April 16, 2020 in Mortgage Suite

The power of loan application analytics with Blend Reporting

Blend’s suite of analytics tools provide lenders with everything they need to make intelligent decisions – and fast.

Against a backdrop of continued uncertainty and unprecedented mortgage volume, it’s never been more important for lenders to move quickly and intelligently. Understanding process bottlenecks and ensuring loan teams are operating effectively can make or break a lender’s success in these trying times.

Informed strategies are built on strong insights. Lenders who can translate raw information into actionable next steps are best positioned to thrive in any market conditions.

Unleash the power of analytics

From analytics to analysis

Subscribe for industry trends, product updates, and much more.

This is where the power of loan application analytics comes in.

Rather than having to lose many precious hours manually digging around for data, loan application analytics tools give you all of the insights you need — and all in one place. See a detailed picture of both loan applications received and the lending decisions made in order to uncover key trends that can help inform better strategic choices going forward.

The most helpful analytic tools allow users to create visual, compelling reports that can be shared in a click of a button without ever leaving the platform.

Ultimately, this gives you the tools to drive continuous improvement and stay competitive, no matter how challenging the lending environment.

How Blend’s loan application analytics tools put data to work

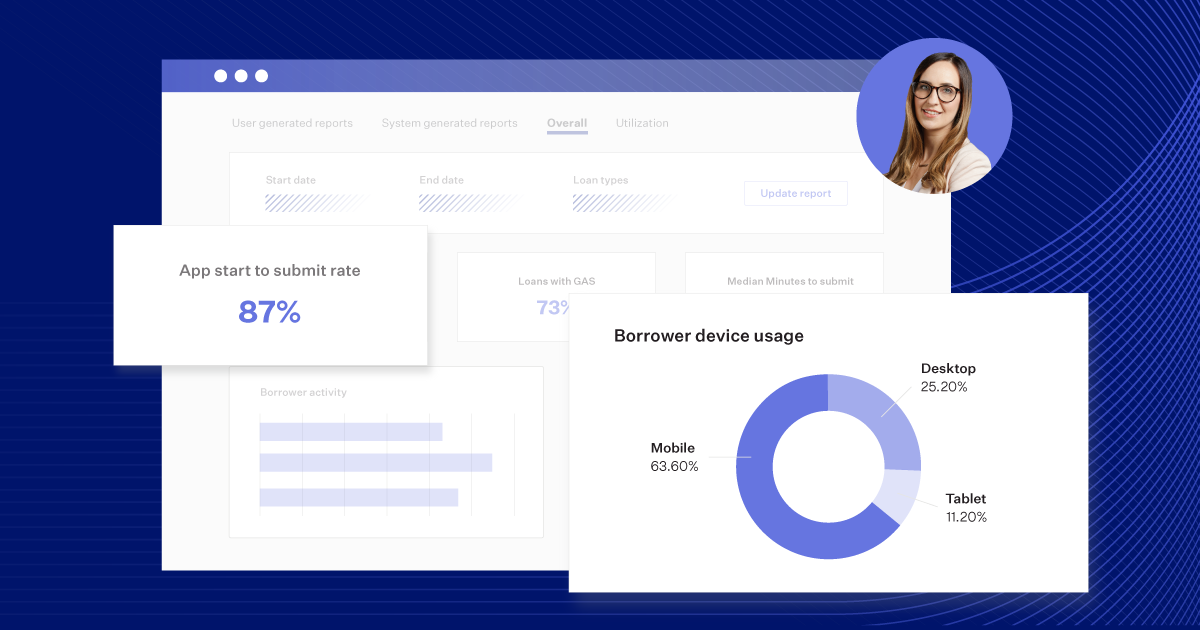

Blend Reporting features a suite of loan application analytics tools that puts stronger insights in the palm of your hand.

Blend Reporting includes the Reporting Dashboard, Interactive and Generated Reports, and the Reporting API — all of which filter detailed, well-structured data into the actionable chunks your team needs. Enable your teams to continually measure, iterate on, and improve internal processes with a clear focus on how they serve the needs of your lifelong customers.

Use the Reporting Dashboard for insights at a glance

Looking for a quick pulse on your lending performance? Interested in observing how key metrics are changing over time? The Reporting Dashboard hub offers high-level loan application analytics and provides access to historical insights at a glance.

Share 30-day application submit rate data with your team to drive volumes if you spot a dip. Commend your team for actions that cause your NPS scores to trend upward. No matter how your team is performing, you’ll have access to the tangible data you need to encourage the agility that underpins success.

Understand key trends quickly with Interactive Reports

Looking to track trends over time? With Interactive Reports, you can answer essential business questions about loan production or team adoption with pre-built data visualizations composed of a variety of metrics.

Dazzle at your board meeting with Generated Reports

Looking for a finer-tuned analysis that will give you brownie points in your next board meeting? Blend’s Generated Reports feature allows you and your team to download customizable reports formatted with the tailored information you need to inform core strategies. Choose user or loan level data and filter by report type, loan type, event type, and date range.

Delve even deeper with Blend’s Reporting API

For teams who want deeper customization, augment your outputs with Blend’s Reporting API, which enables your team to securely import Blend data into your business intelligence tool of choice. Feel equipped to tell data stories at multiple altitudes as you elevate the use of loan application analytics across your organization.

No matter which tools work best for you, rest assured that the system is designed to maximize privacy. Only approved users can access this user-level data.

Tell the data stories that matter to you

Building on insights gleaned from our numerous lender partners, we have compiled a core set of reports that have proven useful in driving business success. You can use these building blocks to construct the narrative you need to get organizational buy-in for loan application analytics and, as a result, encourage positive change across your teams:

- NPS: As a customer-driven organization, NPS scores and comments are the foundation of your long-term success. Analyze individual borrower NPS scores and comments to discover ways to create an exceptional digital loan application experience.

- Borrower processes: View funnel conversion rates to understand where borrowers drop off in the loan workflow. Identify and improve weak points across the customer journey to ensure a fantastic experience from application to close.

- Application list: Understand application sources and compare performance across channels. Maximize your marketing ROI by pinpointing the mechanisms that are driving your highest quality applications.

- Data verification usage: Gain insight into how the asset verification feature is being used by borrowers. Empower your teams to educate consumers about the tools at their disposal that make lending frustrations a thing of the past.

These use cases are just a starting point. We’ve designed our loan application analytics suite to ensure the data we highlight can be integrated into the unique stories you need to tell to be successful. In addition, we continually communicate with our lending partners to identify additional key data sets. We are always looking for feedback on the metrics you crave.

Want to know how loan application analytics can work for you?

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.