October 21, 2021 in Platform and services

A step toward the future of mortgage income verification

We’re reducing friction in the mortgage application process with an instant verification solution.

It’s no secret that verifying income of mortgage applicants is tedious. For financial services firms, it’s time-consuming, error-prone, and a contributor to delays in the loan cycle. For consumers, it’s an interruption, requiring tracking down documents and manually inputting information. Back-and-forth between financial services firms and consumers is common during this process as they work to rectify discrepancies. And before closing, the lender may need to re-verify income, requiring the consumer to search for and supply updated documentation.

Existing digital verification solutions address some of these issues but often only cover a narrow set of consumers and income types. Financial services firms are still stuck with a significant amount of legwork, involving identifying and vetting data service providers, cobbling together a cohesive solution, and managing a process that isn’t integrated into the application flow.

We recently announced Blend Income Verification to help mortgage lenders deliver a streamlined consumer experience and increase loan team efficiency with instant verification. To explore the power of this new solution, let’s examine how it helps address some common challenges within the mortgage processing workflow.

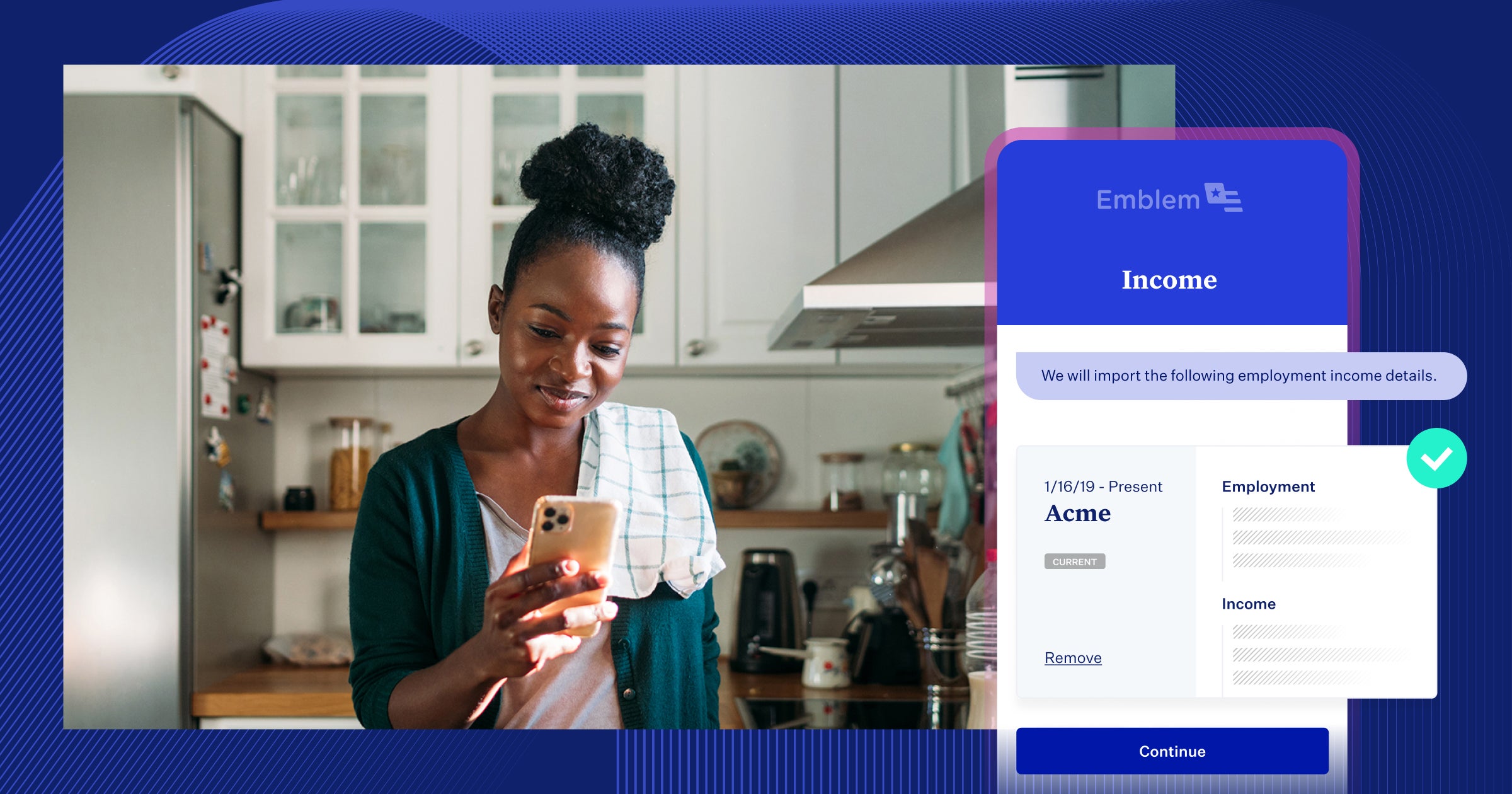

A streamlined experience for consumers

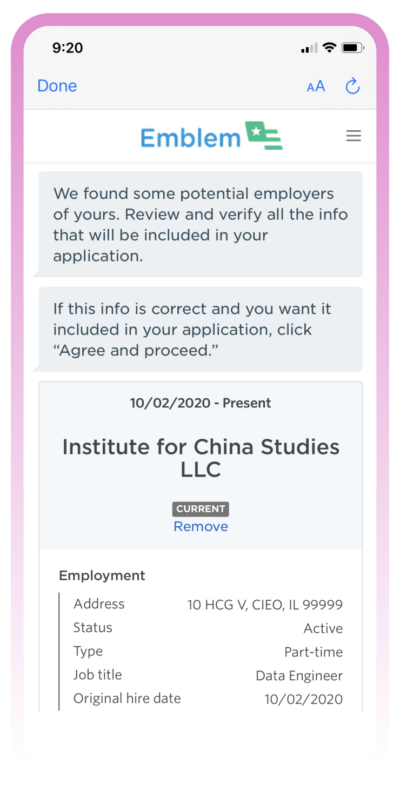

Blend Income Verification leverages leading income data providers and verification strategies to help financial services firms deliver instant verification during the application process.

Instead of manually entering information, consumers can simply validate the accuracy of income data pre-filled in the application. Because it’s built into the mortgage application flow, it’s available while consumers are engaged. When it comes time for closing, consumers shouldn’t have to track down their latest income information. Instead, financial services firms may be able to simply re-verify the data within Blend.

Roadblocks and interruptions are replaced with a simple workflow for consumers, helping ensure a seamless experience throughout the mortgage application.

A powerful solution for financial services firms

Blend Income Verification doesn’t just streamline the consumer experience, it also enables financial services firms to take a proactive approach to income verification.

Verification occurs at a critical point in the loan lifecycle — instantly. With validated information, lenders are able to make informed decisions, including qualifying borrowers and structuring loans, earlier in the process. This helps avoid downstream delays.

Validated income data is available for processing and underwriting earlier, minimizing touchpoints and potentially helping financial services firms close loans faster. Blend is an authorized report supplier for both Fannie Mae’s Desktop Underwriter® (DU®) validation service and Freddie Mac’s asset and income modeler (AIM), helping lenders more easily take advantage of these programs.

Additionally, we’ve designed Blend Income Verification to increase the number of consumers for whom income can be digitally verified, so financial services firms can fund more loans with confidence.

A smooth step in a seamless end-to-end mortgage

An improved verification process is just one of many benefits financial services firms can experience when adopting the Blend Mortgage Suite. We dedicate our resources to identifying and improving upon the most frustrating parts of the mortgage process. With robust tools for loan teams, automation to power operational efficiency, and a seamless, self-serve digital experience for consumers, we are transforming the homeownership journey from application to close.

What’s up next

We’re always working to iterate on our solutions to provide best-in-class technology to financial services firms and their customers. We are working to make Blend Income Verification available for our Consumer Banking Suite in a few months so lenders can increase productivity and delight customers across products.

We’re also hard at work on adding asset-derived income verification, which would allow financial services firms to verify income using asset statements that include a consumer’s existing information at their financial services firm. We believe this will help lenders continue to increase coverage at a lower cost for themselves, as well as provide an even simpler process for consumers. Asset-derived income is integral to the future of income verification — and we’re excited to make it available to customers in the months ahead.

Learn more about Blend Income Verification

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.