July 28, 2021 in Thought leadership

Documents to data: The digital mortgage imperative

View a clip featuring Head of Blend Nima Ghamsari as we explore the role technology plays in end-to-end digital transformations.

Humans have a tendency to resist change. We are programmed to oppose what we believe are potential threats. When our defense mechanisms kick in and force us to push back against abrupt change, it can actually work to our advantage — to a point. New technologies are particularly polarizing, producing either techno-enthusiasts or techno-skeptics.

It’s 2021, and despite having welcomed technology into our personal lives with relative ease, we’re still trying to figure out how much space it should occupy in a professional capacity. Mortgage industry team members have recognized the benefits of a more automated loan process, but fears surrounding human worker replacement and isolation have been high on the list of concerns. Yet, if the past year has shown us anything, it’s that stronger technological integration is critical to increased connectedness, efficiency, and customer satisfaction.

From documents to data

Over the past ten years, companies have taken a hyper-focused approach to digital transformation: reimagining the interaction between people, processes, and digital programs. Back when IoT, AI, and Big Data were just nascent terms, many businesses started recognizing the importance of transitioning from paper to digitized documents, but, for data-sensitive industries like financial services, too many constraints capped its acceleration. Compliance concerns, scalability issues, and legacy architecture were all contributing factors, and while other industries with fewer caveats were quicker to embrace the impending changes, the financial services industry opted for a more risk-averse approach.

Within the past two decades, many banks gave their customers the option to go paperless, and since then have offered the ability to perform numerous financial operations from a preferred device. Essentially, the front end of consumer banking and mortgage origination was given a digital facelift, and while that greatly benefited consumers (and to a certain extent lenders), the back end effects that a complete transformation would have produced never fully materialized. 2020’s pandemic made it clear that time was running out for lingering skepticism and that digital transformation had become the digital imperative.

Working smarter

Delayed full-scale digital transformation might have exposed vulnerabilities in technological infrastructure across many industries, but there is a silver lining. Gradual integration has given both consumers and lenders more time to acclimate to increased automation, which in turn has made room for deepened consumer trust and allayed fears surrounding job security. This, coupled with our ability to adapt to disruptions, has positioned the financial services industry to make the digital imperative work to its advantage.

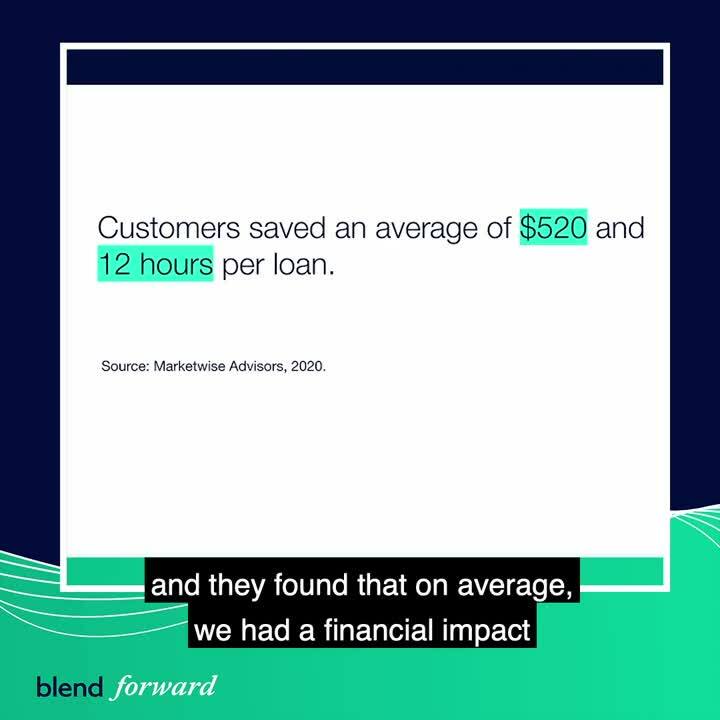

This is especially true for the mortgage industry. Processing mortgage loans requires high-level critical thinking and a team of people processing thousands of pieces of data on a case-by-case basis, yet many of the straightforward, manual processes could be handled by a machine. Investing in and leveraging technology brings more speed and efficacy to the table, higher levels of customer-centricity, and ultimately enables loan officers to focus on more complex cases. The bottom line? Minimized disruptions for customers and increased efficiency for financial services providers. Less stress, more time, better service.

The end-to-end game

The homebuying journey is as exciting as it is stressful — for borrowers and lenders alike. From application to closing and every step in between, the mortgage loan process includes moving parts, and getting them all to align within the established time line requires substantial third-party coordination. We’ve been steadily exposed to attention-grabbing headlines that sound the alarm for workforce robot invasions, but automation functionality can actually add value across the board.

Simpler processes, lower lender costs, and streamlined user experiences are just some of the advantages that can be enjoyed on both sides of the desk. Manual practices take a lot of time and can lack consistency. Once fully-developed, new technologies could minimize time spent on rote tasks like pulling credit scores, verifying income and assets, and even underwriting — freeing up human resources for things that humans do best: forming connections, providing support, and making interactions more relational than transactional.

The reality is that the majority of consumers have come to expect end-to-end homeownership experiences. On top of that, due to a year of uncertainty and isolation, consumer demands for in-person, fully-digital, or hybrid models of banking have only increased. Customers want a one-stop-shop that is capable of handling every financial milestone; technological progress can make that happen. The digital imperative means taking your company ethos from paper-centric to data-centric, and in turn, making it more customer-centric. Embracing technology as an ally reduces friction, resulting in a faster, friendlier, and more fluid mortgage loan process. Change is hard, but it doesn’t have to be.

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.