November 22, 2022 in Mortgage Suite

Mortgage Power Up: Compete with confidence in the current market and beyond

Take an in-depth look at Blend’s latest mortgage features, from home affordability snapshots to automated SMS.

Blend

At Blend, we are always working to develop and build new features and experiences to help our customers move the needle in any market. Leveraging market insights and consumer behaviors, we continue to invest in our mortgage suite to ensure our customers can compete with confidence in the current mortgage market — and beyond.

Take an in-depth look at Blend’s latest innovations in mortgage. From giving borrowers an immediate snapshot of how much home they can afford without impacting their credit to automated SMS for lenders to send follow-ups, pre-approvals, and close notifications with ease and efficiency. All of this we showcased in Blend’s Mortgage Power Up session, which you can watch here on-demand. And read below for more details on Blend’s latest mortgage features and experiences.

Didn’t make it to the Mortgage Power Up?

Self-Serve Affordability snapshot for borrowers

In today’s market, lenders are continually challenged to identify and engage qualified borrowers quickly and efficiently, while borrowers struggle to compete for their dream homes. Both lenders and borrowers can benefit from fast, lightweight onboarding experiences to qualify and convert leads into applications. One solution that Blend is piloting for Q4 2022 is a new feature for Blend Mortgage called Self-Serve Affordability.

Self-Serve Affordability (SSA) lets borrowers discover how much buying power they possess with a minimal amount of self-started inputs and a no-harm soft credit pull.

For lenders, this SSA flow provides a pathway to engage and nurture more leads at the top of the funnel with less demand from LOs — a priority and valued efficiency in today’s low-volume mortgage market.

“Did you know — Blend customers see greater than 95% opt-in to SMS messasging.”

Blend Mortgage is here to make your life easier, help you close more loans faster, and work smarter not harder. Our teams continue to build and iterate on Blend products to not only help lenders compete in our shifting market but also provide borrowers with streamlined digital experiences that accelerate their homebuying journey. This self-driven, pre-qualification SSA flow continues that mission — helping lenders quickly identify qualified borrowers and giving borrowers an accurate home affordability snapshot.

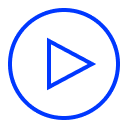

SMS notifications that ensure and centralize compliance reports

The process of nurturing new borrower leads and application completions is fraught with friction. It’s stressful for borrowers to manually and independently work to move things along, not to mention the low pull-through rates and longer loan cycle times. The current process is completely asynchronous and time-consuming.

Lenders rely primarily on emails and phone calls to request borrower documents, which have to be manually archived and tracked by the loan team. Did the borrower receive the email? Open the email? Respond to the email? The manual follow-up work for the loan team is extremely demanding.

Plus, borrowers often consider multiple lenders and offers, which can make the application process stressful and cumbersome. And it’s very common for lenders to see significant dropoffs in the application process because borrowers disengage, overwhelmed or disillusioned by the cumbersome process.

Enabling SMS messaging and notifications can help drive borrower engagement and yield completed applications, but this can be costly and time-consuming for lenders. Plus, there are compliance requirements as well as user consent and privacy policies to implement and track, which come with their own set of deployment and management costs that can increase over time.

That’s why Blend is bringing an SMS notification service to Blend Mortgage — to help lenders increase pull-through rates and decrease loan life cycle times. Furthermore, Blend SMS is a fully integrated and compliant (TCPA and CTIA) one-way SMS notification service that helps lenders automate follow-ups, disclosures, pre-approvals, and close notifications directly through Blend throughout the application process. It’s simple, and it works.

Looking to enable Blend SMS?

Compete with confidence in the current mortgage market — and beyond

At Blend, we are continually investing in new technologies, constantly iterating with new features, and ceaselessly innovating with experiences to meet the evolving needs of our customers and today’s consumers.

The Mortgage Power Up innovation demo is just one showcase of the many new and forthcoming additions to Blend Mortgage. And there’s more to share. If you’d like to connect one-on-one with a product specialist and learn more about how Blend Mortgage can deliver the sticky customer experiences that drive revenue and increase efficiency, please sign up for a personalized demo today.

Power up your mortgage experience with Blend.

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.

Future Branches Survey

Discover how Banks and Credit Unions are innovating to drive deposit and loan growth.

Start learning about Future Branches Survey

What’s Next for Digital Origination? How AI is Fueling Real ROI

Learn how Blend is leading innovation around future use of AI for banks and lenders in this exclusive interview featured on American Banker.

Watch video about What’s Next for Digital Origination? How AI is Fueling Real ROI

Where digital meets human: How Glia and Blend are redefining borrower support

Borrowers expect real-time, personalized support. Glia CEO Dan Michaeli explains how the Blend integration helps lenders boost conversion and satisfaction.

Read the article about Where digital meets human: How Glia and Blend are redefining borrower support