March 15, 2021 in Mortgage Suite

Streamlining closing with an integrated title workflow

Blend is creating a better experience for both consumers and loan teams that require a complete digital transformation of the title process.

At Blend, we strive to make the process of getting a home as easy as making any other purchase online. To achieve this, it’s essential to streamline both the mortgage process and the broader homebuying journey, which includes homeowners insurance, realty services, settlement, and any other services where there is an opportunity for technology to radically improve the process. By helping lenders offer a fully integrated experience, we enable them to exceed consumer expectations and better compete in an increasingly competitive business.

As a step toward this goal, in 2020, we launched Blend Close to provide a more seamless and efficient closing process for consumers, loans teams, and settlement agents. More than 70 lenders have signed on to offer their customers a digitally-enabled closing experience through Blend, and we’ve onboarded over 500 settlement provider partners to enable secure document exchange and coordination on closing.

The opportunity in title

Building on Blend Close, our next focus is the title and settlement process. Due to the localized nature of property records and the tight regulatory requirements that differ from state to state, there has been less digitization in the title and settlement space compared to other parts of the mortgage origination process.

Both loan teams and title agencies typically email the Closing Disclosure back and forth to manage changes. Processors need to manually enter data from the title commitment in the LOS, which is time-consuming, prone to human error, and can lead to delays in the loan cycle.

Also, because title is ordered only after the borrower has signed their initial disclosures, any information uncovered in the title search may require the loan team to restructure the loan and re-issue initial disclosures, further slowing speed to close.

We see a tremendous opportunity to streamline and digitize the process of ordering and curing title, automate the reconciliation of fees and closing costs, and provide a platform for collaboration between settlement agents, loan officers, notaries, and consumers.

A truly better experience for both consumers and loan teams requires a complete digital transformation of the title process from the initial title search through post-closing.

Accelerate loan cycle time with an instant title commitment

Integrating title and settlement components into the consumer’s mortgage experience unlocks the ability to automate title ordering and trigger an instant title commitment earlier in the loan cycle.

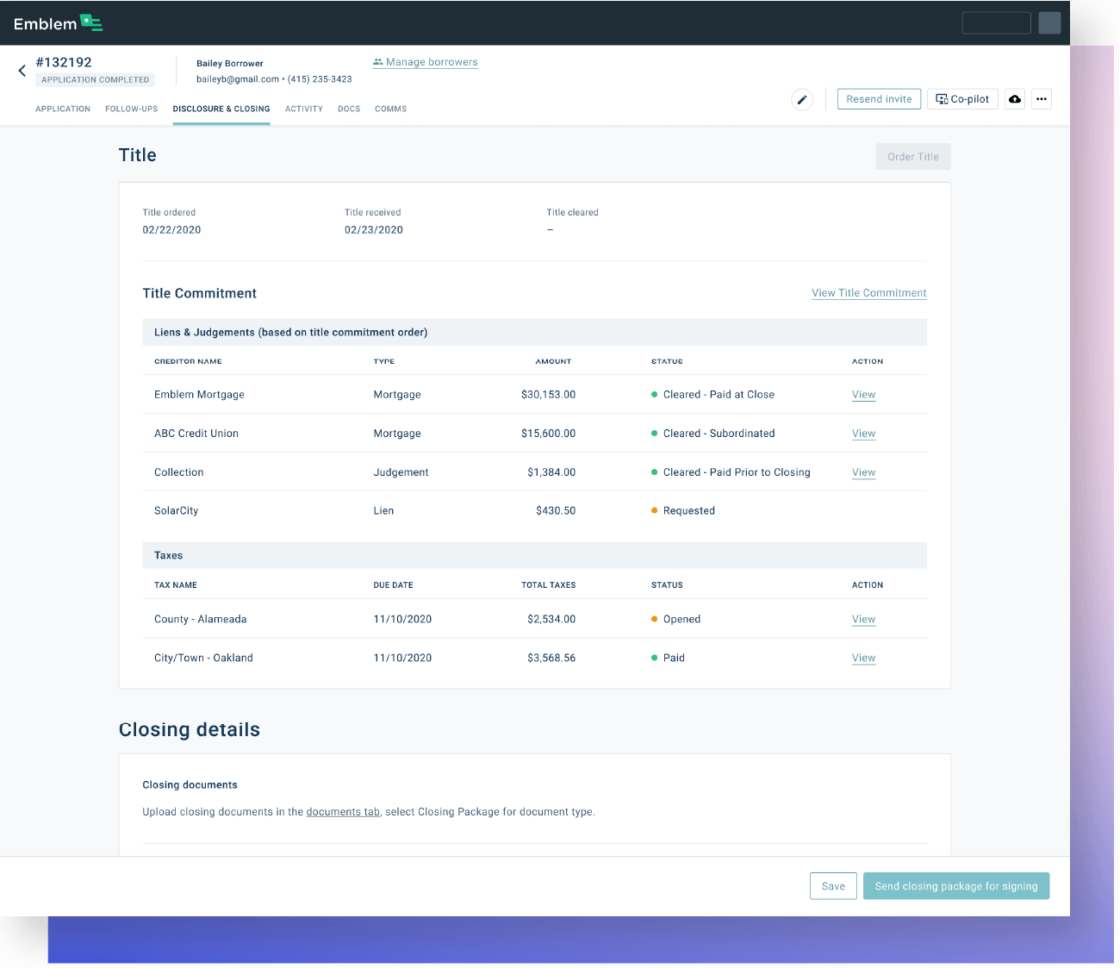

Shortly after a borrower has submitted a refinance application in Blend, a title commitment can be generated and loan teams can view the associated structured data in the Blend Workspace for Loan Teams.

Having title search information available immediately — such as unpaid taxes and open liens — rather than waiting for a traditional title order to be completed reduces unforeseen complexity and can increase a team’s ability to close more loans by helping prioritize their work.

And with the title search complete, title teams can now start working on clearing the title earlier in the process, further accelerating loan cycle timelines.

A more efficient closing for all stakeholders, powered by the Blend platform

We’re building new capabilities to connect title and settlement providers to lenders and consumers through the Blend platform. Loan teams will be able to order title and collaborate with their title agency directly in Blend.

Loan teams can easily collaborate with their title partner via the Settlement Agent Workspace, a dedicated portal to share documents and information to deliver a seamless closing to consumers.

Benefits include:

- Better service and a more secure experience for consumers: Guide consumers through the closing and escrow process and provide educational information. Reduce the risk of wire fraud by sending wire instructions via Blend.

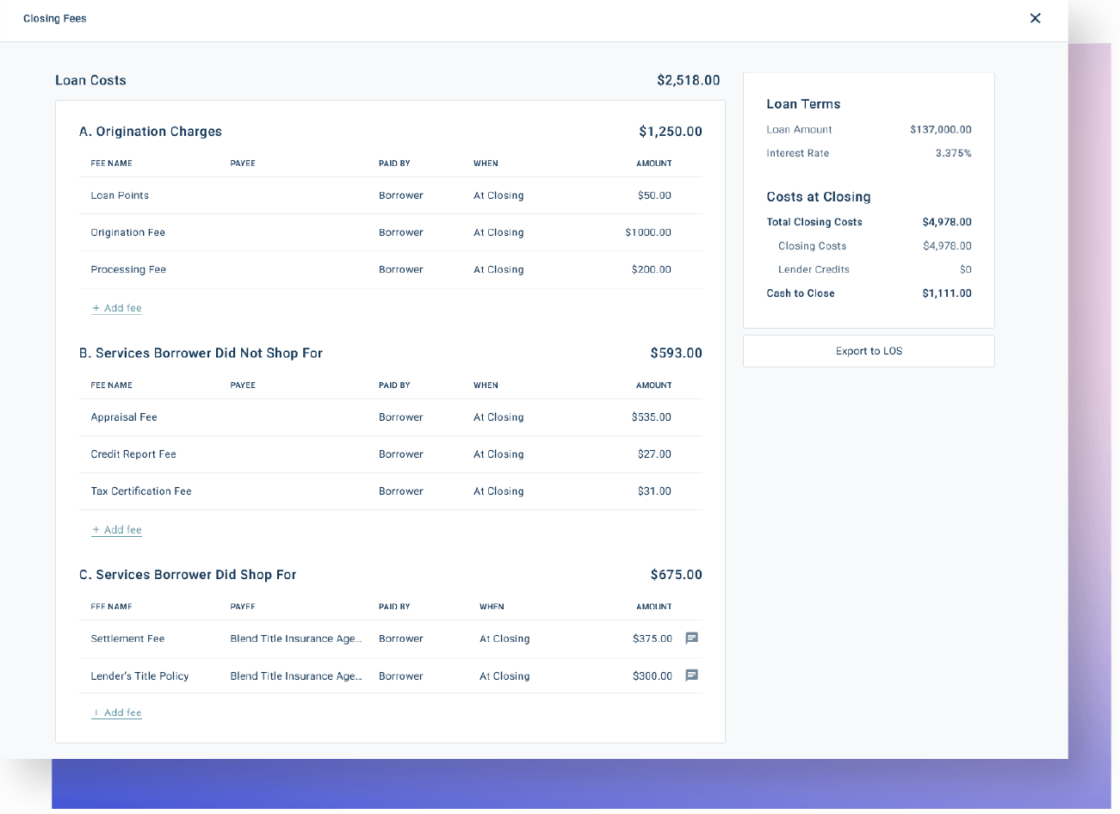

- Easier collaboration between closers and agents on closing fees: Automatically sync fees from your LOS, view a digitized Closing Disclosure in Blend, and review and approve fee update proposals from title agencies.

- Streamlined communication with title partners: Blend keeps all teams on the same page as conditions are cleared, documents get drawn, and the closing date arrives.

Receive a structured title commitment and track the status of title curative work.

Streamline collaboration on closing fees

Unlock flexibility for lenders and consumers with a title marketplace

To unlock more options for lenders and ultimately offer consumers the ability to choose the title provider they work with, we’ve built a title marketplace that makes it easy for a title agency to provide services for lenders using Blend. We’ll be officially launching the marketplace later this year.

Making end-to-end digital mortgages a reality

At Blend, we are committed to developing comprehensive end-to-end digital experiences for mortgages and consumer loans that delight lenders and consumers alike.

We couldn’t be more excited to work with our customers and the broader ecosystem to offer consumers a complete homebuying and home financing journey.

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.