October 4, 2022 in Mortgage Suite

Welcome to eClose technologies 101

Simple, efficient, and flexible: Explore the eClose process and benefits.

Borrower expectations are rising. Capturing consumer attention now demands not only competitive pricing but also convenience, responsiveness, expertise, communication, and speed.

Delivering an eClose solution is a clear path to meeting today’s tech-savvy borrowers where they are, whenever they are, with speed and ease. The process with Blend Close is simple, efficient, and flexible. Close more loans and lower costs with technology that both lenders and borrowers can understand.

The learning doesn’t stop here.

Subscribe for industry trends, product updates, and much more.

In fact, a 2015 study by the Consumer Financial Protection Bureau found that most borrowers using an eClosing solution came away with a better understanding of the mortgage process as a whole. Moreover, those consumers felt that eClosings allowed them to play a far more active role in the transaction — a major benefit for lenders as well. After all, it’s this level of knowledge, participation, and ultimately delight that cultivates lifelong relationships with borrowers and adds value to the customer lifecycle.

An eClose solution like Blend Close allows the lender to electronically package closing documents for borrowers to review and sign at their convenience. Document transfers between the LOS and the settlement agency greatly minimizes the time spent manually signing, and also ensures fewer mistakes.

Benefits of eClose for lenders

- An eClose loan has a shorter life cycle, from origination to delivery in the secondary market, saving time and money.

- There are no costs associated with shipping or storing paper documents.

- Loans are funded faster with the delivery of an eNote, allowing lenders to further optimize capital.

Let’s take a look at the two types of eClosing: Hybrid and RON

Hybrid closings

- The borrower can go online to review all documents and eSign closing documents that do not require notarization, including an eNote if selected.

- An eClose solution can be integrated with a document generation provider.

- Documents that require notarization will be ink-signed in a signing ceremony with a notary.

- While eNotes are not required for hybrid closings, they do yield the convenience and cost-savings of other eSign documents.

- eNotes are normally transferred to investors via MERS registration.

- An eVault is required for generating and storing eNotes.

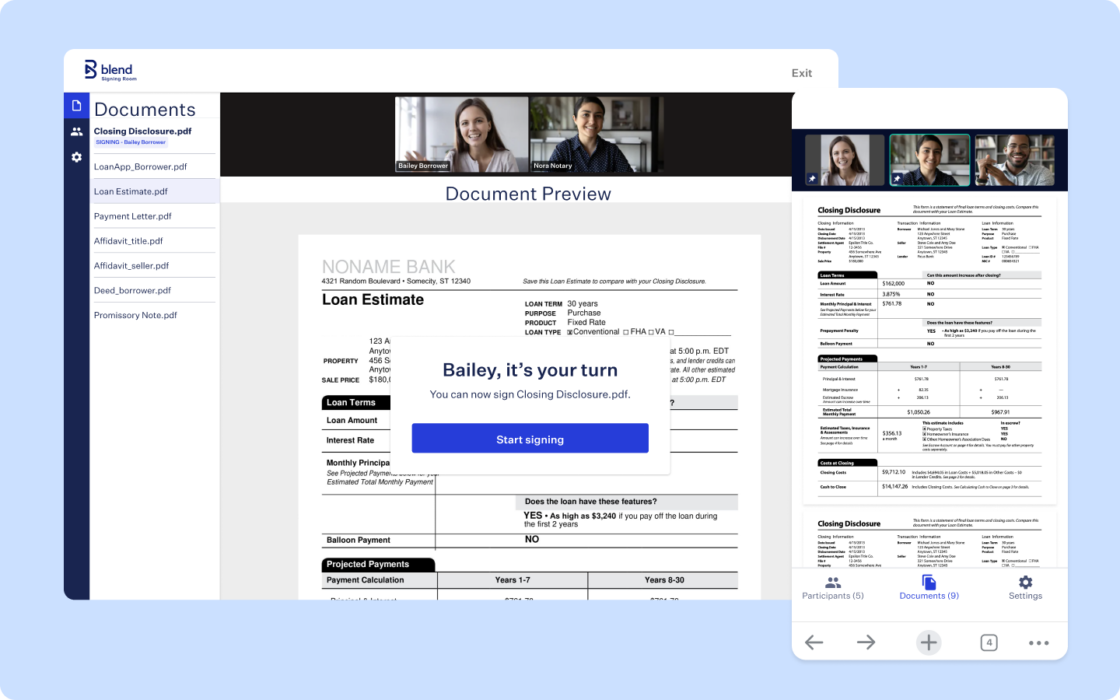

Remote Online Notarization (RON) closings

- The addition of an online signing room allows the borrower to review and eSign all closing documents.

- Borrowers have more choice for how and when they proceed with closing events.

- Errors and missed signatures are reduced.

- Cycle times are accelerated.

- Documents that require notarization are eSigned in the online signing room, allowing the borrower and notary to be in different locations.

Convenience, cost-savings, reduction in errors, and more eClose advantages for everyone involved

An eClose solution can also give settlement agents a holistic view of all loans they are working on and provides a workspace to support seamless interactions between lenders, settlement agents, and borrowers. This centralized coordination of final figures and timely communication of those arranging the closing experience for the borrower benefits all parties involved.

Perhaps most importantly, eClose saves time for both lenders and borrowers through reduced risk and reduced operational error: fewer missing signatures, documents, and files. In fact, a recent study by Marketwise shows that eClosings can result in a significant reduction in errors:

- 11% average reduction in document errors

- 13% reduction in missing signatures

- 12% reduction in missing or lost notes

One can easily see how an end-to-end eClose solution like Blend Close cuts down on time and money spent on closing paperwork, not to mention headaches from any mistakes. Save time. Save money. Reduce operational error. And provide a flexible schedule for everyone involved in the closing process. That’s the power of an eClose solution like Blend Close.

Breaking down the eClose process with Blend Close

Let’s take a look at the step-by-step process of working with Blend Close.

- The borrower selects the preferred closing appointment time.

- The closing date and documents are sent to Blend.

- An email notification with an invitation to a shared workspace is sent to the settlement agent.

- The closing package is automatically separated into witness and non-witness documents and sent to the settlement agent.

- The settlement agent uploads the title documents.

- The borrower reviews closing documents and signs non-witness documents, including eNote.

- The borrower, settlement agent, and remote online notary complete the RON ceremony (in-person for hybrid closings) and the borrower signs the witness documents.

- The completed eSigned documents are made available for download by the borrower and settlement agent, and synced to the LOS.

How Blend can help

Blend wants to make your life easier. And with hybrid and remote online closing options, you’ll save money too. Blend customers who add digital closing to mortgage loan applications can cumulatively save as much as $962 per loan, according to Marketwise Advisors.

The best way to get started is to ask questions. Learn more about how you can increase revenue and close more transactions, while providing your customers with a better experience.

Blend Close is a simple and efficient eClose solution that can strengthen your relationships with borrowers, save time, close more loans, and deliver a flexible and delightful closing experience for all stakeholders today and beyond. At Blend, we call that powering the future with action today.

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.