January 16, 2020 in Mortgage Suite

Put the power of Blend in the palm of your hand

Despite technological advancements that put consumers in the driver’s seat during the mortgage process, the reality is that loan officers still play a vital role. During this high-stress, high-anticipation journey, potential homeowners want a human touch: to voice frustration, to seek financial guidance, or to share celebratory moments. When LOs are kept from providing this personal connection, the process fails.

Devotion to the consumer is at our core. That’s why we’re excited to announce Blend Loan Officer, our new mobile app that offers LOs the ability to meet consumer’s needs at any time, from anywhere.

The Blend Loan Officer mobile app will be a game-changer for your teams, boosting LO productivity and customer satisfaction.

With the new app loan officers can:

- Create new leads, send applications, pull credit, and even qualify borrowers in a few taps

- Track the borrower’s progress through Blend in real time

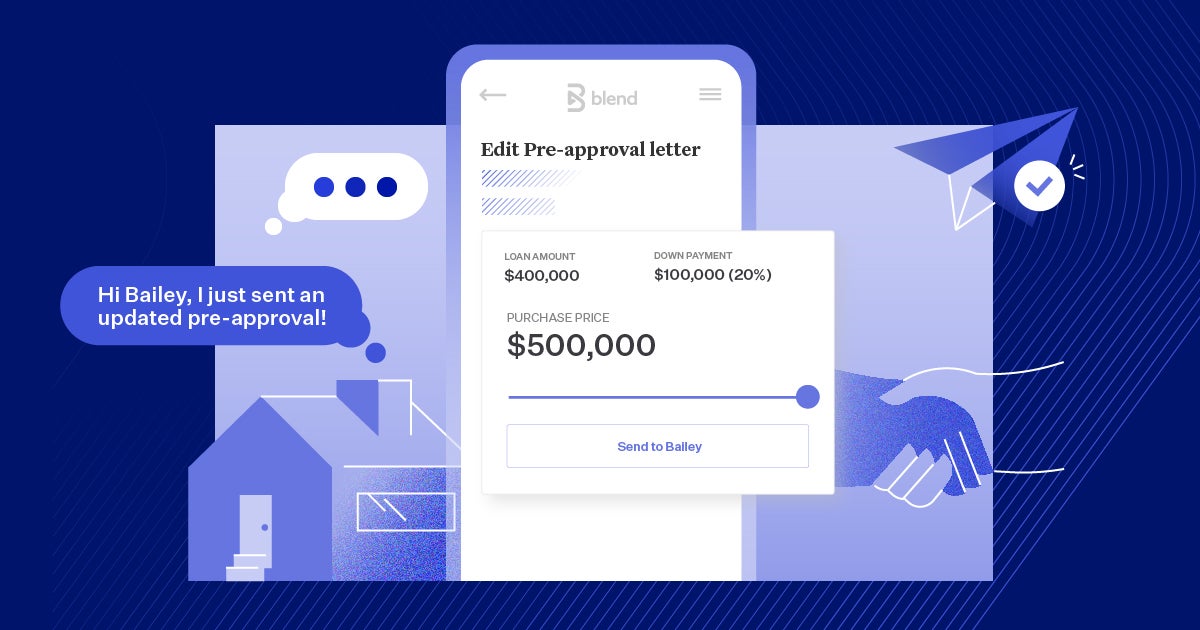

- Take immediate actions to help unblock borrowers at critical times, like providing an updated pre-approval letter ahead of an open house

- Text, call, or email borrowers through the app at any moment

- View and accept documents and countersign disclosures while on the go

We built Blend Loan Officer to provide key loan details and proactive notifications to LOs, maximize efficiency, and free up more time for engaging with consumers.

“Our sales team of 900 originators is great at building relationships and helping people attain homeownership. Those relationships are forged in the very communities they serve. The Blend LO app is a natural fit to make our originators’ jobs easier so they can help our customers on their terms.”

A.J. Swope

EVP of Secondary Marketing, Primary Residential Mortgage, Inc.

Enable your LOs to acquire new leads and convert customers from anywhere

High-performing LOs like to be out in the field building relationships with referral partners and potential homebuyers, providing trusted financial guidance. With the mobile app, loan officers won’t have to worry about missing out on an opportunity to grow their business. At any moment, they can do more than just start the conversation — they can immediately get the prospective borrower started on an application.

Improve the customer experience with proactive communication

Providing proactive assistance doesn’t just drive early borrower commitment, it’s also crucial to a positive customer experience. The impact of proactively communicating statuses and updates through calls, texts, or emails has significant positive impact on borrower NPS, which measures the likelihood of future referral business.

Increase loan pull-through with tools to keep progress moving forward

A key point of differentiation for lenders is the ability to unblock customers at the most critical junctures along the mortgage process, minimizing delays and keeping up momentum.

By combining Blend Loan Officer with the Pre-approval Builder, LOs can get pre-approvals out to borrowers in minutes. They also can easily adjust and send new letters on the go, ensuring a borrower never misses out on their potential dream home.

As borrowers move further down the path, LOs can take actions like viewing and counter-signing disclosure documents from their smartphones.

Build an A-team of high-performing LOs

Equipping your loan teams with premium tools is the best way to recruit, retain, and develop a leading sales organization. Heading into 2020, we want to help lenders empower their teams with modern tools to deliver a frictionless lending experience to their customers.

Current loan officer using Blend and want to see the app in action, download at

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.