June 15, 2021 in Thought leadership

A consumer perspective on the homeownership journey

Consumers are experiencing confusion and stress when buying a home. But there are opportunities to improve this journey.

The journey of homeownership is difficult for everyone. Potential homebuyers contend with a relative lack of knowledge about the process, and they often find that each new phase of the journey leads to more questions and more stress. Within this problem lies an opportunity for trusted advisors to help guide consumers. To find out where the current pain points were, Blend engaged Aite Group to survey consumers and examine consumer interest in a more streamlined homeownership journey.

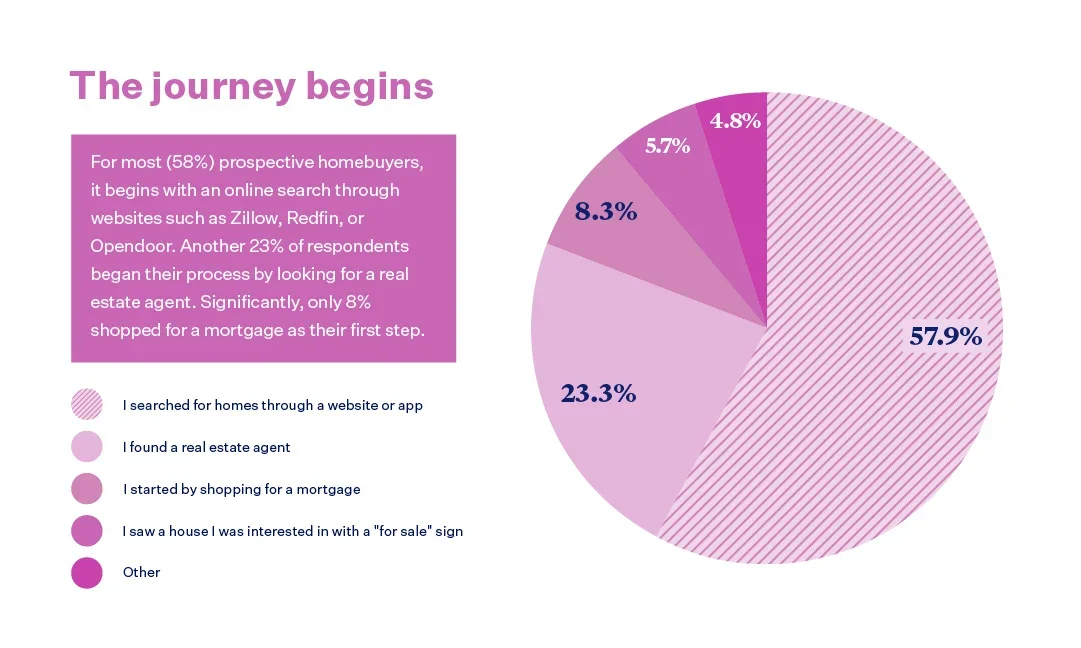

Most potential homebuyers start online

For most (58%) prospective homebuyers, the journey begins with an online search on websites such as Zillow, Redfin, or OpenDoor. Another 23% of respondents began their process by looking for a real estate agent who can help them look for homes. Significantly, only 8% shopped for a mortgage as their first step in the homeownership process.

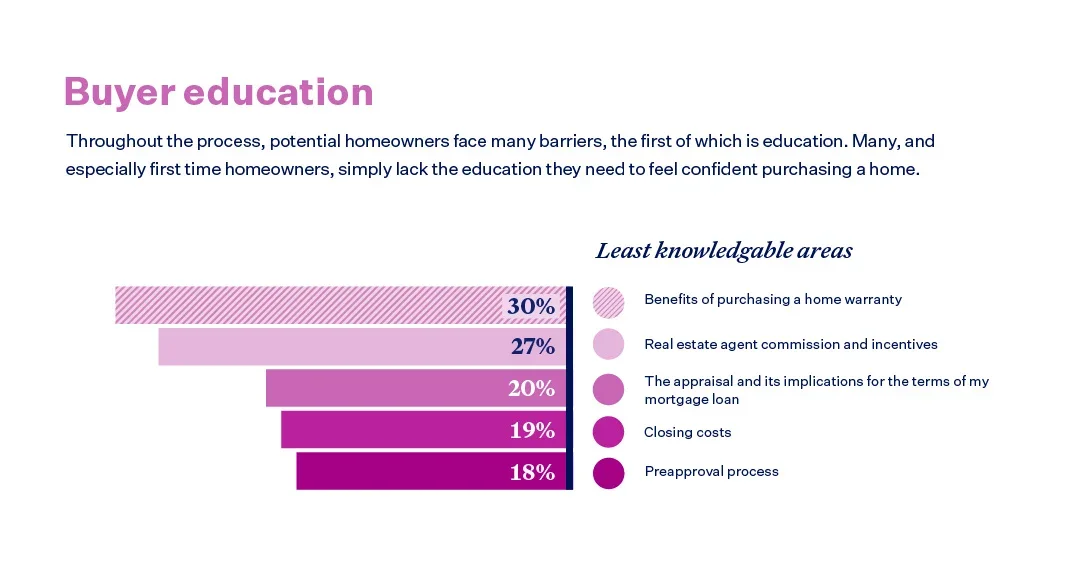

Many consumers lack vital education on the homeownership process

The survey results were particularly clear on one issue: throughout the process, potential homeowners’ lack of education is a consistent barrier. Many, and especially first time homebuyers, simply lack the education they need to feel confident purchasing a home.

Homeowners were least knowledgeable about home warranties and the real estate agent’s commission and incentives, but they also showed a concerning lack of knowledge around the appraisal (and its implications) and closing costs.

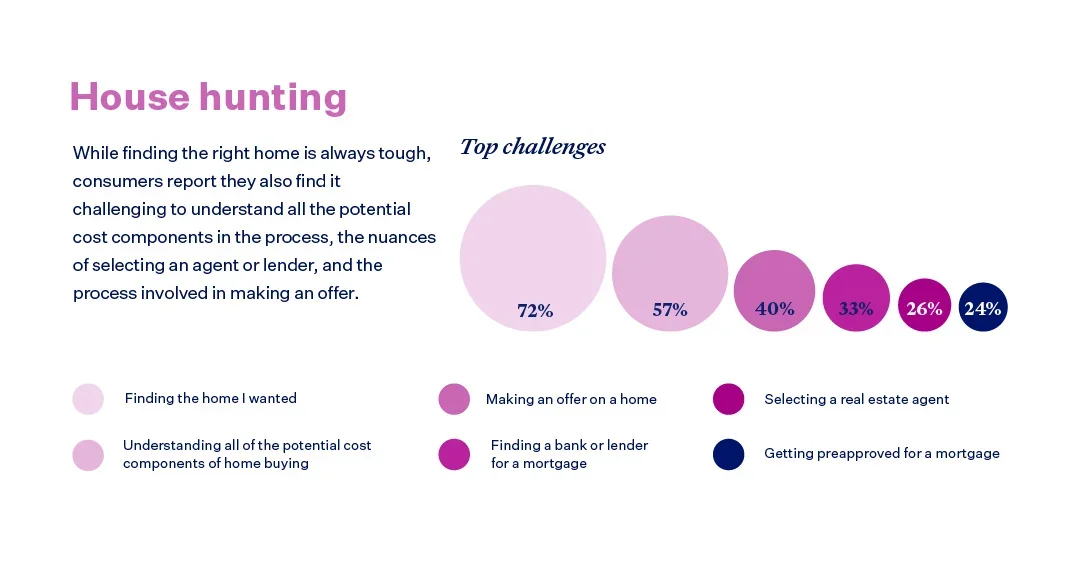

Potential homebuyers struggle to find their dream home

When asked specifically about the house hunting phase of the homeownership journey, consumers reported that finding the home they wanted was the biggest challenge. They also found it challenging to understand all the potential cost components in the process, the nuances of selecting an agent or lender, and the intricacies of making an offer.

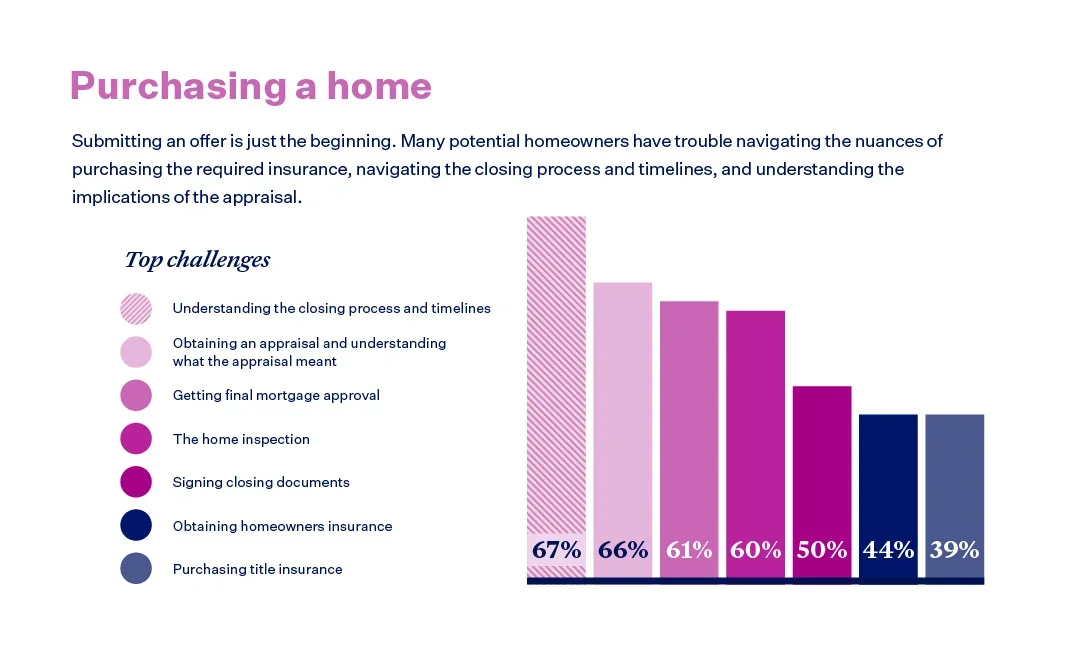

As the purchase process winds down, confusion continues

Once the potential buyer finds a house, the real journey begins. Many potential homeowners have trouble navigating the nuances of purchasing the required insurance, understanding timelines, and other aspects of the closing process.

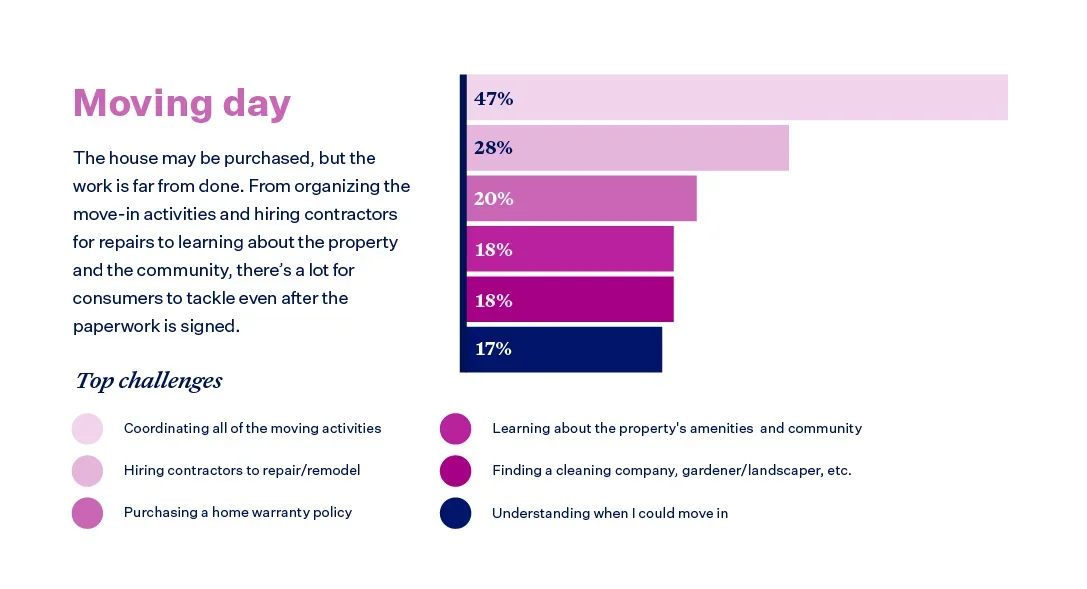

Coordinating post-purchase activities was just as vexing for consumers

Once closing is complete, a new phase begins. Historically, this has been where lenders disappear from the process. However, while the house may have been purchased, the work is far from done. From organizing the move-in activities and hiring contractors for repairs, to learning about the property and the community, there’s a lot for consumers to tackle.

Reframing the homeownership journey

The results noted above highlight potential homeowners’ key knowledge gaps and the demand for an advisor to provide guidance throughout the process.

Because consumers lack in-depth knowledge about the often confusing homeownership process, they often find it challenging to figure out what services they need and how much they should pay. These gaps make an already difficult process even more stressful for consumers.

Understanding these pain points can be a helpful guide for lenders aiming to provide a customer experience that will keep them top of mind when the next big purchase comes along. Providing education for consumers on the various aspects of the process could reduce their stress while improving their experience. There is an opportunity to increase customer satisfaction and create operational efficiency by creating a lending experience that more tightly integrates all the activities related to homeownership while remaining centered around the consumer.

Consumers are looking for trusted guidance

When asked whether they would be interested in a homebuying experience centered around them and provided by the lender, consumers expressed significant interest. They indicated the highest interest in a one-stop shop for all of the services involved in homeownership, but they also showed interest in getting cash offers for their current homes, assistance moving, education surrounding the entire process of purchasing a home, and information on how to manage that home as an asset.

Ready to learn more about the reframed homeownership journey?

Methodology

The survey was conducted in Q1 of 2021. Aite Group surveyed 2,010 U.S. consumers who purchased a home within the past five years and financed this purchase with a mortgage loan. Additional insights were gained through interviews of 21 U.S. mortgage lending professionals. This research was sponsored by Blend.

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.