March 14, 2023 in Composable origination

Announcing: Composable origination

See how the Blend Builder Platform accelerates innovation in this recap of Blend’s special announcement.

On March 14, 2023, Blend held a special event to demo the Blend Builder Platform and discuss composable origination, including a fireside chat with Ken Meyer, chief information and experience officer at Truist.

Read on for a recap of this announcement or click play to watch it for yourself

As you know, Blend’s roots can be traced back to the mortgage sector, where our focus has been on streamlining and simplifying the mortgage lending process for all parties involved. Over the last ten years, Blend has empowered our many partners to better serve their customers while increasing their own efficiency.

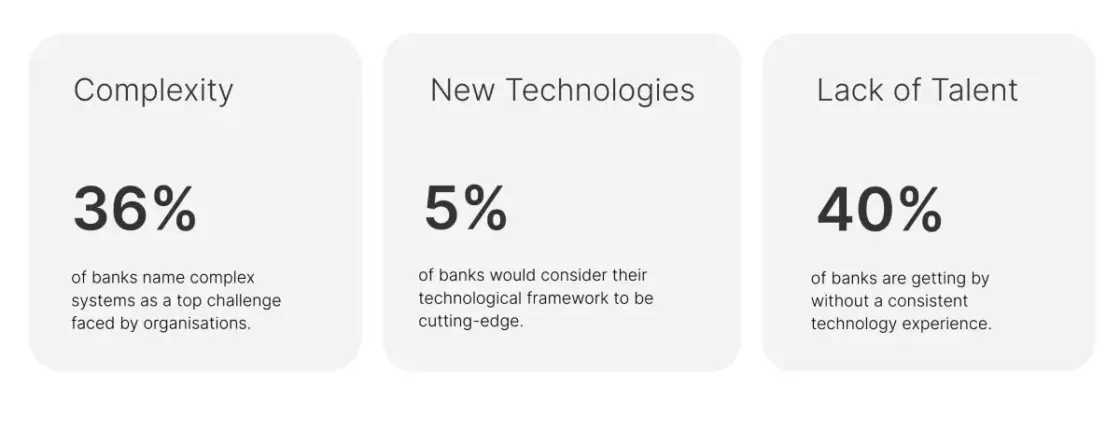

However, we recognized that there was still much more we could do for our partners. Financial services providers are looking for ways to reduce origination costs, stay competitive, and manage resource challenges within their technology and business lines.

Sources: Accenture, “Back Office, It’s Time to Meet the Customers”, FB Digital Banking Report, Sopra, Forrester & IPSOS DBX Report.

After a decade of working with some of the largest financial service providers in the world, we identified a common constraint: the complexity of existing technology infrastructure. Many FIs are hamstrung by their legacy systems and inflexible banking technologies. Technical debt and disconnected systems are holding them back.

And we’ve spent the last three years working to solve for this. We’ve evolved and adapted to the market and the shifting needs of our industry to continue to provide our partners with the capabilities they need to succeed today and for years to come. And this new solution is finally here. We’re calling it composable origination.

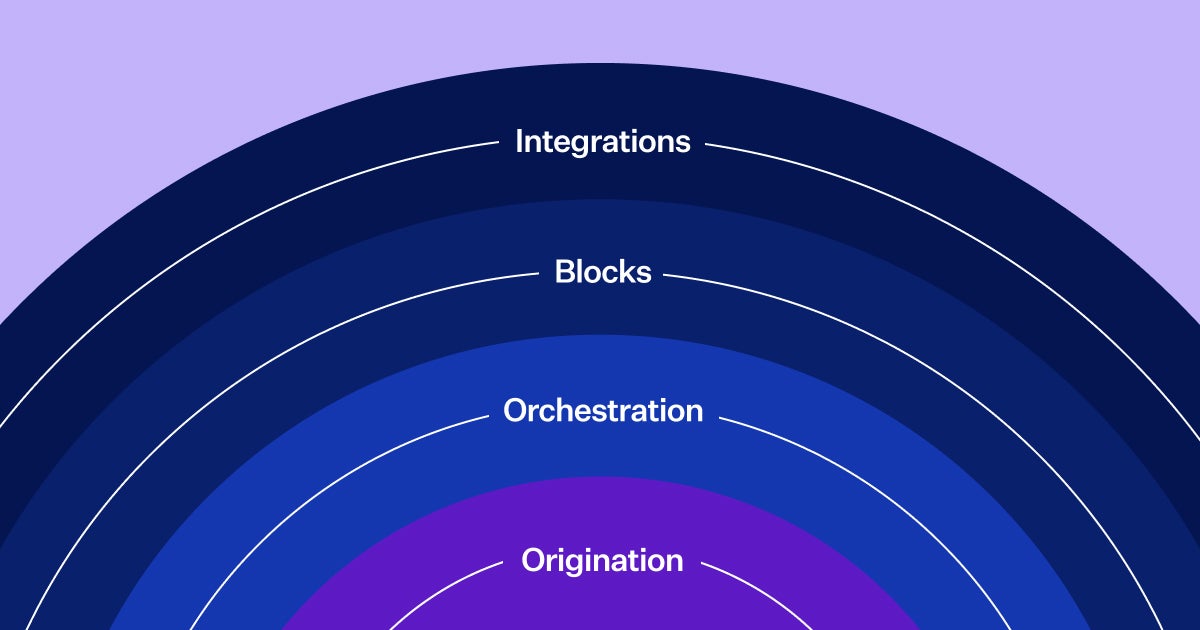

Composable origination powers the creation of new financial products through a modular and customizable approach with speed and flexibility. And Blend’s partners can take full advantage of composable origination through the Blend Builder Platform.

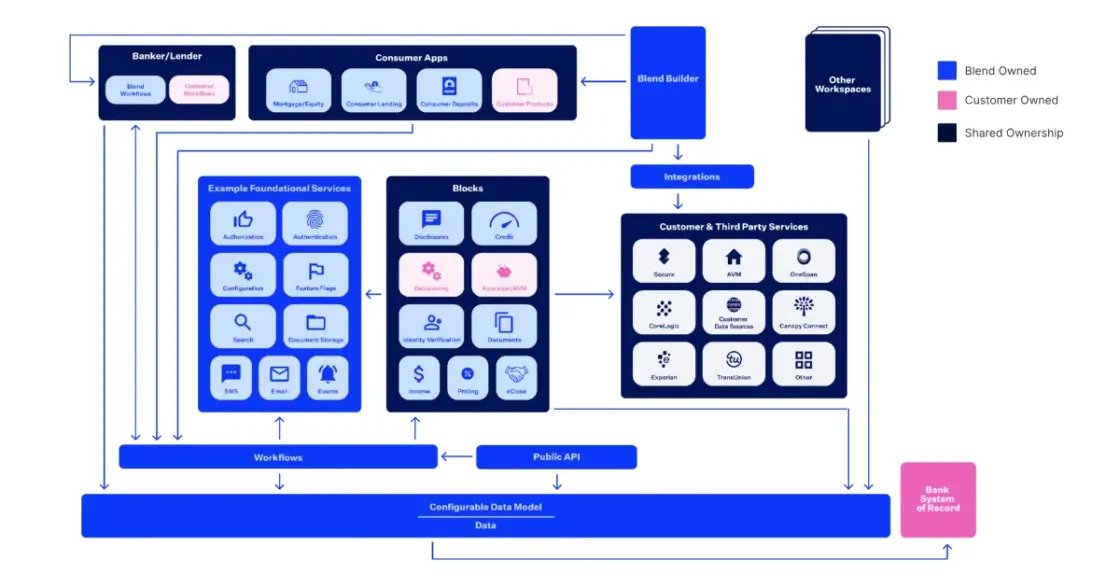

The Builder Platform provides pre-built integrations with all of the major technology stacks used in the financial services industry, including core banking systems, loan origination systems, customer relationship management (CRM), and online banking platforms.

A key part of composable origination is the ability to compose modular components. On the Blend Platform, we call these Blocks. They cover the entire end-to-end origination journey, including decisioning, pricing, income verification, and closing, as well as an orchestration layer that allows for the creation of custom workflows in a low-code, drag-and-drop environment.

In other words, the Blend Builder Platform enables users to build their own origination products, leveraging rich integrations, modular blocks, and easy-to-use orchestration to overcome the limitations of inflexible infrastructure.

In addition to this composable approach, Blend offers out-of-the-box solutions including Instant Home Equity, Deposit Accounts, Personal Loans, and Credit Cards. These products are ready-to-use and purpose-built with product and workflow templates, as well as integration templates that allow for quick deployment.

The Blend Builder Platform accelerates innovation, differentiates products, and reduces costs. For consumers, this means highly personalized, simple experiences delivered proactively.

Technical teams using the Blend Builder Platform can eliminate legacy system constraints and now deploy solutions in days or weeks instead of months or years. And with composable origination, leaders can supplement dev teams with easy-to-configure components across product lines and channels, all of which reduces costs and complexities, enabling rapid experimentation and delivery.

Business leaders seeking to grow market share, deepen relationships, and provide unique experiences can also greatly benefit. Composable origination provides the agility and speed necessary to execute on product strategies quickly. Plus, the solution provides valuable data and insights to inform future decision-making.

These many capabilities are game changers for our industry. This is just the beginning. And we’re thrilled to include you on this journey.

Watch the livestream event to see the Blend Builder Platform in action. Here’s to the future of banking.

See the Blend Builder Platform in action.

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.