May 10, 2023 in Mortgage Suite

3 best practices to get your borrowers clear to (e)close

With more lenders incorporating digital closings into their library of offerings, you’ll want to make your eClosing experience one to remember.

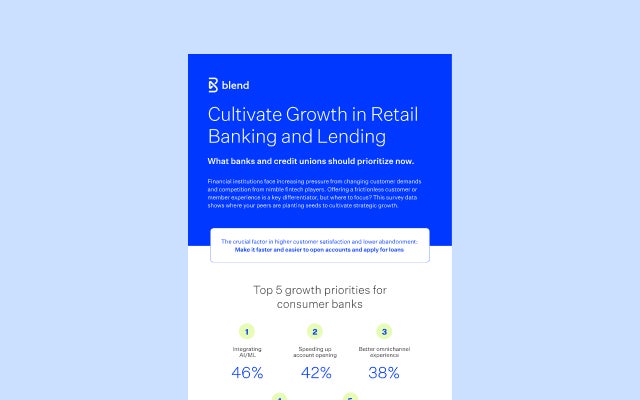

Traditional, in-person closings are becoming a thing of the past. Fully digital experiences are now expected by consumers during the mortgage process, and you do not want to be the one lender that doesn’t offer them. In fact, a majority of consumers (79%) would be willing to eSign some or all mortgage documents. By providing eClosings, you open your business to more borrowers, can increase pull-through rate (meaning close more loans), and save some significant time.

It’s likely that many of your borrowers will have never been through an eClosing and will look to you as the source of truth throughout the process. To ensure they have the best experience possible, incorporate these best practices into your mortgage experience.

Provide a guided, transparent loan process

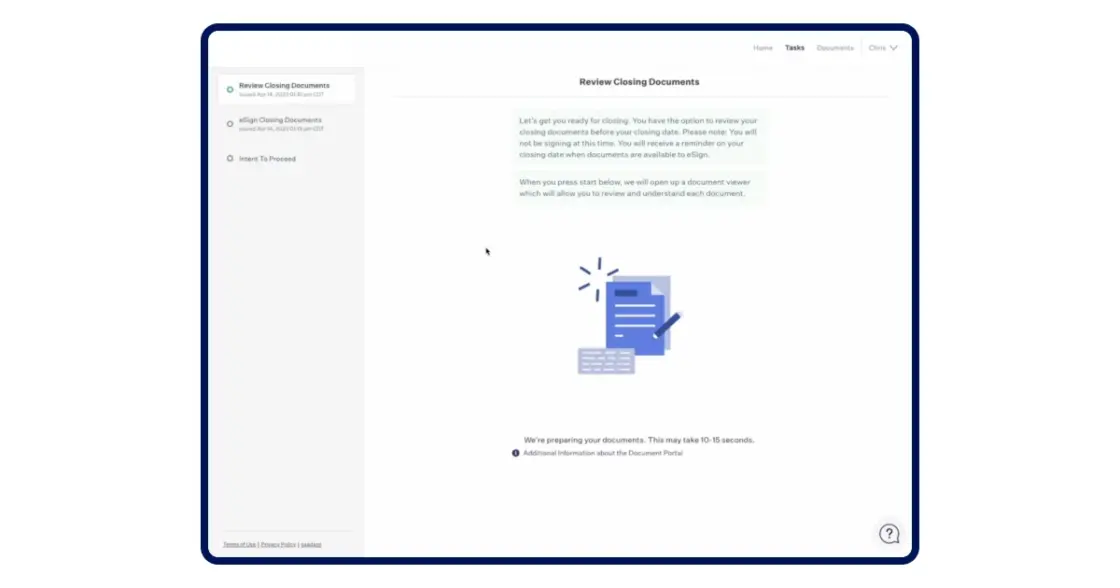

Some borrowers may be hesitant to move forward with digital closings. If they’ve never done one before or weren’t aware it was even an option, they likely don’t even know what the process entails. To ease their worries, clearly communicate what’s going to happen before it even happens, offer guided assistance throughout their closing, and give them full transparency about their mortgage. Educating borrowers about their loan process helps eliminate uncertainty and can give them the confidence to continue with their closing, ask questions, and be responsive.

Here are a couple of strategies to help you provide the guidance borrowers need:

- Record a quick video covering the eClosing steps

- Outline what to expect in a step-by-step guide and include screenshots of the borrower portal

- Create a script that loan officers can use to describe what borrowers can expect

Offer flexible closing choices

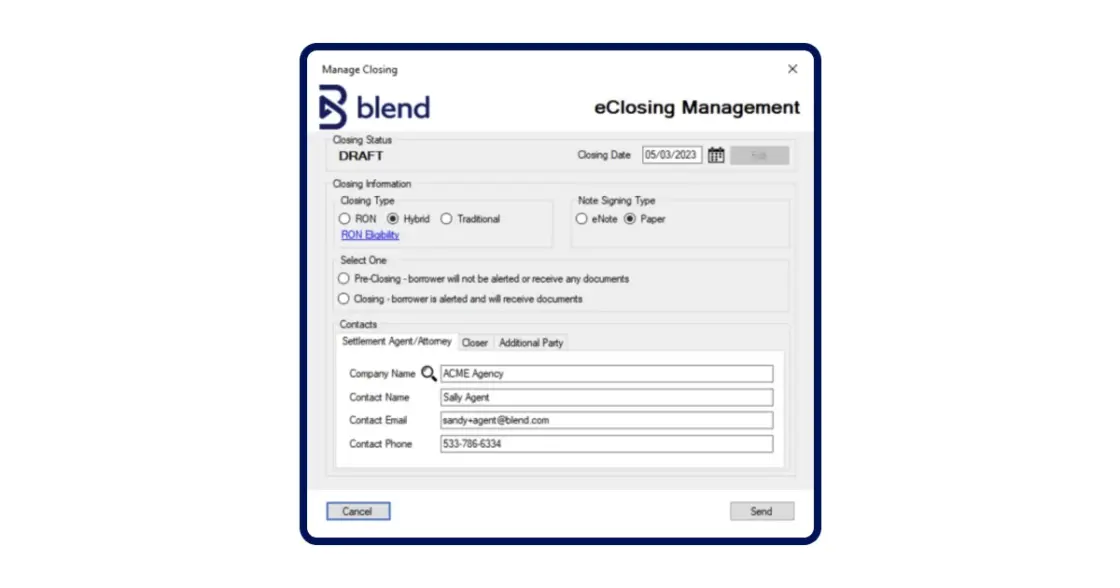

While some borrowers are comfortable with a fully digital experience, others may like to meet in person. Depending on your customer base, incorporate a solution that gives you the choice between hybrid closings or RONs — like Blend Close. By having more flexibility with closings, you may reach a wider pool of borrowers you never have before, and not offering these choices may make you lose these opportunities.

No matter which type you choose to offer, establish expectations with your borrowers for each type of closing. Help prepare them as much as possible with your mortgage tech by allowing them to review and sign closing documents remotely. Even with traditional closings, Blend Close allows borrowers to do this ahead of their closing day.

Maintain an open line of communication

Some may argue there’s no such thing as overcommunication. No matter where they are in the mortgage process, it’s important to keep in touch with all parties involved in the mortgage process — but it’s especially necessary during closings.

Stay easily accessible to your borrowers and agents. Communicating on a single platform like Blend Close helps everyone stay on the same page, stay connected, and understand what’s going on with the loan and closing. When you’re working and communicating on separate platforms, your, your borrowers’, and their agents’ experiences may be disjointed.

Ensure successful eClosings with an intuitive platform

Achieving successful eClosings is easier when you leverage a dynamic, intelligent closing solution that helps your borrowers get through to closing quickly and efficiently.

With Blend Close, you don’t have to make your borrowers leave the Blend Mortgage Suite or waste time completing manual tasks or correcting signing errors. And by implementing this product solution, you can even increase your pull-through rate. In fact, Blend has a 93% average eClose completion rate across all customers. Don’t fall behind your competition. Join the 135+ lenders that have signed on to offer their customers a digitally-enabled closing experience through Blend.

Want to provide a better eClosing experience?

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.