June 17, 2021 in Thought leadership

A lender perspective on reframing the homeownership journey

By putting consumers at the center, lenders can improve experiences and deepen relationships.

Recently, we looked at where consumers face obstacles in the homeownership process. Prospective homeowners reported that they dealt with everything from a lack of education to an inability to centrally coordinate all the necessary activities. What the average consumer wants is an easier, less stressful, and cheaper way to purchase homes. What they often get is one of the most stressful experiences of a person’s life.

It begs the question: what if the homeownership process was reframed around the consumer, with lenders at the nexus of critical services surrounding the process, providing the opportunity to reduce costs and stress for homebuyers while deepening and improving the stickiness of these relationships? To find out, Blend engaged Aite Group to perform a study of 2,000 consumers and lenders to understand their current pain points and how this new approach might address them.

Many lenders lose their customers’ business to competitors

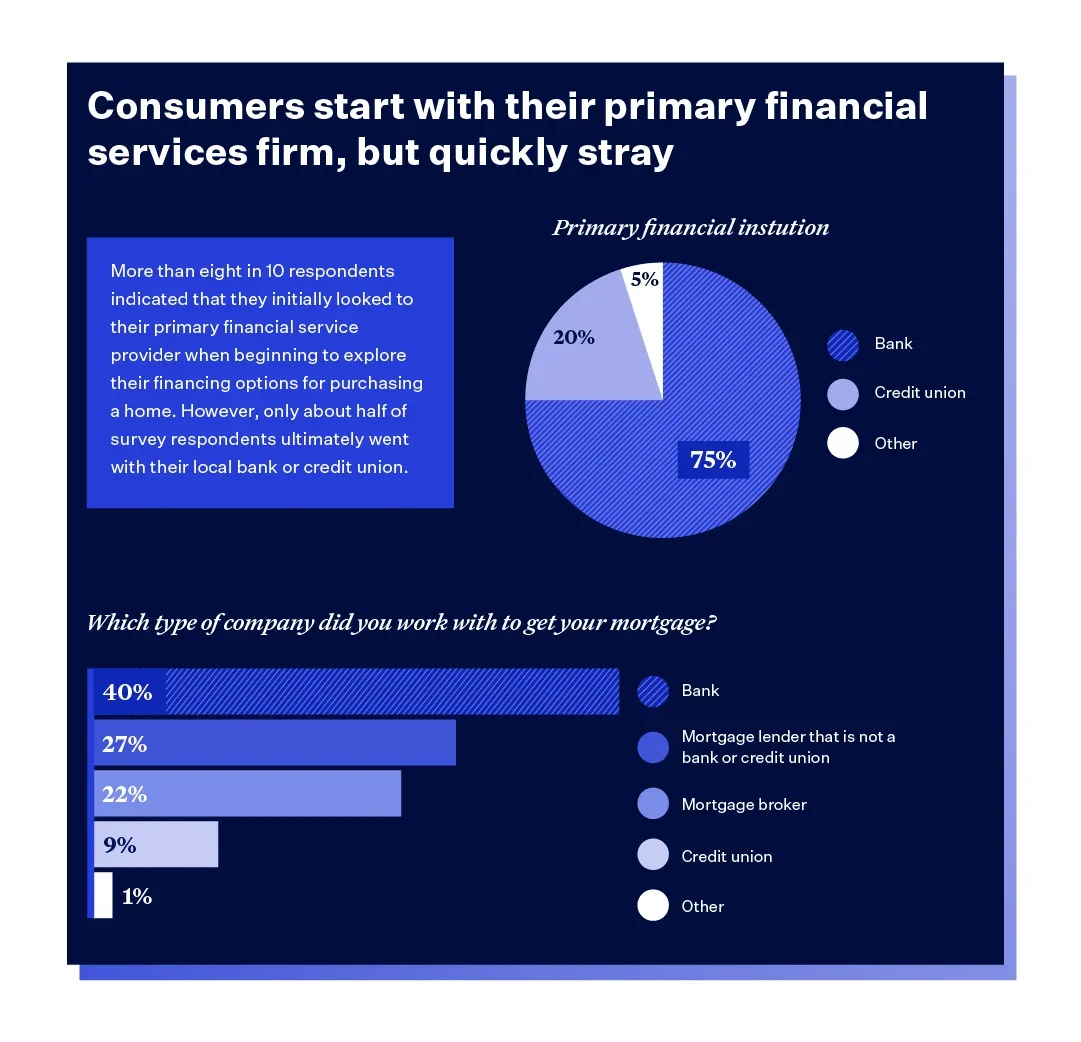

While almost every consumer surveyed began their search with their primary financial service provider, relatively few actually wound up getting a mortgage from them. The majority (75%) of consumers surveyed named a bank as their primary financial service provider, but when we asked where consumers ultimately secured their mortgage, only 40% went with a bank. Credit unions also saw significant drop off. 27% of homebuyers worked with an independent mortgage lender and another 22% worked with Mortgage Brokers.

This highlights an issue that many lenders already know they face: consumer loyalty appears to be product driven and not brand driven, and many see their own customers going elsewhere when it comes time for a mortgage.

What if lenders played a more central role in the homeownership process?

While the lack of stickiness is a pain point for lenders, the lack of education and clarity around the homeownership process is equally painful for consumers. There may be an opportunity to solve for the friction both groups experience. When Aite Group asked consumers whether they would be open to using a complete end-to-end homeownership solution if it were offered by a lender, eighty-nine percent of consumers said yes.

Where are homeowners looking for help?

Across all areas, consumers expressed significant interest in a better homeownership process. They indicated the highest interest in a one-stop shop for all of the services involved in homeownership, but they also showed interest in getting cash offers for their current homes, assistant moving, education surrounding the entire process of purchasing a home, as well as learning how to manage that home as an asset.

Consumers want to know more

A lack of consumer education on the homeownership process was a recurring theme in the survey. For example, prospective homebuyers felt they lacked a firm understanding of the costs associated with coordinating multiple service providers throughout the process. There is an opportunity to increase customer satisfaction and create operational efficiency by creating a lending experience that more tightly integrates all the activities related to homeownership.

At the most basic level, an online loan status page that provides the consumer with information on the status of a loan was something that consumers suggested they wanted. They also showed interest in online tools to help estimate closing costs as well as help understanding the inspection report. Ultimately, what consumers are looking for is trusted guidance through the process.

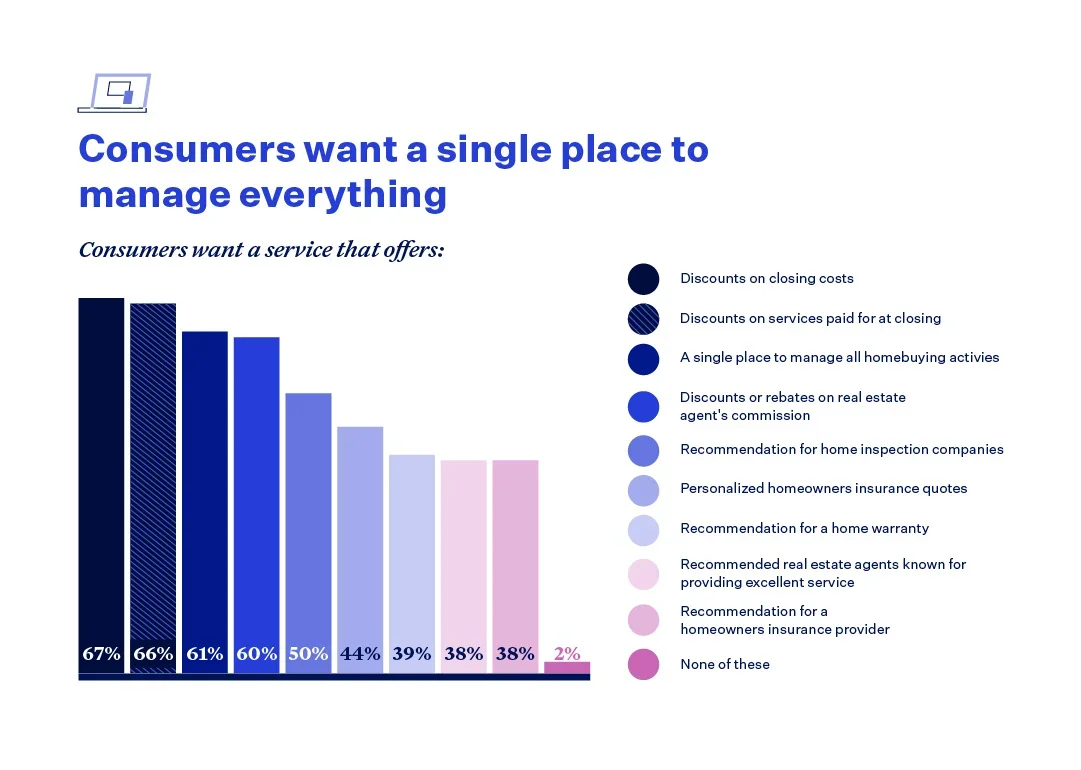

Consumers want a single place to manage everything

Consumers also noted that they would be interested in a single place to manage the entirety of the homeownership process. In addition to wanting a one-stop shop for managing all of these services, consumers were particularly interested in receiving discounts on closing costs, such as title insurance and home appraisal and discounts or rebates on the real estate agent’s commission that could be applied to closing costs. It’s not surprising that cost was top of mind for consumers during the homebuying process and that they would seek out discounts where they could.

From a lender perspective, providing competitive rates and pricing is always a challenge. The consumer-level interest in discounts on related services could suggest that were lenders to provide discounts on these services, there may be an opportunity to reduce customers’ price sensitivity on rate in return, providing those lenders with a significant differentiator compared to their peers.

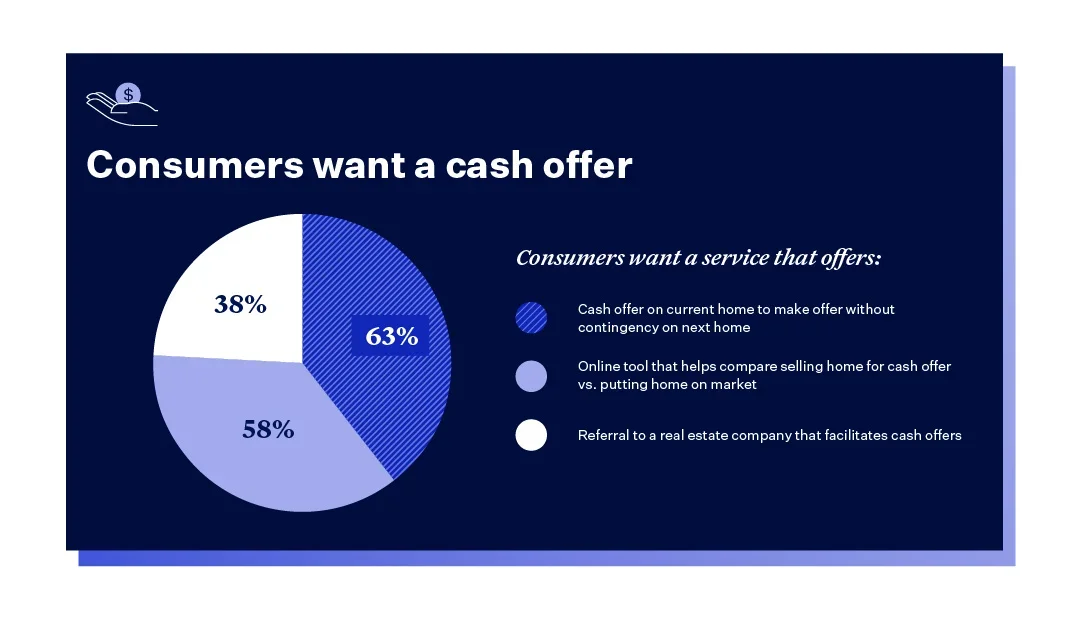

Consumers are interested in cash offers

The twin pain points of cost and a perceived lack of education for consumers continue to inform how they view the homeownership process, and what type of assistance they’d be interested in. Homeowners were interested in a program that gives them a cash offer on their current home so they can make offers on new homes without contingencies, as well as an online tool to help them determine the costs and benefits of accepting the cash compared to selling their home on the open market.

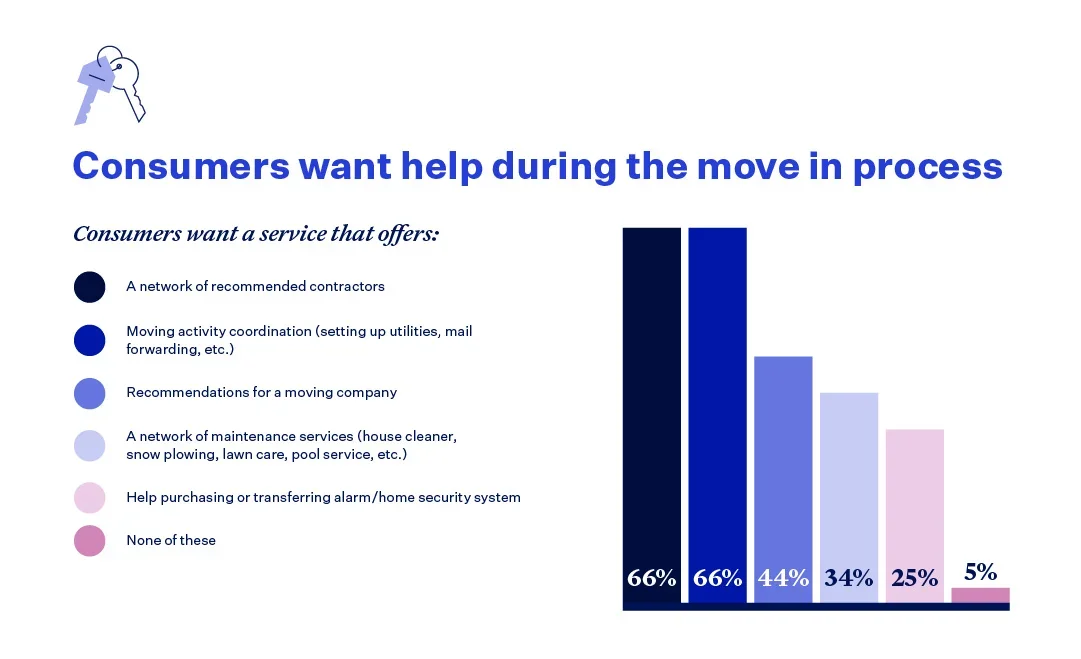

Consumers want help during the move-in process

One notable takeaway from the survey is that consumers didn’t just want help with the transactional aspects of homeownership. While they did find the costs and steps associated with closing confusing, they also reported interest in help during the moving process, including recommendations on contractors, movers, cleaners, etc., as well as the ability to coordinate moving activities, set up utilities, or purchase a security system. With everything that is on their minds during the process of finding a new home, it’s not surprising that consumers would look for help managing these things, and it could be an opportunity for lenders not only to lighten the load for these consumers but at the same time expand their involvement in the homeownership process.

Consumers want guidance investing in their home

Moving beyond the purchasing phase, and even beyond moving day, homeowners still suggested they wanted education about managing their home as an asset, including refinance advice, help understanding remodeling investments, and even expressed interest in a service that would monitor the home for damages. It’s clear homeowners see purchasing a home not as a discrete transaction but as the beginning of a new phase of their lives; lenders could adopt this view and help provide guidance to — and remain top of mind for — homeowners well beyond the actual purchase of the home.

Rethinking the lender’s role in the homeownership journey

Consumers clearly signaled interest in a reframed homeownership journey that includes a single place to manage the entire home purchase process and related activities, as well as in education to help them better understand their options throughout the homebuying process and well beyond it. Lenders have an opportunity to capitalize on this interest and deepen relationships with current customers by becoming a trusted advisor in addition to a lender of money. These relationships could last for decades and encompass more than just a mortgage as homeowners look to understand how they can manage the equity in their home. Finally, a service such as the one described could be a differentiator for lenders who compete closely on rate: by lightening the load for consumers in other areas, lenders could provide more value to potential homeowners than their competitors.

Ready to learn more about how lenders can reimagine the homeownership journey?

Methodology

The survey was conducted in Q1 of 2021. Aite Group surveyed 2,010 U.S. consumers who purchased a home within the past five years and financed this purchase with a mortgage loan. Additional insights were gained through interviews of 21 U.S. mortgage lending professionals. This research was sponsored by Blend.

Find out what we're up to!

Subscribe to get Blend news, customer stories, events, and industry insights.