January 26, 2023 in Consumer Banking Suite

Unpacking the value of the Consumer Banking Suite

An exceptional experience across all consumer banking products underscored by a platform that helps your teams maximize productivity.

The Blend Consumer Banking Suite offers so much more than an exceptional customer experience across products. Beneath the streamlined process — which makes it easy for customers to understand next steps while minimizing manual tasks — you’ll find a platform with lender benefits that drive new levels of productivity, helping teams grow volume faster. Each feature was designed with purpose — let’s break down how they come together to drive smooth customer onboarding and productivity for your business.

Blend enhances the customer experience

Blend understands the evolution of customer expectations. Every facet of our applications has been optimized to bring customers to the finish line, easing sticking points along the way.

With guided user flows

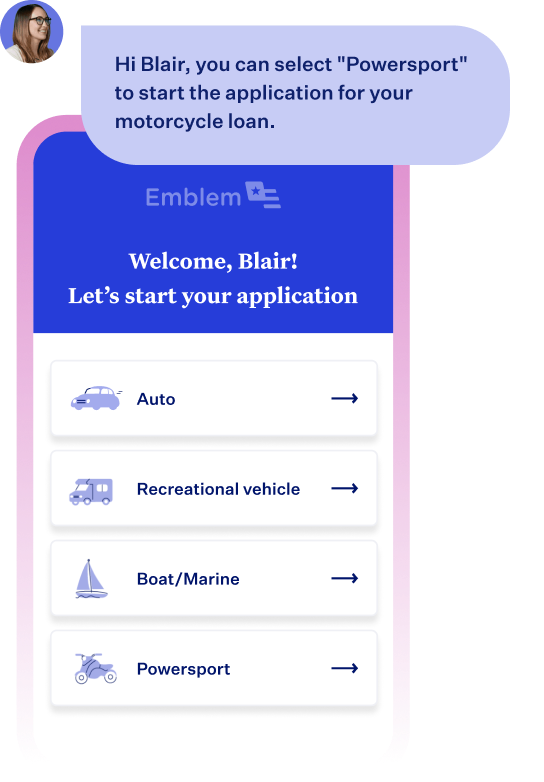

When a customer opens a Blend application, an intuitive interface guides them through each step. This user-friendly journey includes inline contextual help, with useful snippets for portions of applications that can be tricky to navigate with traditional applications.

If a customer needs more help on a loan application, they can ask for — and receive — real-time assistance within the application. Blend Co-pilot gives loan officers a 1:1 visual match of a customer’s application so they can quickly understand what the customer is stuck on and provide an answer. These capabilities enable customers to get any guidance they may need without picking up the phone to call their loan officer or get in the car to make a branch visit.

With a responsive design that’s optimized for any device, customers can apply how and when it works for them — from anywhere. Staying in one portal from application to close minimizes confusion that can come from logging in and out of multiple interfaces.

And simplified applications

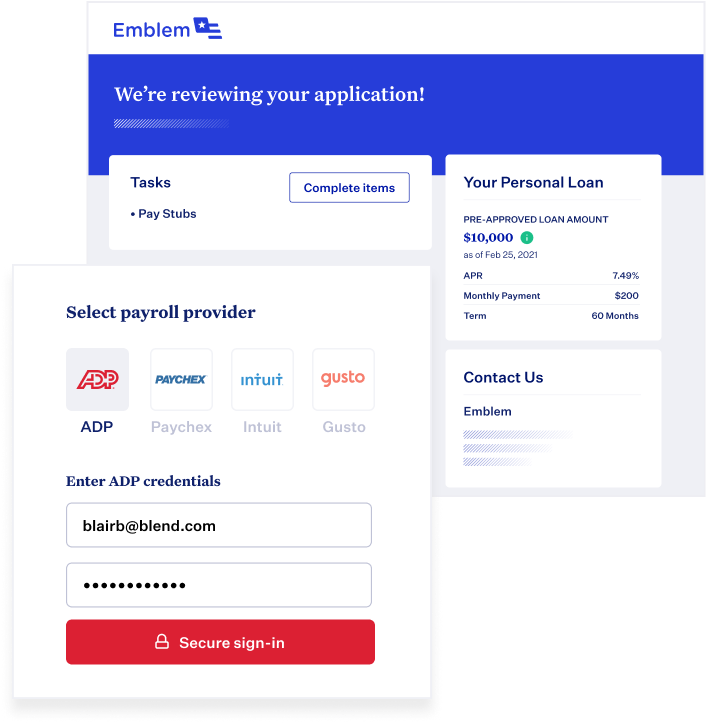

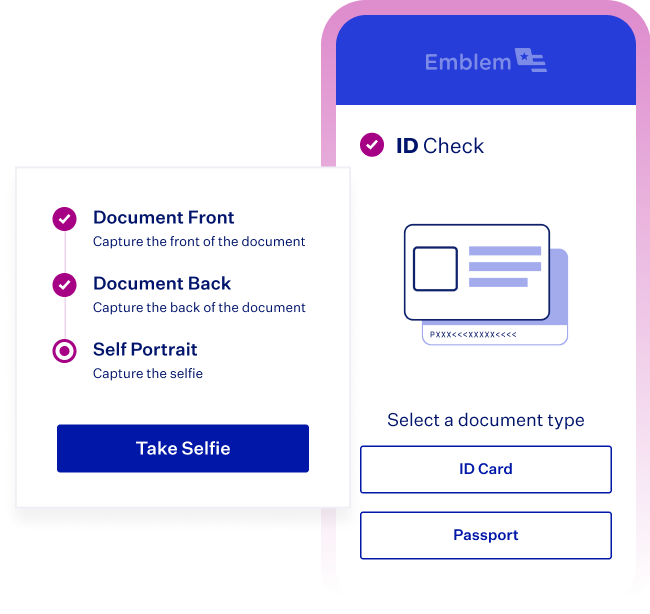

In addition to shepherding customers along a clearly outlined process, Blend also minimizes the work required of applicants where possible. From the start, borrower single sign-on and applications prefilled with previously provided financial information decrease the number of fields a borrower needs to fill out.

When it comes time for borrowers to supply asset, payroll, and tax information, they have the option to connect to their accounts through a simple and trustworthy experience.

All told, Blend Consumer Banking Suite enables you to offer consistency across products so your customers get the same great digital experience in every interaction.

Blend amplifies your teams’ productivity

Blend fuels the application process for customers, but the impact of the Consumer Banking Suite doesn’t stop there. Automation and banker tools enable you to reduce manual work for your teams from origination to close.

Starting with origination

Your bankers strive to close loans quickly while working with disparate tools and systems.

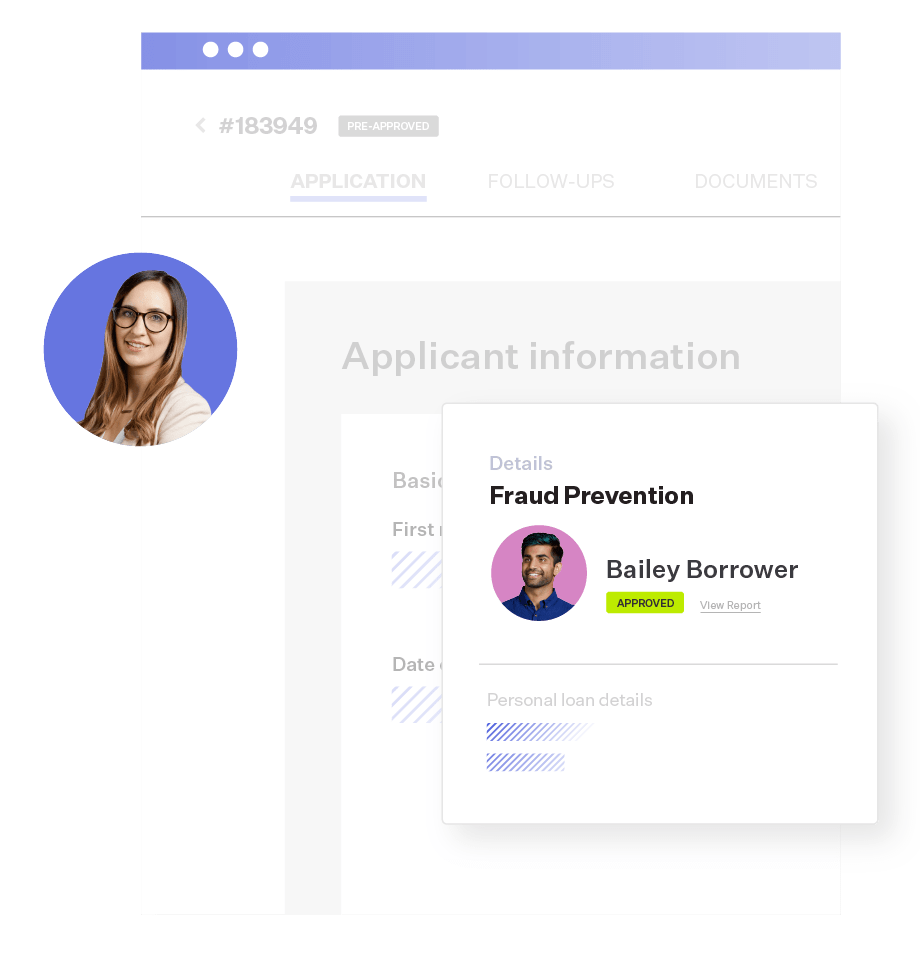

Blend’s Banker Workspace supports them on all key workflows across the loan process in one workspace, driving efficiency by reducing data entry, routine tasks, and compliance management.

Bankers can easily intake applications for multiple products at any step in the process and manage follow-ups with a central dashboard of applications and statuses. With the time they save, your frontline staff can focus on building deeper customer relationships.

And throughout processing and underwriting

As soon as a borrower submits their application, Blend allows you to automatically undertake income and employment verification, eliminating the need for bankers to manually comb through and verify paystubs and W-2s.

This feature leads to time savings in processing, but it also helps ensure that underwriters will get a complete and accurate file for review.

Less back and forth between processing and underwriting allows the process to continue seamlessly — and more quickly. Automated stipulations also reduce processing and underwriting touches by surfacing issues at the time of application.

Wondering how the Blend Consumer Banking Suite can uplevel your customer experience and drive efficiency?

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.