May 23, 2023 in Composable origination

What experts are saying about platform technology and why it’s a must-have for banks

Hitting the right notes with composable tech.

If you ever want to be minorly freaked out, do a quick search for videos of suspension bridges. We think of them as solid structures, but they’re actually quite flexible. They can sway and move. It’s a little unsettling to see in action, but having that flexibility is exactly what helps them be adaptable and resilient in changing conditions.

The same is true with banks. The more flexible — and adaptable — they are, the more resilient they become. Flexibility allows banks to pivot in changing markets, to mitigate risk and take advantage of new opportunities.

Change has always been a constant in the banking industry. And as of late, the conditions in the industry have been shifting quite a lot. Rising interest rates, increased customer acquisition costs, and more competition from neobanks are highlighting the need for more resilient institutions.

With these topics being top-of-mind for many in the industry (including us), we sat down with guest speaker Jost Hoppermann, Principal Analyst at Forrester, to better understand what banks can do to help safeguard their future success.

In our illuminating talk — Building Agility Through Platform Architecture — Hoppermann shared insights he’s learned through research and conversations with industry leaders. If you’re curious to learn more, you can see the talk in its entirety below.

Readdressing resilience

According to Hoppermann, the two primary things banks and other financial institutions need to pay attention to in order to achieve resilience are:

Technology – Traditionally, banking software has primarily served as a system of record. Though legacy systems excel in those areas, they aren’t particularly malleable. Investing in tools — like banking platforms — that are easily upgradable, with interchangeable parts, helps banks stay agile in changing conditions.

Business models – With competition for new customers higher than ever and margins shrinking, solely relying on traditional revenue streams isn’t enough to safeguard future success. Hoppermann suggests banks will need to expand into things like invisible banking — which require more modern technologies to work — in order to maintain healthy businesses.

Investing time and resources into these different areas allows banks to bend without breaking, making them more resilient and able to change with evolving market, and customer, expectations.

What defines a banking platform?

In our chat, Hoppermann surfaced a few key features banking platforms should have in order to provide the most value to banks. First, Hoppermann notes they need to integrate with legacy software.

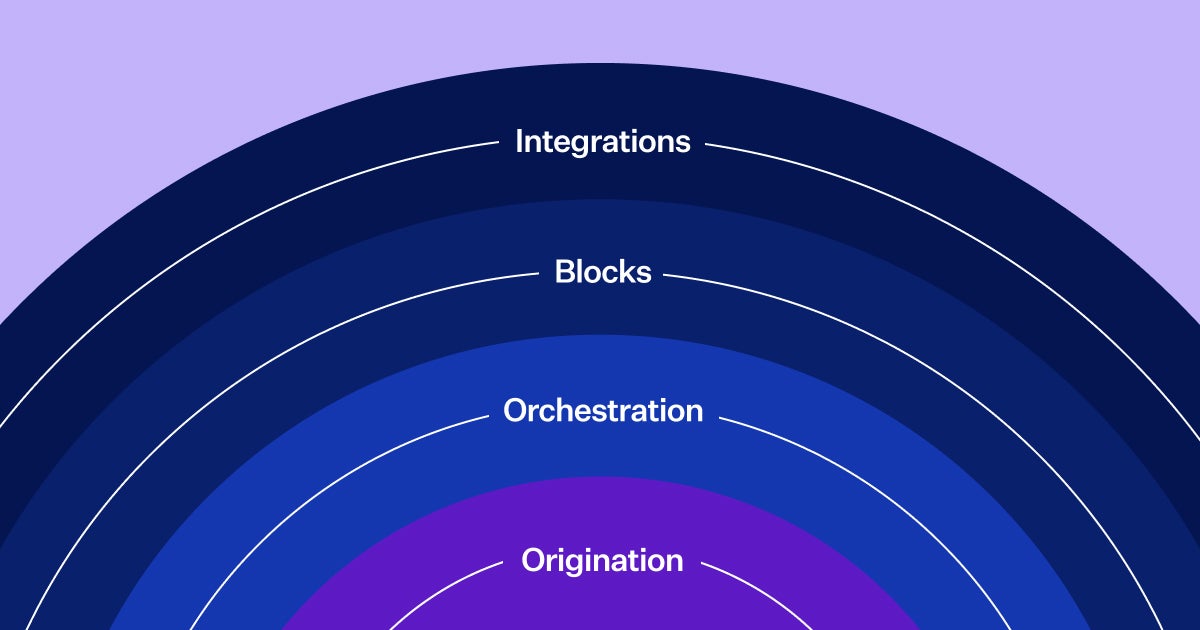

Second, he notes that platforms should be modular in design, meaning the platform should be a collection of applications. Further, he notes these applications need to be “cohesive and decoupled.” Essentially, they should have the ability to interconnect but not be totally dependent on one another.

Last, they must have the ability to send and receive information. Having those capabilities allows banks to create a better customer experience by reducing the amount of effort required for a customer to sign up for another product.

Challenges to adoption

Even with the clear benefits of banking platforms, there are a few challenges that are slowing adoption. The most common challenges are technical, financial, and cultural. On the technical front, legacy systems don’t always integrate well with newer banking platforms. Because of this, integration can be resource intensive.

Being a resource-intensive process also means that there’s a decent upfront cost to adopting a banking platform. As margins in banking decrease, so do budgets, making it a tougher sell to executives who are trying to conserve cash.

Along with the financial and technical challenges, there are also cultural challenges that some institutions face. Handling people’s and businesses’ money is a big responsibility. Because of that, banks have traditionally been slow to adopt new technologies as they represent some amount of risk.

Even though the risks are valid, in order to keep up with customers’ wants and needs, it’s important for banks and other financial institutions to be open to adopting new technologies. Without the investment, it’s possible current and potential customers will look for alternative options.

Embracing new technologies

Being able to keep pace with customer and market expectations is key for continued success. Through the flexibility and agility offered by modern banking platforms — like Blend’s Builder Platform — banks and credit unions are able to continue to meet customer needs and keep pace in a changing market. Better positioning them to be able to serve customers for many years to come.

Ready to learn why now is the time to invest in composable tech?

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.