August 17, 2021 in Thought leadership

10 questions to ask when reaching out to a lender for a loan

Shopping for a lender can be overshadowed by shopping for a house. Start the homebuying journey off on the right foot by asking your loan officer insightful questions.

Reaching out to a lender for a loan is one of the most important parts of the homeownership journey, but it’s also an area that some consumers fail to prioritize. Did you know that, according to the Consumer Financial Protection Bureau, less than half of consumers actually shop around for a mortgage? This means that most people are not doing enough research to compare their options. We have many team members who have previously worked as loan officers. Here are some of their tips.

Why our experts believe it’s important to find the right loan officer

Rather than shopping for a mortgage loan purely based on the lowest advertised rates and/or fees, our team suggests shopping for the right loan officer first. Building a lifelong relationship with a loan officer can lead to you having a trusted advisor to help you and your family members with future transactions.

Get your questions answered.

Subscribe for industry trends, product updates, and much more.

When applying for a mortgage loan, we suggest finding the best loan officer at a lender who is the best fit for you and is willing to provide you with the level of service you require.

The benefits of finding the right loan officer for you can bring benefits long into the future. Beyond the initial home purchase, there are additional lender touchpoints down the road if you choose to refinance or take out a home equity loan. The right loan officer will understand your unique financial situation and won’t need to ask you to start the loan process from scratch each time you need a new loan. And since many lenders will match on published rates and fees — and major lenders publish their rates on their websites — it is not hard to sanity-check your loan officer’s quotes early on and negate price differentials.

Key questions to ask a mortgage officer

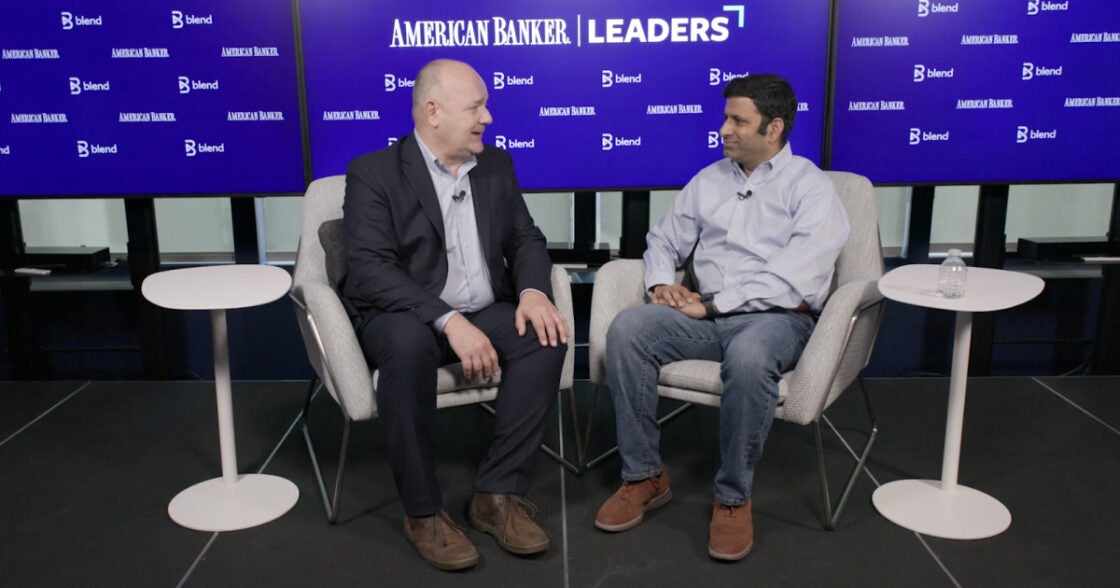

It can be really difficult to know how to talk to loan officers. At Blend, we have the privilege of regularly interviewing top-producing loan officers from various lenders as part of our ongoing user feedback sessions for our mortgage origination software. There are a number of particularly important questions we suggest asking when reaching out to a lender for a loan:

Question 1: How many transactions do you work on per month and per year?

Completed transactions are similar to upvotes or likes. The more transactions the loan officer is working on or has closed, the more experience they are likely to have — and this experience really matters. Seek out an LO who has a solid track record. One to two closed loans a month is generally considered good.

Question 2: What is your Net Promoter Score?

Net Promoter Score is used by many lenders to track their loan officers’ performance on every closed loan. This score is a factor in measuring the performance of the LO. As with any rating, you likely want to interpret it as a signal rather than the absolute last word. But it can be a good starting point for understanding the level of service you can expect.

Question 3: What is your experience working with consumers similar to myself?

If you are a software engineer working at a startup and receiving annual bonuses and incentive stock options, you might want to know that the loan officer has experience working with consumers with a similar profile to your own. Working with a loan officer who understands how to structure transactions for your consumer profile can provide peace of mind.

Question 4: Tell me why you chose this profession?

Passionate professionals are more likely to be involved in every step. As an example, we spent some time with a top producing loan officer who is on track to close over $100 million in loans this year. We could tell right away that they were dedicated to delivering the best consumer experience possible based on the feedback they gave us on how we can continue to optimize the mortgage experience to be as seamless and user-friendly as possible. Whether over the phone or in person, it’s helpful to identify loan officers who are passionate and will go the extra mile to deliver a compelling experience to consumers.

Question 5: Can you explain your process and turn-times for working with applicants to get loans from application to approval?

Assuming the application process should work a certain way without understanding and setting expectations can lead to disappointment. Bear in mind the following:

- Every lender and loan officer has different processes and turn times, so it is a good idea to understand this upfront.

- Your loan officer should be able to explain the mortgage process concisely and clearly.

- Some of the most modern application processes start and finish all in the same platform, which simplifies things for you as a consumer.

Question 6: How do I keep track of the status of my loan and at what milestones will I receive updates?

Communication is key. For many of us, applying for a mortgage loan is extremely stressful. Getting regular updates during the mortgage process will allow you to tackle one step at a time and track your progress. Loan officers have a lot going on, especially if they are working on a lot of files. It’s helpful to receive updates from your loan officer — such as “your loan has been suspended for further documentation” — immediately so you can take the necessary action in a timely manner. Some lenders have online portals to make it easy for consumers to track the status of their loan.

Question 7: What is your track record of on-time mortgage closings?

A track record of closing on time is paramount, especially when you have a high stakes home purchase and can be held liable for a breach of contract by the seller for not meeting a deadline.

Question 8: What do you think my chances of loan approval are?

Most experienced loan officers can tell you if your loan will be approved before an underwriter formally reviews your loan file. They have a good understanding of what their institution can and can’t approve. Your loan officer may use an automated decision engine to see if your loan can be approved.

Question 9: Where are your processing and underwriting centers located?

Every loan needs to be sent to a processor and underwriter as part of the loan process. Bear in mind the following:

- If processing or underwriting is not in your time zone, you may want to know what hours you can contact them for questions.

- It’s prudent to find out how this might impact your loan closing.

Question 10: Is there anything we have not discussed that I should be aware of?

No matter how thorough you are, reaching out to a lender for a loan is complex. By asking this question, you will uncover some unknowns. Things like, “Will I get a discount for setting my account up for auto-pay or opening a bank account?” You may also discover things your loan officer feels that you should be aware of, whether positive or negative.

Curious to learn how Blend’s innovative software is equipping lenders with tools to better serve their customers?

A version of this post was first published on Quora on October 9th, 2015: http://qr.ae/RPSsK3

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.