November 2, 2020 in Mortgage Suite

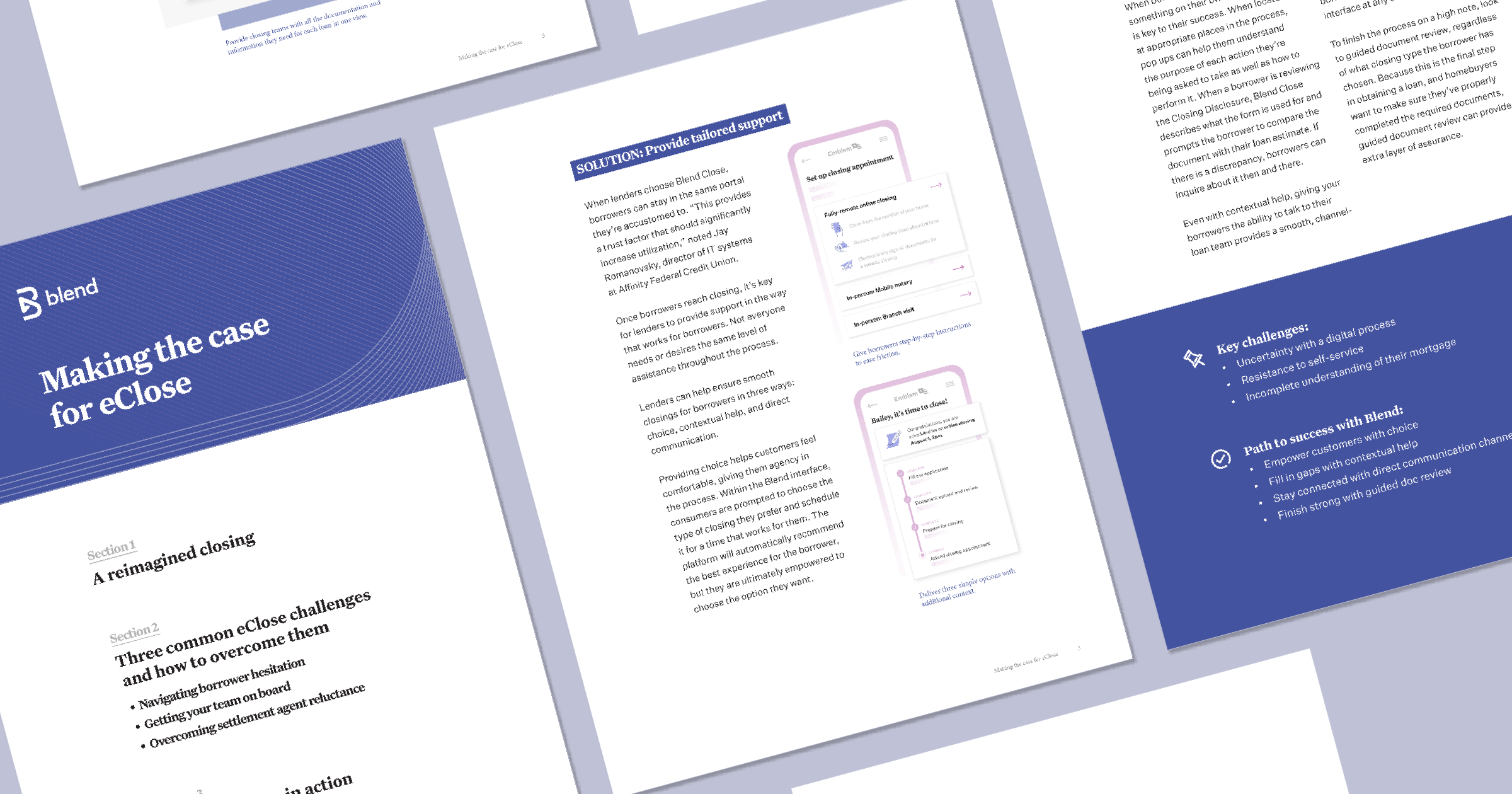

Adopting your new eClose solution: Overcoming objections

In case you missed it, we recently announced the arrival of Blend Close, a single, integrated experience that supports the two main types of eClosings: hybrid eClosing and remote online eClosing (aka RON), along with traditional wet-sign closings. Our eClose solution helps lenders utilize the latest technology to empower consumers to choose what works best for them.

To support this launch, we’ve identified common objections to adopting an eClose solution and addressed how our solution can help you overcome them. We cover hesitation from borrowers, closing teams, and settlement agents.

Three solutions to common objections when adopting eClose solutions

Borrowers, closing teams, and settlement agents all stand to benefit from the streamlined processes that digital closings offer. In addition, lenders are quickly being pushed to adopt digital solutions to mitigate the challenges of social distancing.

But there are still some hesitations that lenders encounter as they look to make the “e” shift. Here are three strategies that can help you overcome this hesitation.

Overcoming borrower hesitation

Borrowers can be cautious of new processes across the homebuying journey, especially when they’re used to a certain way of doing things. This includes the closing process, particularly when a borrower has participated in a traditional closing before. There are three main ways to put borrowers at ease when adopting an eClose solution.

The first is choice: allow borrowers to decide what works for them. Blend Close not only offers the borrower options on what type of closing they would like, but allows them to choose the appointment time.

The second is contextual help: guide them through the process with relevant information. Our solution provides this guidance in the form of pop ups and step-by-step instructions guiding the borrower through the process.

The third is direct communication: ensure they have access to assistance. While not always necessary, giving borrowers the ability to reach out to a closing team member gives them a sense of assurance. If they have a question, the answer is only a chat or call button away.

Minimizing friction to internal adoption

Like consumers, some of your team members may be hesitant to move to a new process. If they’ve worked in the industry for a while, they’ve been using a traditional method for quite a while and have likely mastered it.

It’s key to show your team the value of this new process for them and their borrowers. With Blend Close, time won’t be added to the process. Instead, they’ll soon realize time savings that result from having all closing documents in one portal instead of tracking down countless emails. They may also see a decrease in incoming questions from borrowers due to the in-portal assistance and simplified interface provided by Blend.

Additionally, you can quell worries they have about managing the various types of closings that Blend Close supports because the process is standardized across each type.

Displaying value to settlement agents

Some settlement agents may balk at the idea of adopting yet another piece of technology. But getting them on board won’t be a difficult task once you lay out the benefits to them.

Just like with your closing teams, Blend Close enables settlement agents to ditch the email back and forth and send and receive documents securely within one portal. They can check the status of each loan and collaborate with your closing team within the dedicated Settlement Agent Workspace.

They also don’t have to create a different login for each lender, something that can cause quite the headache. With our solution, agents create and utilize only one login that works for all lenders using Blend.

Overcome objections with Blend Close

We’ve rolled out Blend Close to some of our lender partners to great results. We kept borrowers, closing teams, and settlement agents all at the forefront of our minds when we developed this solution, and the positive feedback is reinforcing this approach.

A unifying benefit to borrowers, closing teams, and settlement agents is staying in the same portal for the entire experience. For borrowers, they continue the homebuying journey in the same experience they applied in. Closing teams and settlement agents can operate in one portal for all loans. Blend Close provides a seamless experience for all involved. To learn more about how its functionality enables this experience, check out the full ebook.

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.