We believe in stronger financial futures.

We believe in improved financial access.

We believe in better lending, for all.

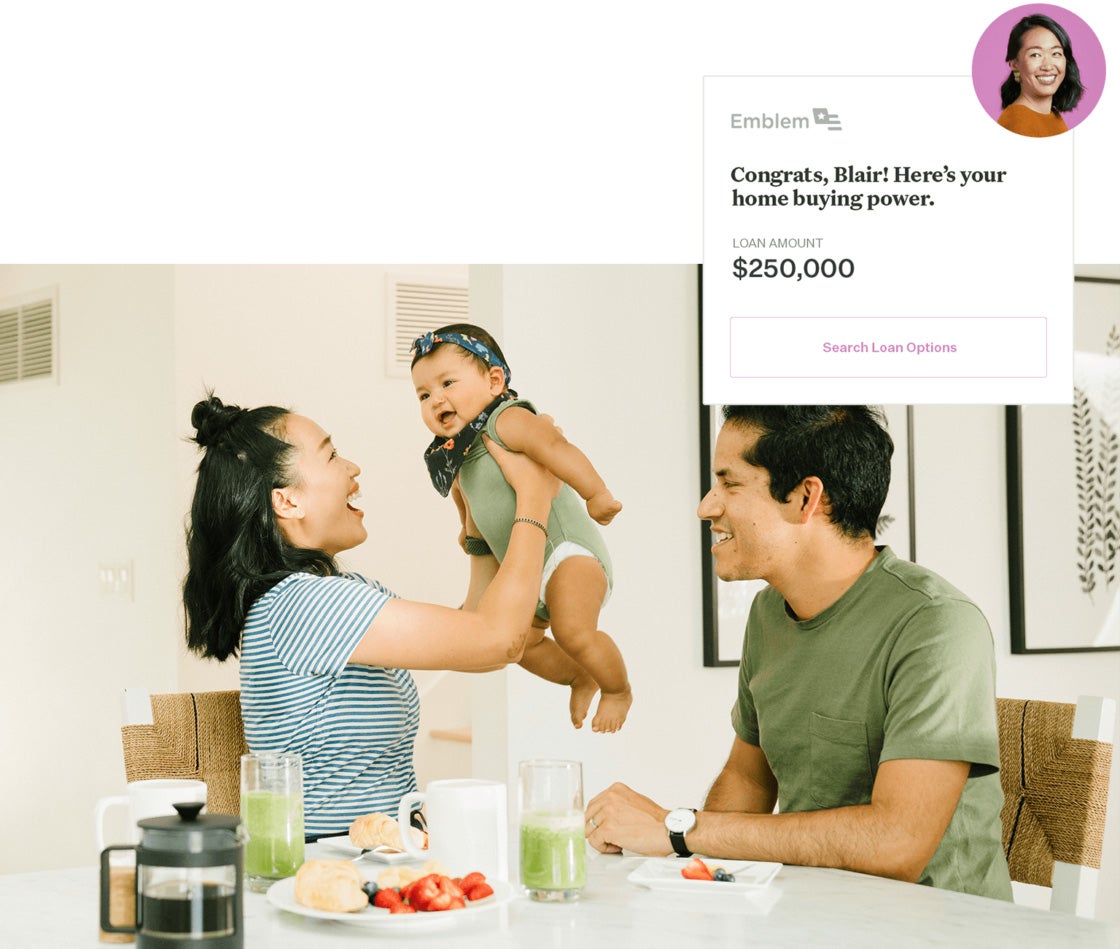

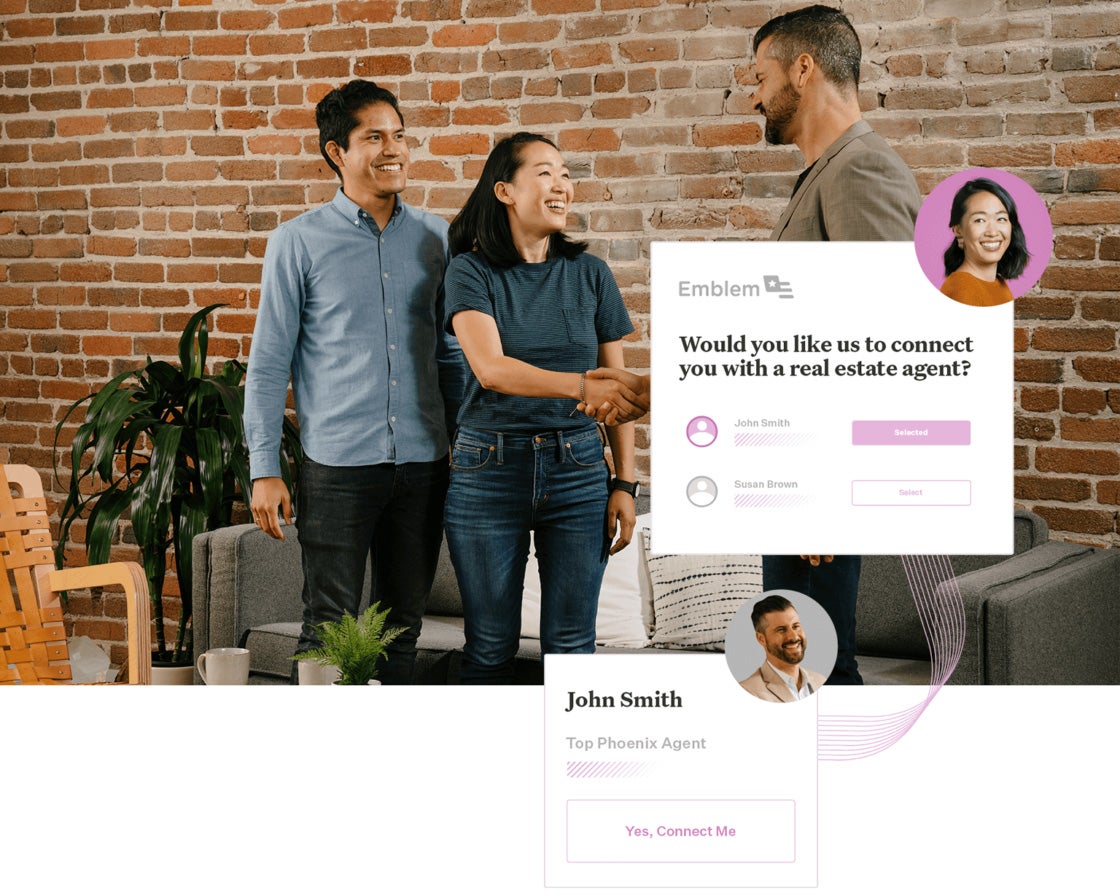

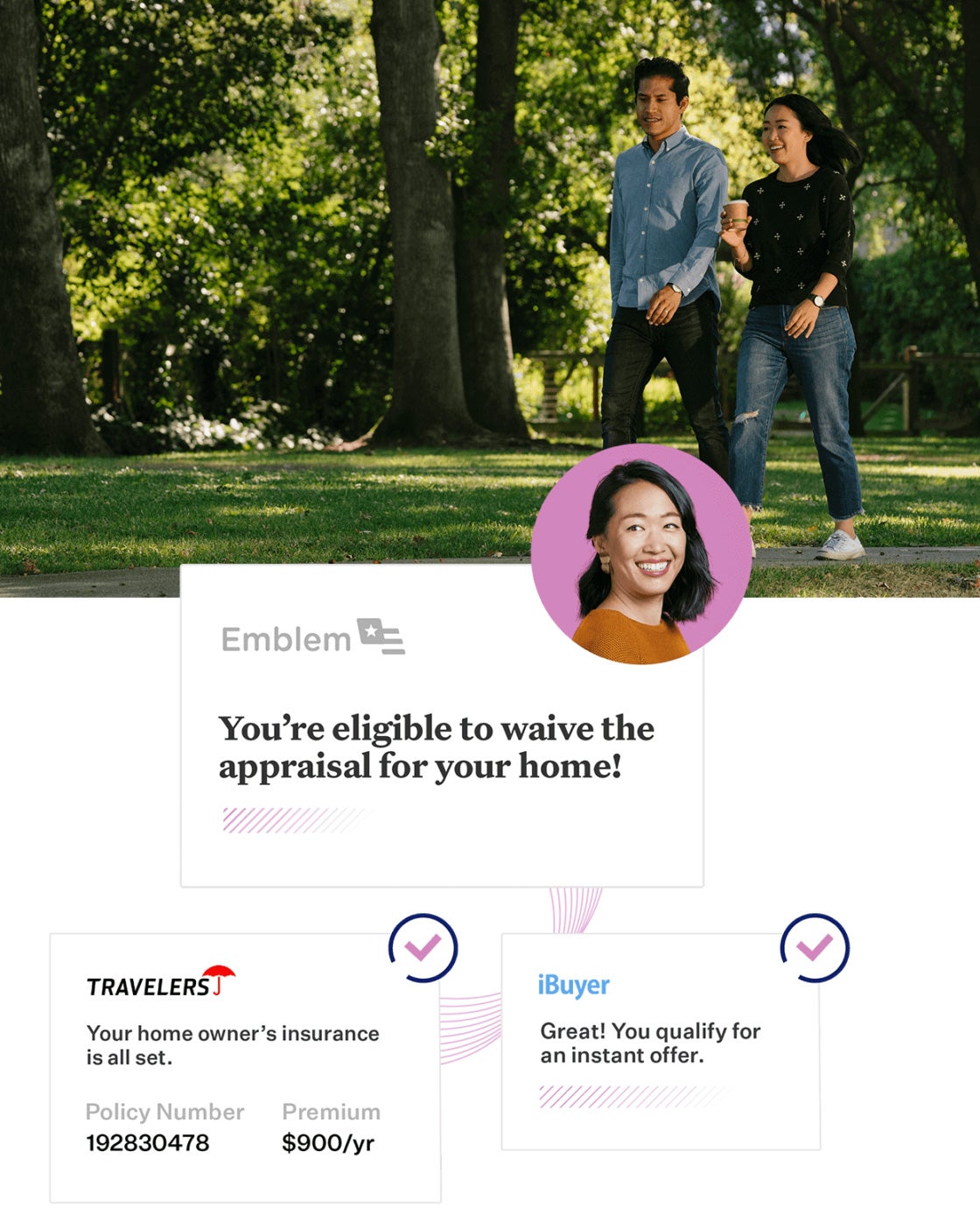

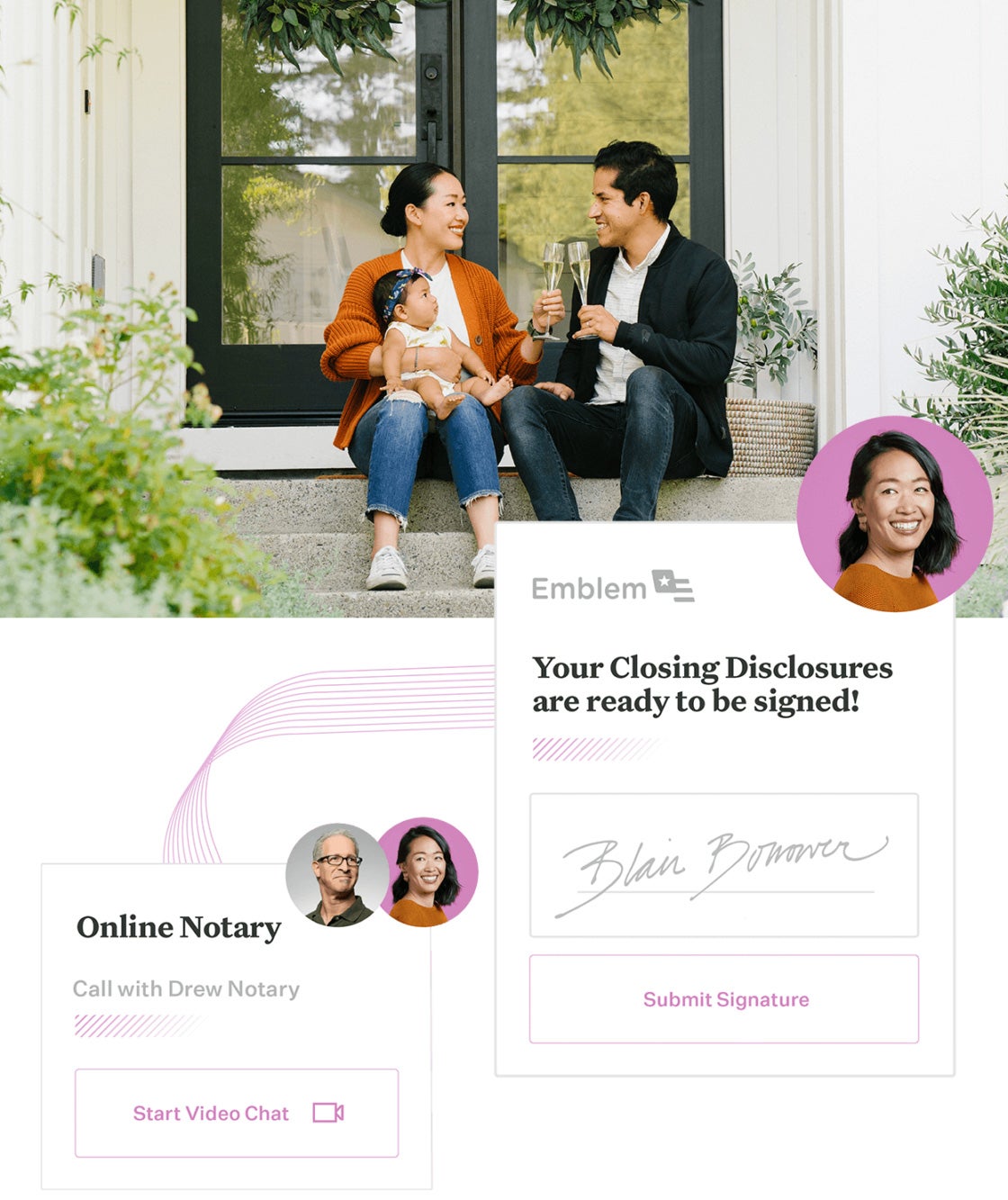

Every major life event provides an opportunity for lenders to reinforce connections and foster smart financial decisions.

Lenders are much more than providers of capital. They are the stewards of better financial lives for millions.

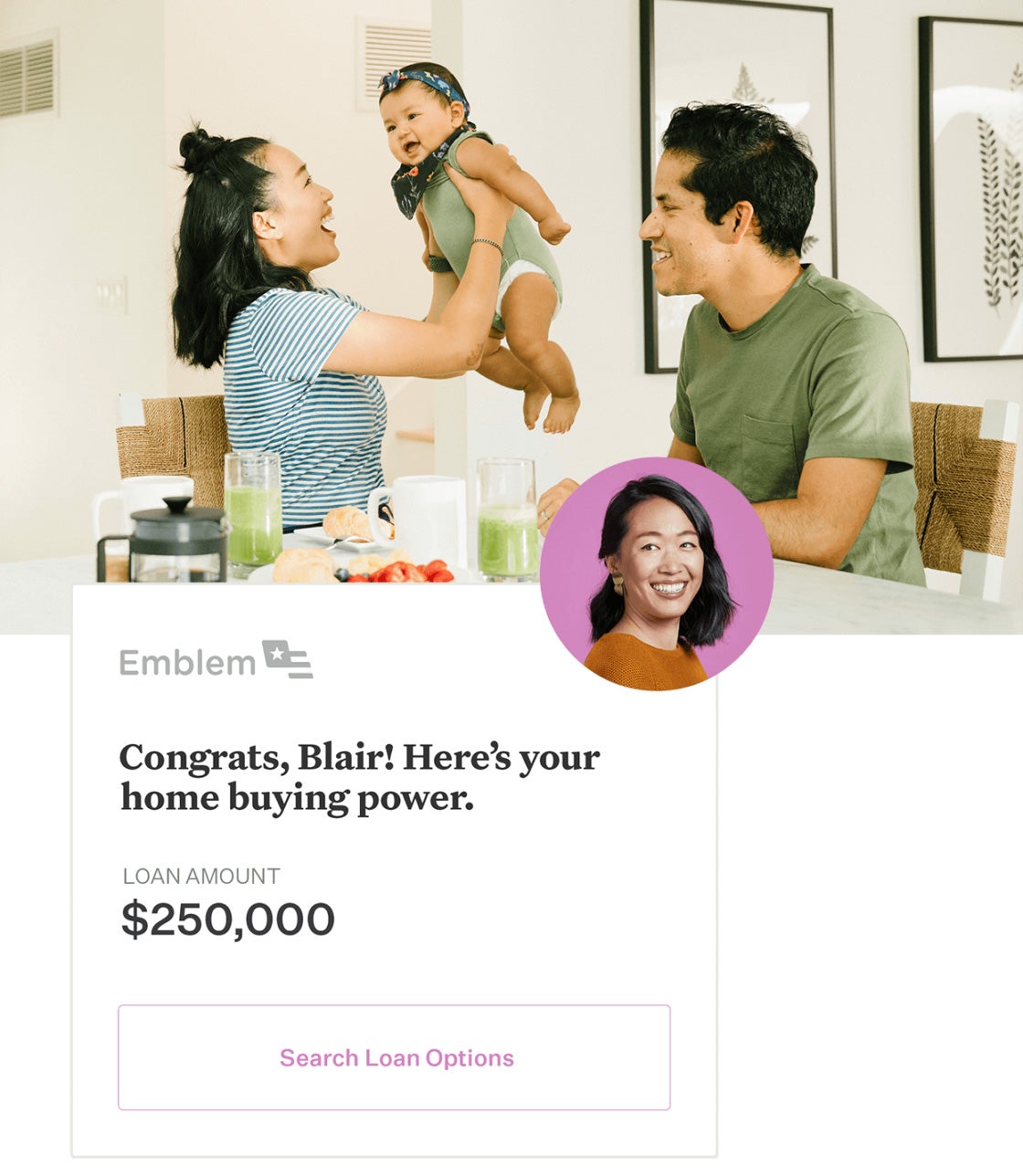

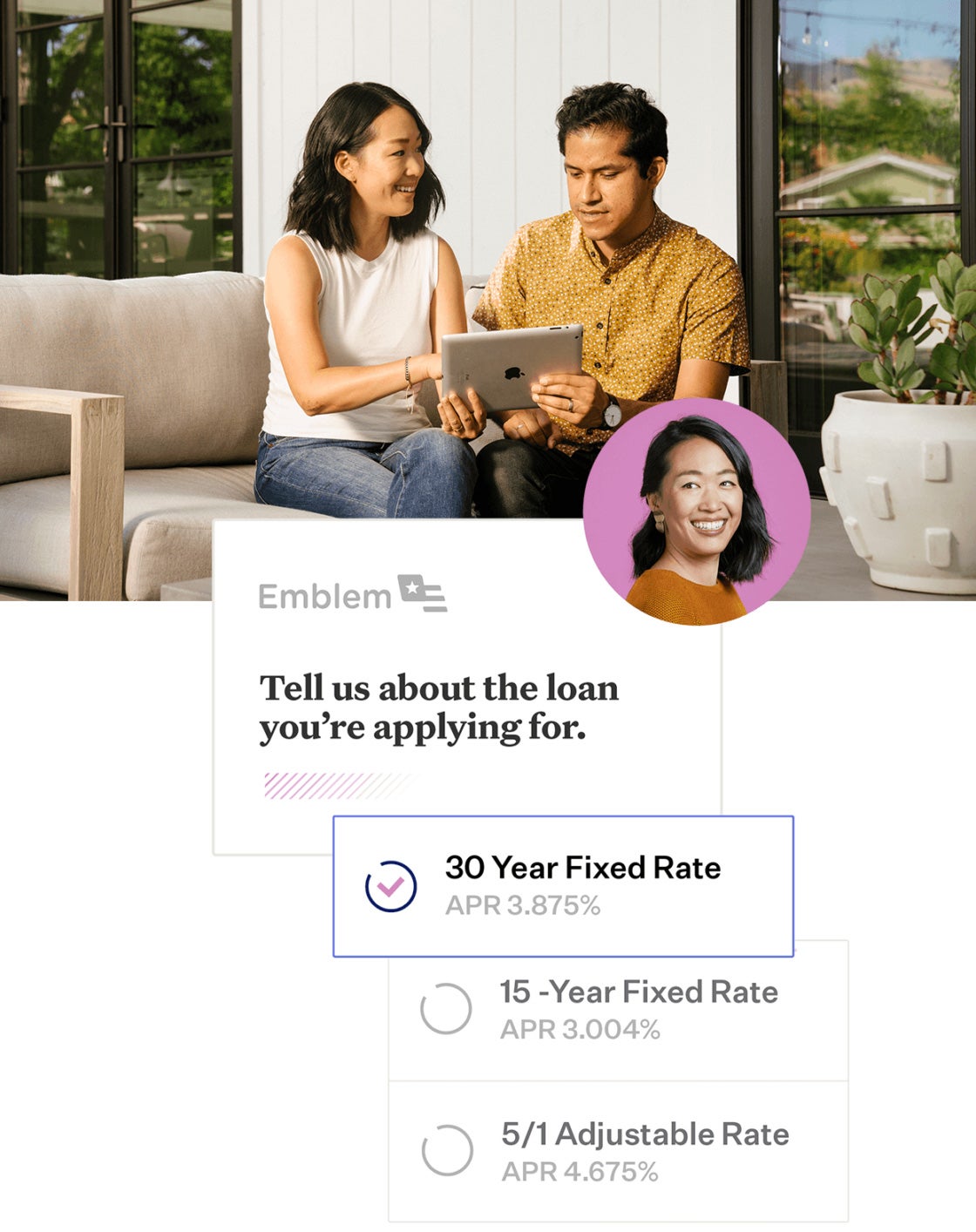

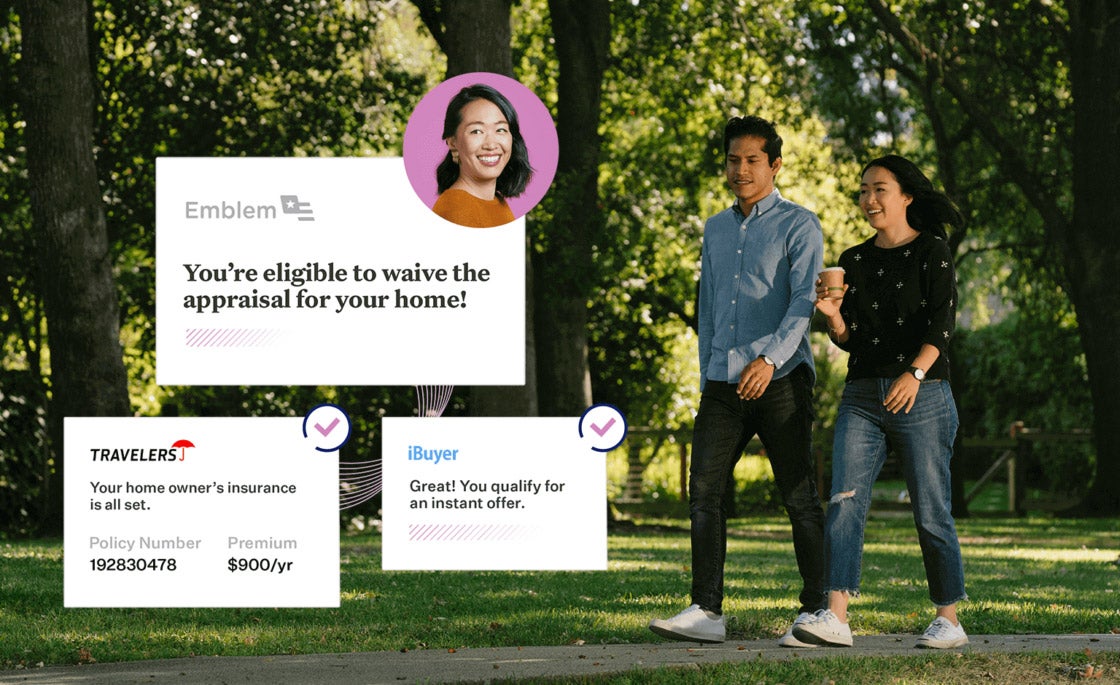

Technology should enable exceptional experiences everywhere.

Technology should free time for human connection.

Technology should feel effortless for everyone.

We envision a future where Blend powers one-tap access to the world’s financial resources.

We are lenders technologists.

We are disruptors partners.

We can do this alone can't do it without you.

We are spearheading a transformation from reactive banking to proactive guidance in service of the consumer.