes and now you need to update your identity verification workflow to be in compliance. You can edit that module and when you publish the changes it will automatically update that module in every application currently using it.

Continuous improvement

One of the biggest challenges of monolithic architecture is updates. That’s because all of the parts are heavily dependent on one another. So, changing one part can derail the whole. That’s not the case with platform technologies.

The idea of being cohesive and decoupled essentially means all the parts connect together, but aren’t dependent on one another. So, if a part of an application becomes obsolete or outdated in any way, you can easily update that one part without impacting the application as a whole.

Circular data sharing

Another very key aspect of platform technology is its ability to send and receive information. Applications built on the platform can share information, making it possible to do things like prefill applications, or prequalify people for additional products. This is very useful to increase cross-sell opportunities and can even help with things like loan utilization.

For example, let’s say you run a personal loan application. With platform tech you could do a soft credit pull in the background to find additional credit accounts the customer could consolidate and use the personal loan for. It’s one less step for the customer to take and arms bankers with a more compelling case to get them to use the funds right away.

A foundation for the future

The needs of banks and customers are continually changing. To keep up with those changes it’s imperative that banks invest in technology that allows them to build a solid technology foundation to serve current and future needs.