March 30, 2021 in Mortgage Suite

Announcing the LO Toolkit: Make Blend the new home for LOs

Increased productivity and higher-quality interactivity are just the start of the benefits your teams can expect.

In a purchase market with increasing rates, lenders are facing intense competitive pressure to capture borrowers while driving productivity and operational efficiency. Loan officers face a number of challenges as they work to close loans quickly while working with disparate tools and systems. You can’t control the market that your LOs work in, but you can arm them with a unified toolset to help them thrive.

Blend’s newly released LO Toolkit supports loan officers on all key workflows across the mortgage loan process in one workspace. The Toolkit’s feature set enables LOs to optimize their efficiency so they have more time to act as trusted advisors. Help your LOs close more loans with shorter turn times while decreasing origination costs.

Managing a complex environment

Your loan officers balance prospecting, qualifying new loan applications, and following up with borrowers, among other tasks. They bounce back and forth between a number of different systems for each loan they originate. They coordinate with a number of stakeholders, including borrowers and processors, at dozens of touchpoints across the loan cycle.

Let’s get 2021 right, together

Subscribe for industry trends, product updates, and much more.

Many LOs are skilled multitaskers, but the role is complex, and each LO has a slightly different way of doing business. Maintaining flexibility in LO workflows is important to each LO’s productivity — as long as you’re ensuring uniformity in upfront loan data quality. Upfront loan quality dictates workload downstream, so establishing high-quality files as the standard can speed up processing.

Adding to this pressure is the prevalence of remote work, which makes it even harder to address issues that impact efficiency and file quality.

As lenders adjust to a competitive purchase market, the need for a unified toolset that drives a better borrower experience and helps LOs increase productivity has become more glaring than ever.

LO Toolkit in action

Maximizing loan officer efficiency and automating processes across the loan lifecycle can help you stay one step ahead of competitors.

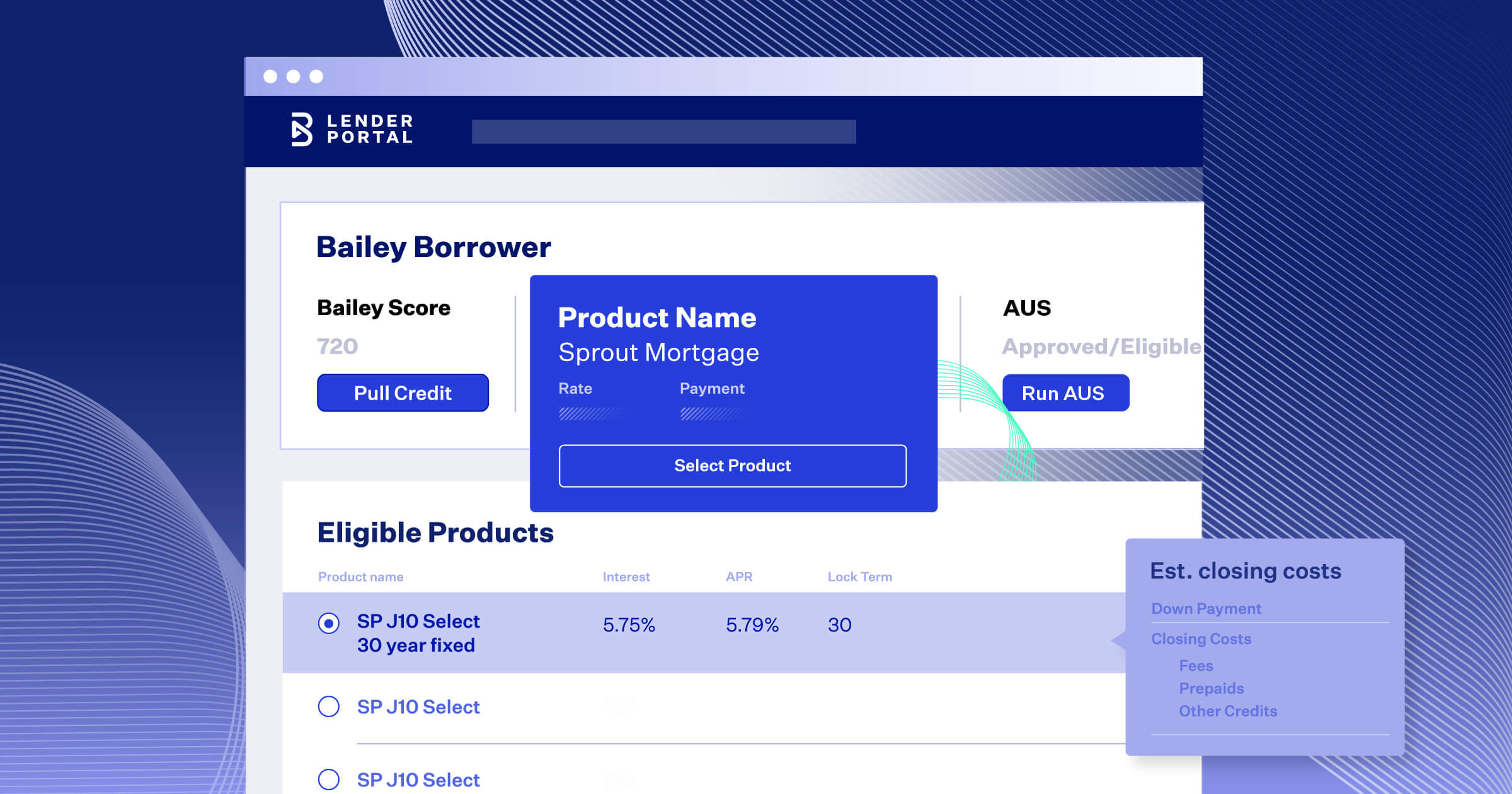

Blend’s LO Toolkit facilitates flexible workflow configurations across the entire loan process. Within Blend, LOs can:

- Start applications

- Pull credit

- Structure loans, including, product, pricing, and fees management

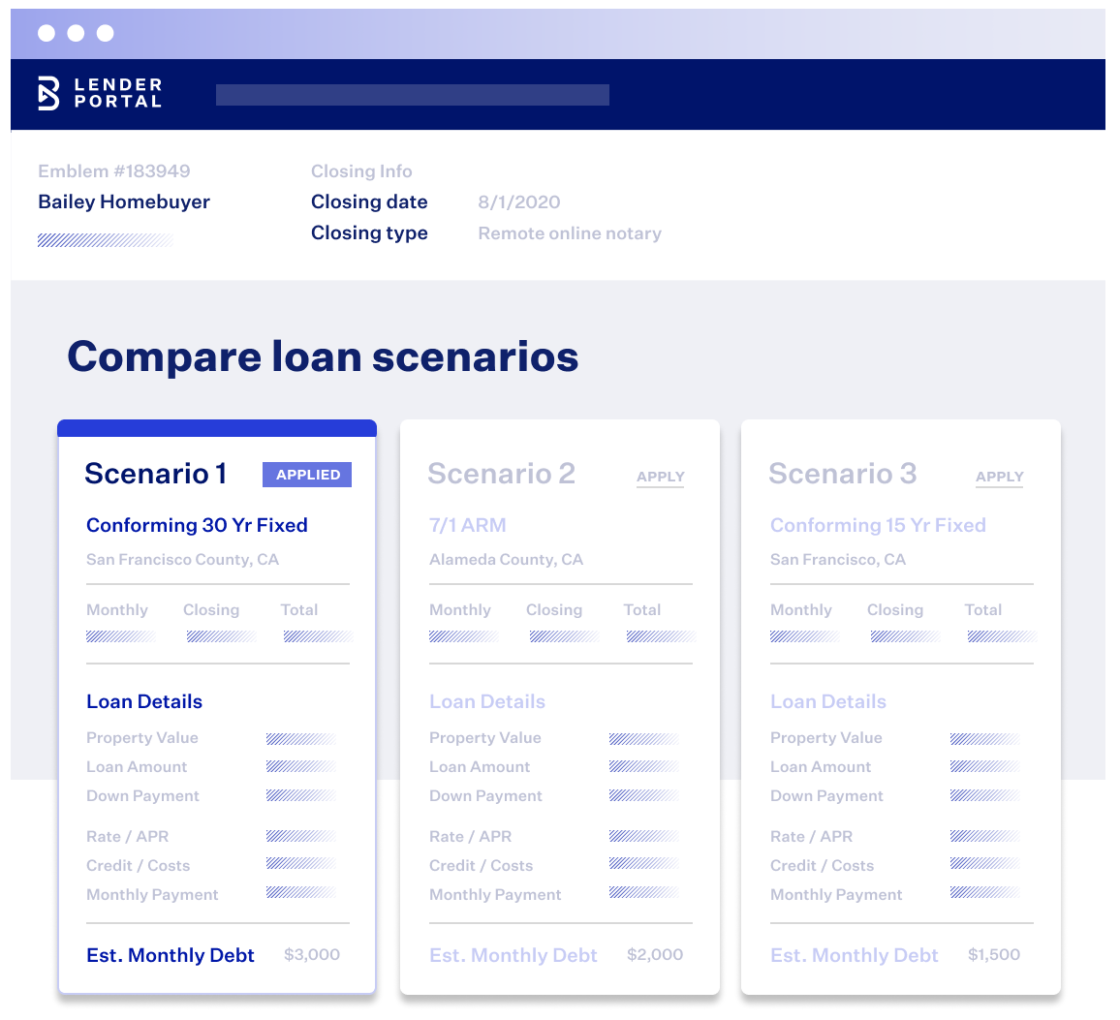

- Create loan scenarios

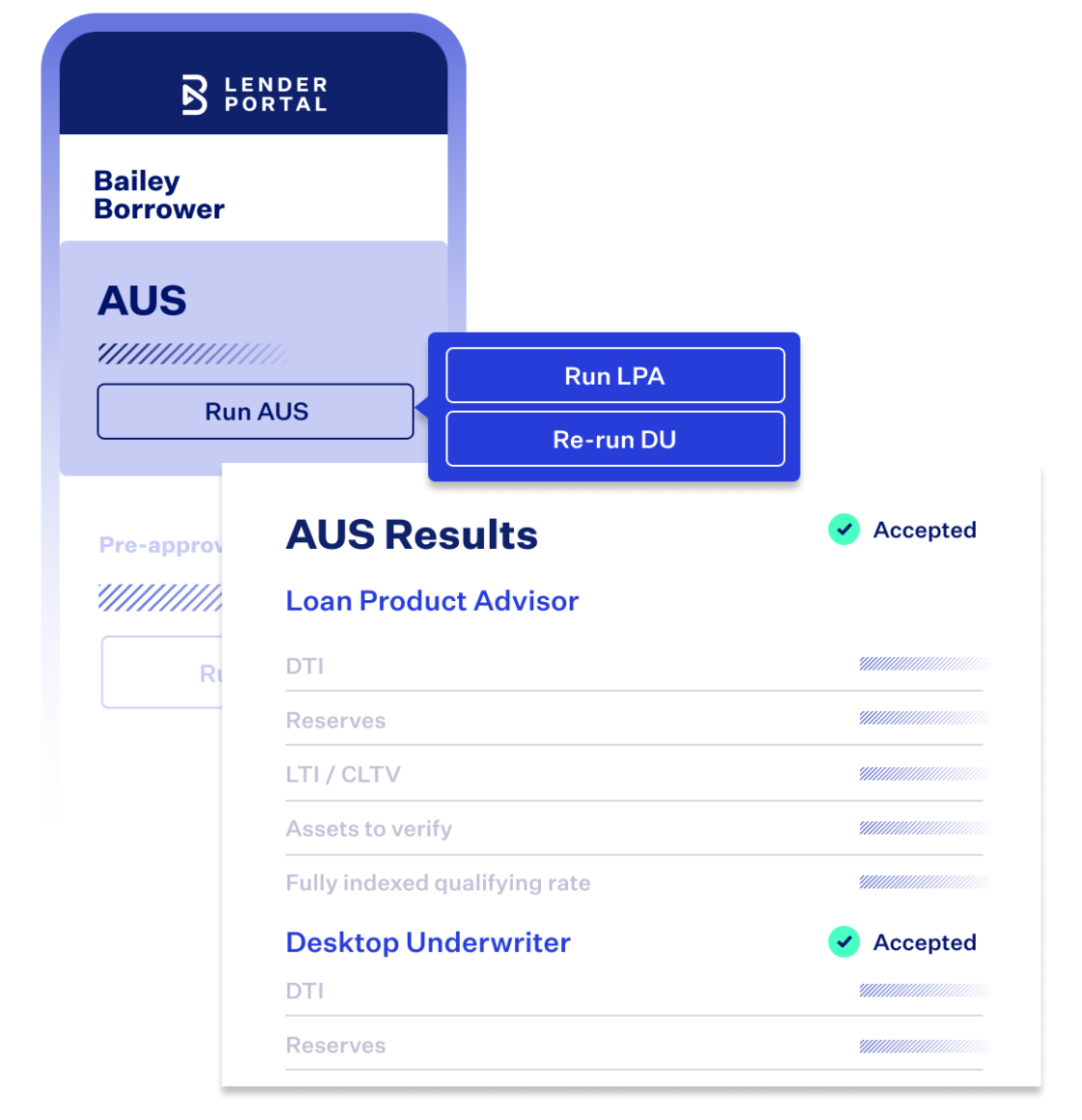

- Perform dual AUS runs

- Grant pre-approvals

- Lock rates

We designed the workflows to mirror how LOs and borrowers interact, providing an intuitive experience.

This more streamlined workflow enables loan teams to close more loans faster while reducing origination costs. Loan Officers can close up to 67% more loans with Blend. Let’s examine how Blend’s LO Toolkit makes this possible.

LO Toolkit helps you optimize lending operations …

Standardizing upfront data quality across your team leads to fewer issues during the underwriting process.

This uniformity also helps establish consistency throughout the loan lifecycle — accurately estimate workloads and better align with current market conditions so you can worry less about making changes to operations or headcount.

With a standard operating procedure in place, you can be confident that your LOs can be productive from anywhere, including their homes.

… automate processes …

Loan officers spend hours handling countless tasks for each loan. Some add value for your customers, and some are time-inefficient and repetitive.

Loan officers are already saving up to two hours per loan with Blend’s Digital Lending Platform, and the LO Toolkit aims to further increase these efficiencies. Leverage our automation capabilities to help shorten loan cycles while reducing error rates and processing costs.

But you won’t just save hours due to automation — according to a recent study conducted by MarketWise Advisors on behalf of Blend, those Blend Mortgage customers that participated are reducing their overall loan cycles by an average of 7.3 days.

… and enable LOs to be trusted advisors

Thanks to reductions in manual tasks, you can free your loan officers from acting as data clerks, captive to the LOS. They can spend more time prospecting and engaging with potential customers.

They also have more of an opportunity to do what they do best: provide expert advice, guiding borrowers through the process of getting a loan from application to close. Having all the tools they need in one cohesive experience enables them to quickly and accurately determine qualification, facilitate rate and loan scenario comparisons, and match borrowers with loan products that suit their needs.

Future-proof your origination stack

These benefits don’t just help you in today’s economic environment. Blend scales with you, offering the flexibility you need.

Easily integrate new technologies and change workflows to align with changing customer expectations, new lending practices, and regulatory changes, so you can rise to any challenge.

Ready to see LO Toolkit in action?

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.