May 26, 2020 in Thought leadership

Solving the SBA loan processing problem: A partnership with M&T Bank

Blend was born from the ashes of the last financial crisis. Working as a software engineer in 2008 opened my eyes to the decades-old systems and paper-based processes utilized by financial institutions, and I saw an opportunity to build the technology that could help transform the mortgage industry.

Another crisis has reared its head, and for us, it’s another call to action.

The birth of Blend

Even before the aftermath of 2008 amplified the challenges lenders faced, the status quo was inefficient at best.

So when I started Blend with my co-founders, we focused on building a product that would help facilitate simplicity and transparency through data and digitization. A platform approach was key. It would allow us to serve the process end-to-end, guiding both customer and lender through a typically complex process, including eligibility, data collection and verification, and third party integrations. Wanting to provide long-term agility, we intentionally built a platform that would be able to adapt over time as the needs of the market changed at an accelerated pace.

It proved successful. We’ve worked hand-in-hand with our lender partners to improve lending on a massive scale — our lenders process over $3 billion in loans through Blend each day, enabling them to provide experiences that are safer, faster, and better for all involved.

Then the world was hit with an entirely unprecedented challenge.

A crisis compels immediate action on SBA loans

When the effects of COVID-19 required all but essential businesses to cease operations, it became clear that if no major action was taken, many businesses wouldn’t be able to weather the storm.

Sensing the potential for a disproportionate impact on small businesses, which employ around 60 million Americans, the government responded with The Coronavirus Aid, Relief, and Economic Security (CARES) Act, which includes the Paycheck Protection Program (PPP), offering loans and tax relief to struggling small businesses.

Despite the best of intentions, there wasn’t much time to build a system to handle the scale of funding that was expected. Banks knew they would be inundated with requests soon after the SBA guidelines were provided, and they would struggle to process the applications fast enough. They had a choice: staff massive call centers to fund loans or build automated processes to help them handle the volume. Creating a system from scratch in a few days that could serve the masses of small businesses was near impossible.

Similar challenges to those that had plagued lenders in 2008 were at the forefront of this latest crisis, and we knew Blend could make a difference.

All in three days’ work

As news of the initial struggles rolled in from conversations we were having with our lender partners, an idea struck our team. Hans Morris, one of our investors from NYCA, reached out to me when the bill had yet to be passed. The power of our platform, he believed, meant that we could help lenders process these loans more efficiently than any other technology provider.

It was a no-brainer. The issues lenders were facing as they attempted to process the deluge of SBA loan applications felt like a challenge our platform was built to handle: a dynamic workflow, third party data integrations, document signing, and back-office integration. We knew our team could help banks tackle this challenge, and we knew we could do it quickly.

Right away one of our existing partners, M&T Bank, came up as a great company to work with on this. Chris Kay, who leads M&T’s consumer and business banking divisions, set us up with CIO Sonny Sonnenstein and his technology team to conceptualize a stack that could function seamlessly, and their team worked to open up E-TRAN backend access. Because of the critical circumstances, our team pledged to help configure, integrate, and roll out the platform for this use case for free.

We needed to collaborate with M&T to adapt our platform, and its flexible nature made rapidly creating a new application workflow possible. The end-to-end product had to comply with the newly implemented SBA guidelines. Our teams were up to the task, working non-stop to ensure the stability and scalability this program required. Safe, efficient, and accurate processing was our goal, and the team rallied day and night to put together an application flow with the components that would enable this.

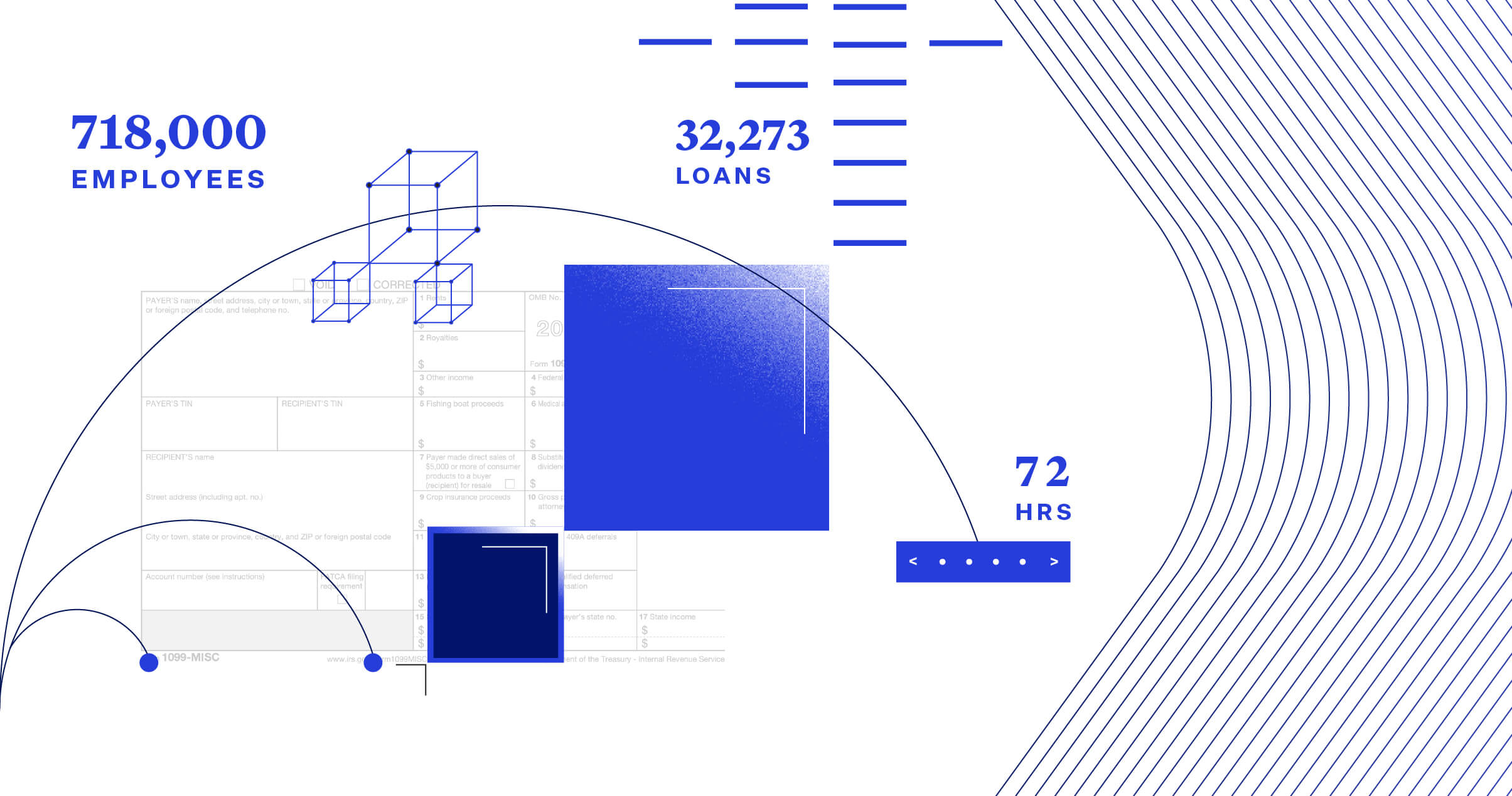

Our teams finalized integrations like single sign-on and customer profile data while configuring the Blend platform to match the SBA PPP workflow. We were up and running — with a live, self-serve application through signing and integration — in 72 hours.

“Partnering with Blend meant we could move quickly enough to be there for our customers when they needed it,” Kay told me in a recent conversation. “The team’s dedication to making this work on a short timeline is a testament to the type of partner Blend is, and the way your platform could adapt to this new situation and scale rapidly was especially impressive.”

Scaling impact, rapidly

The applications flew in. In the first hour, M&T accepted nearly 10,000 loan applications, underscoring the demand from small businesses and the need for technology that streamlined applications and processing.

Receiving digital applications is one thing. M&T needed a solution that also ensured incoming requests were accurate, fully complete, and eligible.

By aligning the platform-level dynamic eligibility and correctness checks, applications were clean, accurate, and approved the first time around. Since opening up applications in April, the bank has funded nearly 100% of the requests they received, amounting to 32,273 loans totaling almost $7 billion. That money will help 718,000 employees around the country.

Working together to adapt our platform to fit the drastically changed needs of small businesses empowered M&T to process more than 18 times the SBA loans that they would usually process in a year in only three weeks.

We’re proud to have helped businesses of all sizes. Typically, scaling smaller dollar loans, which serve the smallest of businesses, would have proved a challenge. Yet more than 65 percent of the approvals were for loans less than $100,000.

Reflecting back and looking forward

For eight years, our team has worked on a flexible platform powerful enough to handle any financial product. As we harness this power to provide solutions for acute circumstances affecting millions of Americans, we are more committed than ever. The financial services industry has the ability to help, and we understand our unique role in aiding our partners to best provide this help and lessen the impact of this crisis on businesses and their employees.

The landscape changes every day, and the products of the past won’t always be the products demanded in the future. Digital transformation is now table stakes, but things are changing too fast to wait to deliver new products end-to-end for years or even months. This necessitates digital agility — measured by how quickly their technology stack allows them to adapt to the ever-increasing pace of change — from every bank as they look to serve consumers and businesses. I’m proud Blend has built a platform that provides help when it’s most needed by facilitating this agility.

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.